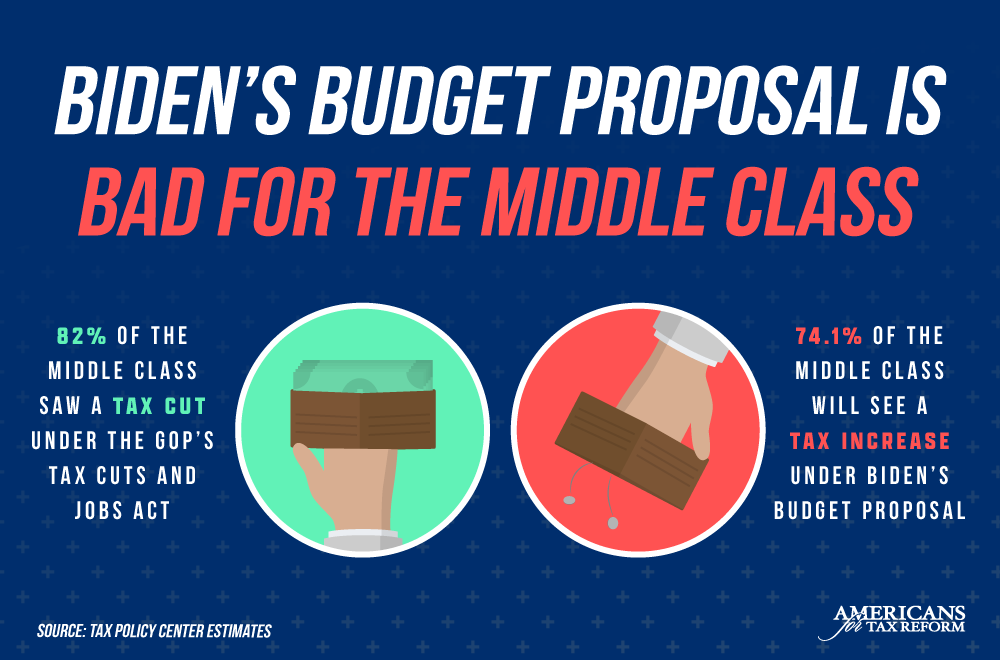

Taxes will go up on middle class Americans if the policies proposed in Joe Biden’s budget go into effect, according to a recent analysis by the left-of-center Tax Policy Center. While these policies will harm working families, the Tax Cuts and Jobs Act (TCJA) passed by Republicans in 2017 reduced taxes for American families, as TPC has previously noted.

According to a recent Tax Policy Center analysis, Biden’s budget will raise taxes on 74.1 percent of middle income-quintile households. By 2031, TPC finds that 95 percent of this income group will see a tax increase because President Biden’s budget allows the expiration of middle-class tax cuts.

While President Biden has promised not to raise taxes on anyone making less than $400,000, he still refuses to maintain lower taxes for the middle class. As TPC explains,

“For those looking to see if Biden kept his promise to not raise taxes for those making $400,000 or less, the answer is: Mostly, but not entirely.

Including corporate tax increases, most households would pay more in 2022. About three-quarters of middle-income households would face a tax increase…”

While TPC notes that Biden’s policies will raise taxes on the middle class, previous analyses conducted by the organization found that the TCJA reduced taxes for the majority of American families.

According to a March 2018 analysis, 82 percent of middle income-quintile taxpayers/households saw a tax cut thanks to the Tax Cuts and Jobs Act.

American families and individuals saw strong tax reduction from the TCJA. According to IRS statistics of income data analyzed by Americans for Tax Reform, households earning between $50,000 and $100,000 saw their average tax liability drop by over 13 percent between 2017 and 2018. By comparison, households with income over $1 million saw a far smaller tax cut averaging just 5.8 percent.

Thanks to the TCJA, millions of Americans saw an increased child tax credit, and millions more qualified for this tax cut for the first time. The TCJA expanded the child tax credit from $1,000 to $2,000 and raised the income thresholds so millions of families could take the credit. In 2017, 22 million households earning $200,000 or less took the child tax credit. These households received an average tax credit of $1,213.

By 2018, 36 million households earning $200,000 or less took the child and other dependent tax credit. These households received an average credit of $2,002.

The TCJA repealed the Obamacare individual mandate tax by zeroing out the penalty. Prior to the passage of the bill, the mandate imposed a tax of up to $2,085 on households that failed to purchase government-approved healthcare. Five million people paid this in 2017, and 75 percent of these households earned less than $75,000.

The tax cuts resulted in businesses giving their employees pay bonuses, pay raises, increased 401(k) matches, and new employee benefit programs.

Even left-leaning media outlets have (eventually) acknowledged the tax cuts benefited middle class families. The Washington Post fact-checker gave Biden’s claim that the middle class did not see a tax cut its rating of four Pinocchios. The New York Times characterized the false perception that the middle class saw no benefit from the tax cuts as a “sustained and misleading effort by liberal opponents.”

Congressional Republicans delivered savings to the American middle-class when they passed the tax cuts. Despite calling himself a so-called champion for average Americans, Biden’s plan would result in middle-class Americans paying more in taxes.