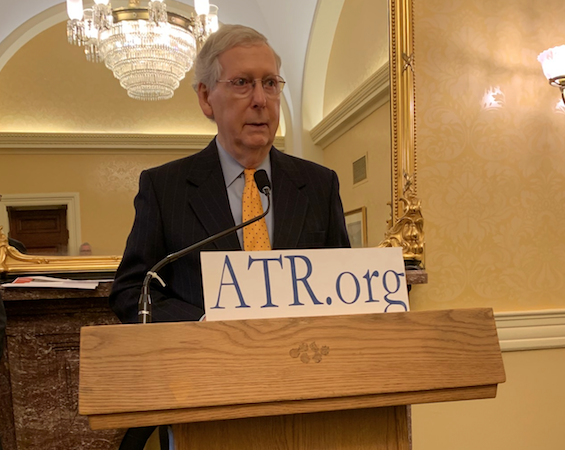

Today Senate Majority Leader Mitch McConnell (R-Ky.) addressed Americans for Tax Reform’s annual pre-Tax Day press conference, hosted by Grover Norquist.

“The evidence is in – that it’s been very good for the economy,” said Sen. McConnell of the 2017 Tax Cuts and Jobs Act enacted by House and Senate Republicans and signed by President Donald Trump.

“I think it was one of the great successes. Obviously I put the Supreme Court first, but in a close second, I would put this extraordinary bill,” said McConnell. “This was a lot better than the one we did in 1986, a lot more pro-growth, and at the risk of sounding a partisan note, I think that’s probably because no Democrats voted for it, so we didn’t have to water it down in ways that made it less consequential for the economy. So it’s a day to celebrate. Most Americans have paid less this year than they did in the past, and I think we’re reaping the benefits of it. And again, I want to thank you Grover for pestering us on this issue for literally decades, and again salute former Speaker Paul Ryan for whom this was a great passion.” A Kentucky list of good news arising from the tax cuts can be found here.

McConnell also thanked Norquist “for being on the front of this issue for a long time.”

Ways and Means Committee member David Schweikert (R-Arizona’s 6th District) noted the Tax Cuts and Jobs Act’s positive effect on wages and jobs. “If you take a look at what’s going on, it’s a miracle mathematically,” said Schweikert at the press conference. “And you’d think our friends on the other side would actually embrace the joy of what’s going on in our society, where populations that were functionally written off as to be the permanent underclass, are not. Their employment numbers, they are the fastest income movement quartile, they are the fastest quartile with income growth, and I will argue with you that it is substantially because of the things we did in the tax reform that are moving investment into the parts of our economy that actually increase productivity. Because you can’t pay people more if you don’t have a society that is becoming more productive. There’s good things happening out there, and it breaks my heart in this hyper-partisan environment that we exist in, that there seems to be this inability whether in this body or in our press to take one step backwards and take a look at the baseline data and what’s going on and the really good things that are happening out there.” An Arizona list of good news arising from the tax cuts can be found here.

[Click here to read more of Congressman Schweikert’s remarks from today’s press conference]

Ways and Means Committee member Adrian Smith (R-Nebraska’s 3rd District) noted the Tax Cuts and Jobs Act’s inclusion of both personal and corporate tax relief. “I think it’s important to note that even President Obama said we needed a lower corporate tax rate. But we Republicans were not going to just pass corporate tax relief and not give individuals tax relief as well. That’s why we doubled the standard deduction, that’s why we doubled the child tax credit, and really empowered workers,” he said. “The whole bill created upward pressure on wages. That’s going to do far more for workers than a group of politicians thinking they can come up with new regulations that will highlight what they think they can. We are seeing this economic growth in a way that’s substantive, it is meaningful, and workers are benefiting, our economy is expanding, and I think that’s good news in and of itself.” A Nebraska list of good news arising from the tax cuts can be found here.

[Click here to read more of Congressman Smith’s remarks from today’s press conference]

Congressman Kevin Hern (R-Oklahoma’s 1st District) is a longtime business owner and job creator. “I know what burdensome tax policy looks like,” said Hern. “Since reform was passed, Oklahomans have seen a windfall of economic growth, wage increases, more jobs, better benefits, and the list goes on and on. In fact, we have a great example in our district – Tulsa-based QuikTrip is a very large 800-unit chain that has gas stations, convenience stores, and is constantly improving and innovating. They give all of the credit of their continued growth and all they’ve done for their employees, the bonuses they’ve given to their hourly employees, not to just their leadership, that they’ve given because of the Tax Cuts and Jobs Act. And there are many other examples around our district from that particular tax cut.” An Oklahoma list of good news arising from the tax cuts can be found here.

Hern is working to make the tax cuts permanent. “We’ve got to continue our work, continue our job to make this permanent as we get beyond 2025.”

[Click here to read more of Congressman Hern’s remarks from today’s press conference]

Norquist also provided examples of the household tax relief thanks to the TCJA. “A family of four with an annual income of $73,000 – the median family income – is seeing a tax cut this year of $2,058. A 58 percent reduction in federal taxes. A single parent with one child with an annual income of $41,000 is seeing a tax cut of $1,304 – a 73 percent reduction in their tax burden.”

Norquist noted ATR’s compilation of over 800 in-their-own-words examples of employers raising wages, hiring more workers, expanding facilities and increasing employee benefits as a result of the TCJA.

Click here for the full video of today’s press conference.