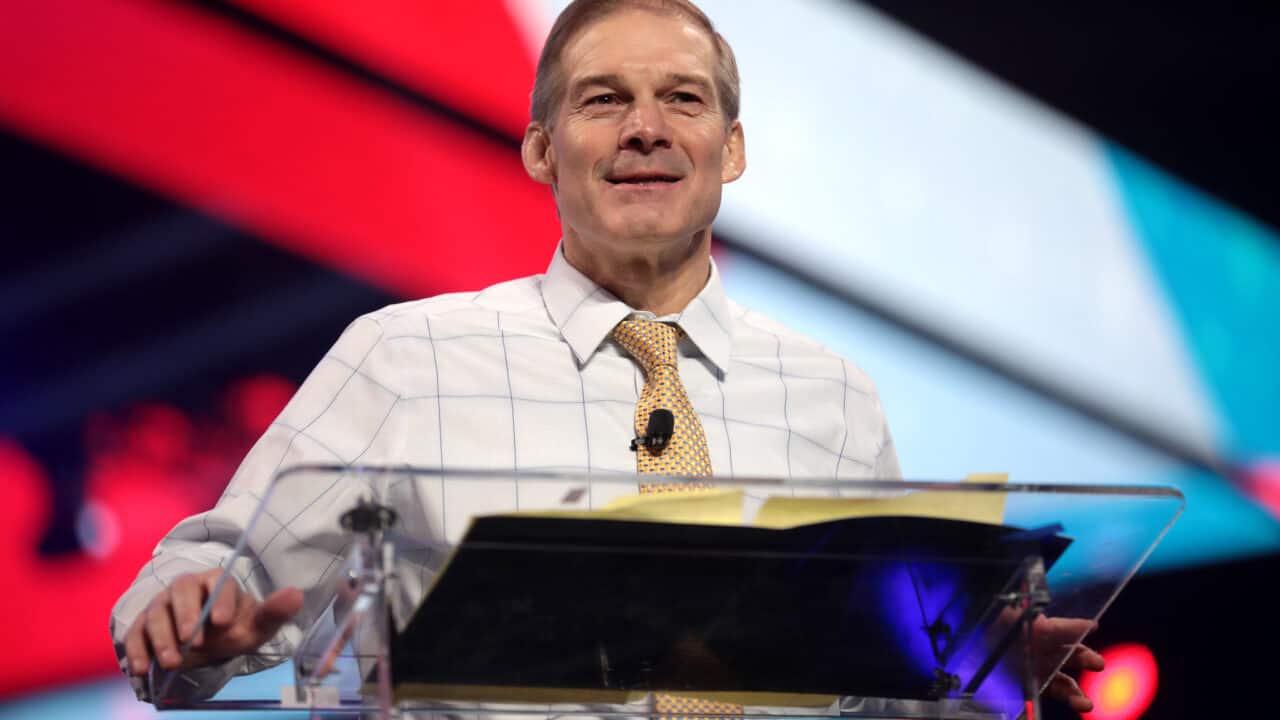

Jim Jordan by Gage Skidmore is licensed under CC BY-SA 2.0

Jim Jordan by Gage Skidmore is licensed under CC BY-SA 2.0

The House Judiciary Committee and its Select Subcommittee on the Weaponization of the Federal Government released a staff report titled, “Fighting the Weaponization of the Internal Revenue Service (IRS): The End of Abusive Unannounced Field Visits.”

The report details the Internal Revenue Service’s long history of abuse, citing countless examples that date back to the Roosevelt Administration while simultaneously addressing current examples of how the IRS has abused its power to target Americans.

The report specifically addresses a recent IRS controversy surrounding journalist Matt Taibbi. On March 9, Taibbi testified before the Select Subcommittee about his reporting on the Twitter files and how the Biden Administration worked with social media companies to censor Americans.

Yet as Taibbi testified before the Select Committee, an IRS agent chose to make an unannounced and unprompted visit to his home. After receiving no response, the agent left a note for Taibbi to call the IRS 4 days later.

When Taibbi contacted the IRS, they informed him that the agency had rejected his electronic tax return filings from both 2018 and 2021 even though in 2019 the IRS had notified Taibbi’s accountant that his 2018 tax return had been accepted. Mr. Taibbi was aware the IRS rejected his 2021 electronic filing twice. However, in both cases, the IRS did not attempt to make contact with Mr. Taibbi by other means before its unannounced field visit.

Following this intrusive and violating practice that has become an extremely common tactic of the IRS, the Committee and Select Subcommittee set out to determine whether the field visit was an attempt by the IRS to intimidate a key witness testifying to Congress about “the most serious” government abuse he witnessed in his career as a journalist.

On March 27, 2023, the Committee and Select Subcommittee sent a letter to the IRS asking about the unannounced field visit to Mr. Taibbi’s home.

In May, the IRS produced 267 pages of documents, none of which corroborated the agency’s version of the story. The documents showed that the IRS opened its examination of Taibbi’s 2018 tax return nearly four years later, on Christmas Eve 2022. This was also 3 weeks after Taibbi published the first Twitter Files thread, detailing countless government abuses.

Yet rather than try and contact Taibbi through less intrusive means, the assigned IRS agent scheduled its field visit for March 9—the day Taibbi would testify before Congress. Following these revelations, the Committee and Select Subcommittee sent a follow-up letter to IRS Commissioner Daniel Werfel.

Following the tremendous oversight and focus of both the Committee and Select Subcommittee, IRS Commissioner Danny Werfel repealed the practice of unannounced field visits altogether. Americans owe a debt of gratitude to Chairman Jordan and all members of the Select Committee for working to hold the government accountable and having their focus end an intrusive and intimidatory tactic by the IRS. While this practice should have been ended decades ago, American taxpayers can breathe a sigh of relief knowing the IRS won’t be showing up to their houses unannounced.