Photo by Chen Mizrach on Unsplash

Photo by Chen Mizrach on Unsplash

A new survey found that 73 percent of student loan forgiveness applicants would spend the extra money from relief on non-essentials like vacations, eating out at restaurants, buying a new phone, drugs/alcohol, gambling, and gaming systems.

In sum, working class families will be responsible for subsidizing a $1 trillion student loan bailout to fund the irresponsible spending habits of privileged 20-somethings.

In August, President Biden announced a plan to cancel $10,000 in student loan debt for borrowers making less than $125,000. Pell Grant recipients who make less than $125,000 would be eligible for $20,000 in cancellation. For couples that file jointly, the limit would be $250,000.

The survey was conducted in October by Intelligent.com. They surveyed 1,250 student loan borrowers who have applied or plan to apply for the student loan forgiveness program.

The survey lists shocking key findings:

- 73% of applicants say they are likely to spend their extra money on non-essentials, including vacations, smartphone, drugs/alcohol

- 2x as many Democrats than Republicans say it’s acceptable to spend the money on non-essentials

- 77% of applicants say they could use money more wisely

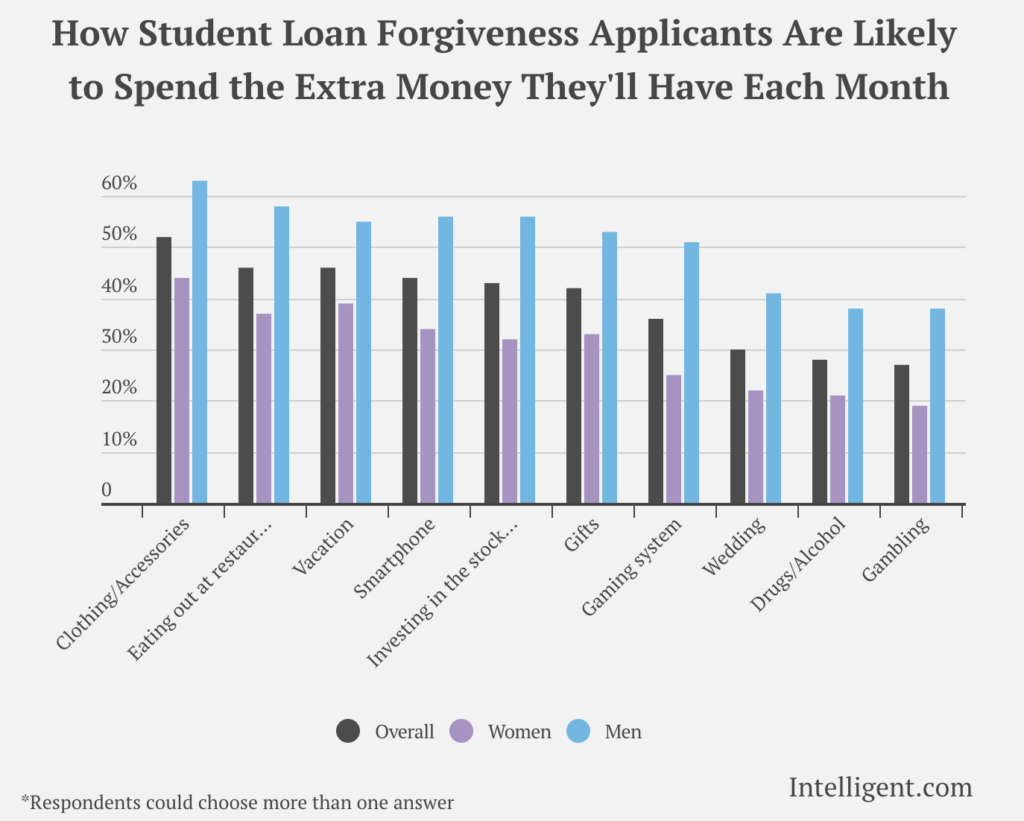

The survey also provides a breakdown of which goods/services applicants would spend extra money on each month:

- Clothing and accessories (52%)

- Vacationing (46%)

- Eating out at restaurants (46%)

- Smartphone (44%)

- Investing in the stock market (43%)

- Gifts (42%)

- Gaming system (36%)

- Wedding (30%)

- Drugs/Alcohol (28%)

- Gambling (27%)

This survey, in addition to our existing knowledge that student loan borrowers are disproportionately wealthy with high earning potential, is a slap in the face to taxpayers.

The Biden Administration’s student loan forgiveness plan is projected to cost up to $1 trillion. The Penn Wharton Budget Model found that debt cancellation alone will cost up to $519 billion, with the moratorium extension costing $16 billion and changes to the IDR rules costing about $450 billion.

Not only will the American people be paying for this through their tax dollars, but also in higher prices, as this kind of spending exacerbates already-high inflation.

The federal government is already flooding the economy with so much money that demand is growing too fast for production to keep up. In October, inflation remained high at 7.7 percent. Inflation is costing American households an extra $635 a month. Even if prices stopped increasing altogether, the average American household will spend over $7,600 more this year due to inflation.

To make matters worse, low-income households are disproportionately harmed by inflation. Essential goods including groceries, gasoline and housing typically account for a larger share of total spending for low-income households. These households are less likely to have attended college or hold student loan debt. Meaning Biden’s student loan bailout will be paid for by the very Americans most impacted by inflation while they themselves see no benefit, only rising prices from increased government spending.

Due to the blatantly unconstitutional nature of the Biden administration’s bailout, a federal appeals court blocked the plan in October. However, if courts fail to uphold the Constitution, the American public and lawmakers must fight against this reckless use of taxpayer dollars.