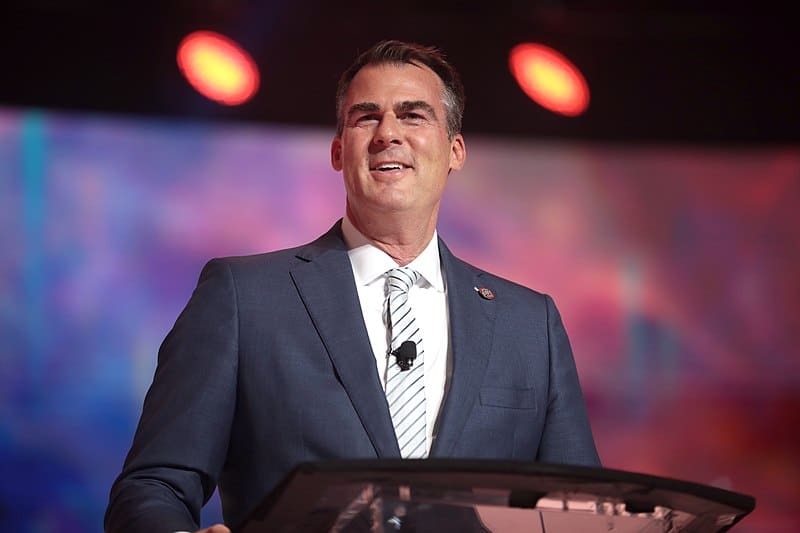

Oklahoma Governor Kevin Stitt delivered his 2023 State of the State Address Monday, calling for a number of ambitious conservative reforms – including on school choice and taxes.

“Let’s cut taxes,” said Stitt, to applause from the combined Senate and House of Representatives.

I’m proposing to eliminate Oklahoma’s state grocery tax and reduce our personal income tax rate to 3.99%.

These cuts will save families in Oklahoma hundreds of dollars each year.

Let’s cut taxes! pic.twitter.com/mJtju4T1bK

— Governor Kevin Stitt (@GovStitt) February 8, 2023

The Governor called for cutting Oklahoma’s graduated income tax down to a single 3.99% tax rate, stating, “In my executive budget I am proposing to eliminate Oklahoma’s state grocery tax and reduce our personal income tax rate to 3.99%.”

Currently the state’s personal income tax tops out at 4.75%, the corporate income tax rate is at 4% (both were trimmed in 2021).

At a flat 3.99% tax rate, Oklahoma would have the fifth-lowest flat tax rate in the U.S. The state would have a lower rate than Colorado, Illinois, and Utah, and higher than Arizona, Indiana, Pennsylvania, and soon Iowa. Governor Stitt’s proposal would take Oklahoma from the middle-of-the-pack on competitiveness and make it one of the most welcoming tax environments in the country.

The Governor also backed elimination of applying sales tax to groceries once again. Oklahoma remains an outlier among just seven states that impose this tax in full on grocery necessities. Certainly, high inflation has made providing relief for families on grocery bills a priority, with multiple states looking at trimming grocery sales tax, from Virginia to Oklahoma.

Americans for Tax Reform President Grover Norquist cheered the idea, telling media, “Putting Oklahoma on the path to reduce, flatten, and eliminate its income tax is the right thing to do, and the smart thing for Oklahoma’s future. The permanent flat tax reform Governor Stitt is calling for will help Oklahoma families and businesses grow, instead of the government.”

Governor Stitt also backed the creation of an Oklahoma Legacy Fund, similarly named and styled to North Dakota’s fund. Senate President Pro Tempore Greg Treat has filed this bill.

Governor Stitt’s achievable, ambitious flat tax plan could work well with Sen. Pro Tem Treat’s Legacy Fund to put taxpayers first, while giving the state confidence that as income tax rates come down any revenue decline would be met with that progress being paused, and an insurance policy should a significant economic shock hit the state.

The great news for Oklahomans, states with no income taxes at all are thriving as responsible tax policy is rewarded with supercharged growth in places like Florida, Texas, and Tennessee. Legislators should be confident they can get big tax reform done and join Gov. Stitt in making Oklahoma one of the lowest-taxed states in the country.