Yesterday, the Bureau of Economic Analysis released its report on U.S. international transactions for the Second Quarter in 2018.

One part of the report details the effects of the Tax Cuts and Jobs Act on components of the international transactions accounts.

Prior to tax reform, the United States had an outdated worldwide tax system. This meant that U.S. companies with subsidiaries abroad were taxed twice on their foreign profits. The profits were first taxed by the country where the profits were made, and they were also taxed by the U.S. government when the profits were repatriated. Many U.S. companies, therefore, kept their profits abroad in order to avoid taxes by the U.S. government. In fact, an estimated $2.6 trillion was held overseas before tax reform. This old tax system also encouraged companies to move their legal headquarters overseas.

President Donald Trump and Congressional Republicans fixed this problem with the Tax Cuts and Jobs Act. Tax reform was designed to encourage U.S. companies to reinvest their profits from abroad back in the United States. The tax system was changed to the more commonly used territorial system where profits are only taxed once in the country where they are made. A one-time repatriation tax of overseas profits of 8% (15.5% for cash) was also introduced.

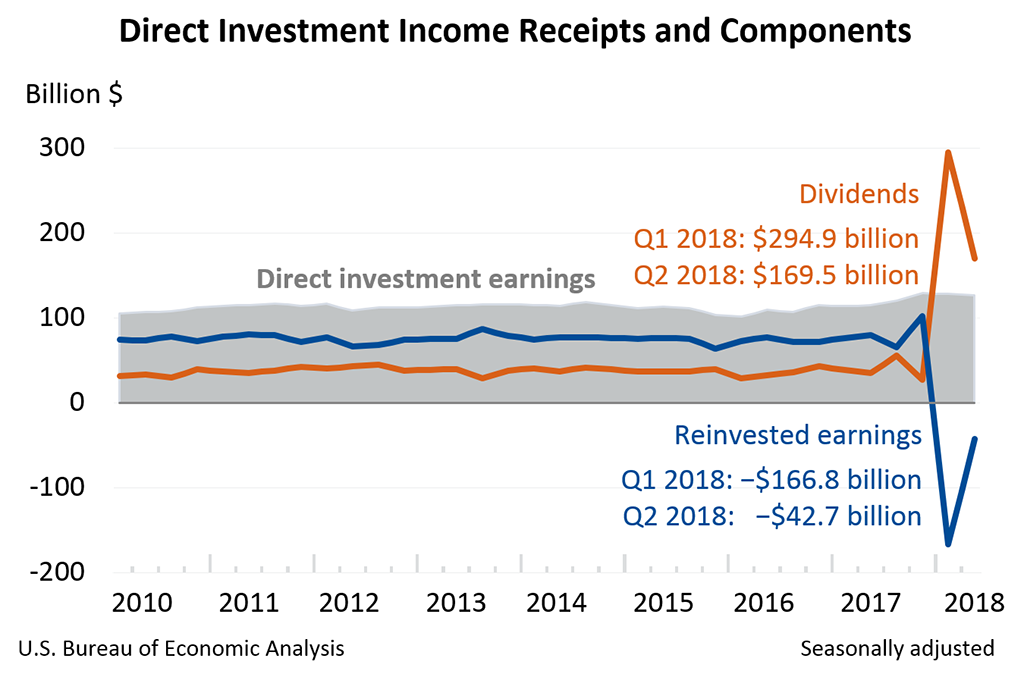

This new system is working. Yesterday, the Bureau of Economic Analysis reported that $294.9 billion was repatriated in the First Quarter of 2018 alone and an additional $169.5 billion was repatriated in the Second Quarter. In just the first two quarters, that is a total of $464.4 billion repatriated.

Only $35 billion was repatriated last year during the First Quarter. The Bureau’s chart below shows how tax reform is working:

The orange line is the amount of money that is repatriated each year. Prior to tax reform, that number was fairly flat and low, but after the Tax Cuts and Jobs Act, that number soars.

More repatriation is a tremendous boost to the economy and means more jobs and higher salaries for Americans.

To see more of how the Tax Cuts and Jobs Act is helping Americans, click here for the list of companies that have given salary increases, bonuses and other benefits to their employees thanks to tax reform.