In the final minutes of a nearly 12-hour session extending late into Thursday night, the Kansas Senate approved key legislation that would move Kansas to a 4.75% single-rate tax, marking a significant reduction in the state’s top personal income tax rate of 5.7%.

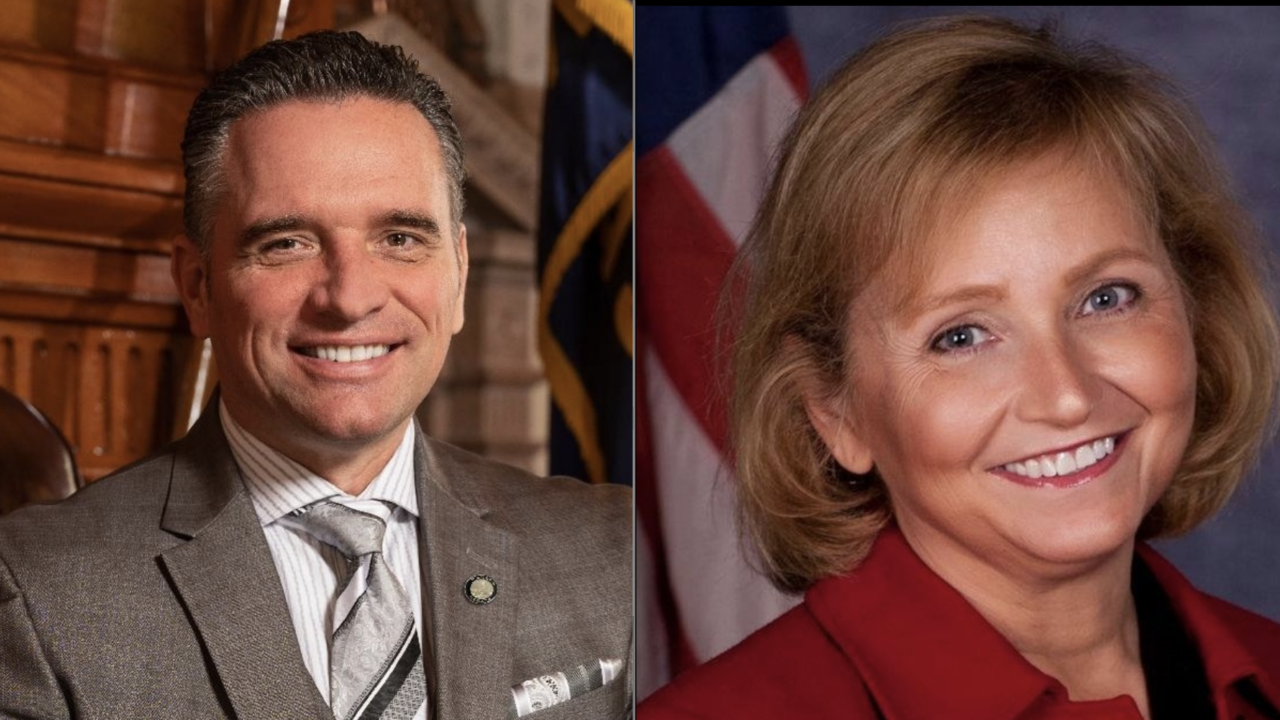

SB 169, a top priority for Senate President Ty Masterson and tax committee chair Sen. Caryn Tyson, would make Kansas the 14th state in the nation to enact a flat personal income tax, providing hundreds of millions in ongoing relief while not raising taxes on a single resident.

Right now, Kansas has a progressive income tax structure, with a top rate of 5.7% for earnings over $30,000. Income above $15,000 is subject to a 5.2% rate, and the rest is taxed at 3.1%.

Compared to neighboring states, Kansas income tax rates are not competitive. The state may be losing potential new residents and investment to nearby competitors like Texas, South Dakota, and Wyoming, all of which are no-income-tax states. Meanwhile, border states like Missouri, Oklahoma, and Colorado already have income tax rates below 5% and some want to cut them even further.

Sen. Masterson, who has championed SB 169 since its introduction in early January, pointed out the benefits of having no income tax during last night’s debate.

“The states that are doing the best are the zero income tax states. The states that are next have a flat tax,” he remarked. “You know what the fastest growing states are? Florida, Texas – no income tax. North Carolina – flat tax.”

Kansans would save around $570 million each year under the flat 4.75% income tax endorsed by the Senate, a rate that applies to all income over $5,225.

The Senate also passed another bill Thursday evening, SB 248, that would accelerate the phase out of the state sales tax on groceries that is currently scheduled to conclude in 2025.

If enacted, not only would SB 248 eliminate the current 4.0% state sales tax on unprepared food by January 1, 2024, but it would also prohibit localities from imposing any sales tax of their own. Taxpayers can look forward to keeping even more of their hard-earned dollars, especially since local sales taxes in Kansas are often as high as 2%.

With Senate approval of a flat tax and other pro-growth cuts, Kansas leaders are showing their dedication to strengthening their state’s economy and protecting the hard-earned dollars of their residents.

A lower, flatter income tax also directly benefits small businesses, which are taxed on the personal side of the code. Companies will have even more of a reason to invest in new jobs and higher wages throughout the state of Kansas. This is a better path forward than passing even more targeted tax carve-outs that only benefit politically favored groups.

“We can’t continue to buy economic development,” said Sen. Masterson, referring to the numerous subsidizes and special tax rates intended to entice specific companies to invest in Kansas. “The best thing we can do, long term, is to have a structure that is beneficial.”

SB 169 now moves on to the House for consideration. In fact, the House is already considering its own version of flat tax legislation.

HB 2061 would institute a 5.0% single-rate tax for both personal and corporate income taxes, but with a more generous exemption threshold set at $15,000. The House bill also includes “revenue triggers,” a mechanism that requires that state revenues grow a certain amount above budgetary needs before tax rates are reduced.

Several states, such as North Carolina and Missouri, have implemented revenue triggers of their own to further reduce income tax rates. HB 2061 would similarly funnel excess revenue into a dedicated fund, reducing state income tax rates until they eventually reach zero.

Any flat tax proposal will eventually require either the signature of newly reelected Democrat Governor Laura Kelly, who has spoken repeatedly in opposition to a single-rate tax, or the support of 2/3 of legislators in both chambers to override her veto. Assuming no Democrats break with the governor, all but 1 Republican in the House and 2 in the Senate are needed for an override attempt to succeed.