The Internal Revenue Service recently announced that the upcoming federal income tax filing deadline is moved from April 15 to July 15, 2020.

“Taxpayers can also defer federal income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed,” explains a March 21 statement released by the IRS. “This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax.”

Now state government officials across the U.S. are taking action to delay their tax filing deadlines in order to sync up with the extended federal deadline, which will help avoid taxpayer confusion and also increase household and small business liquidity at time of economic uncertainty.

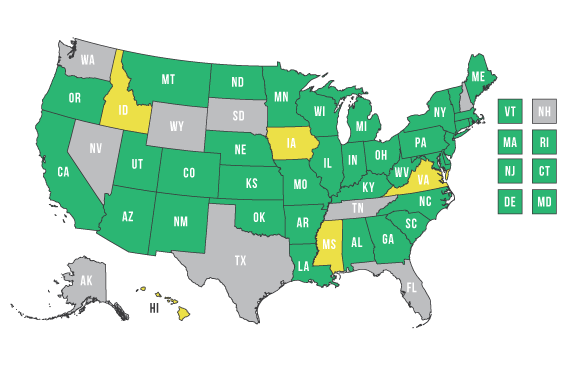

The states shaded green on the above map have moved their filing deadline to the same as the new federal deadline of July 15. The five states colored yellow have delayed their filing deadlines but, to an extended date that is different than the new federal deadline of July 15. The extended dates for those five states are:

Hawaii – July 20

Idaho – June 20

Iowa – July 31

Mississippi – May 15

Virginia – June 1

The nine states shaded gray do not impose a state income tax. While Tennessee and New Hampshire do not tax wage income, they do tax investment income. The deadline to pay investment income taxes has been delayed in Tennessee, but not in New Hampshire.