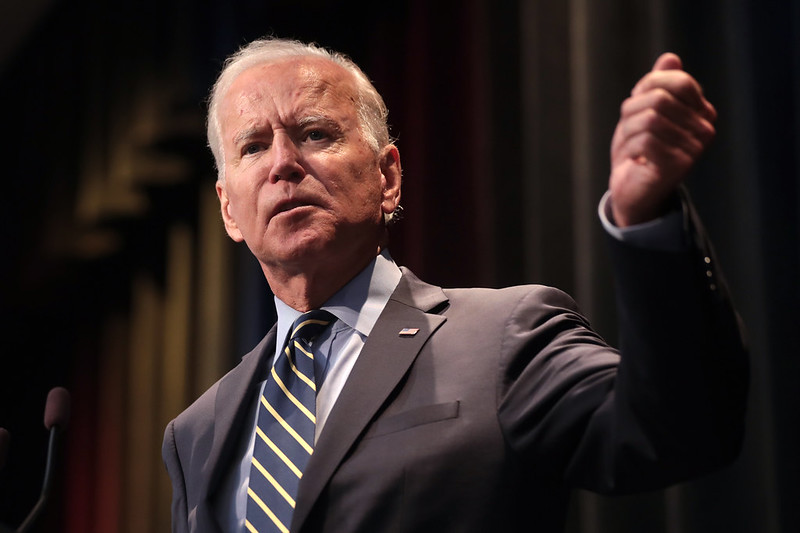

Biden has proposed raising taxes on American businesses, workers, and families. Biden’s plan would also claw back all the progress President Trump and Congressional Republicans have made in reforming the tax code for the benefit of all Americans.

In compiling this list, ATR used Biden’s estimate for revenue raised for each new provision. All told, Biden says his tax hikes would raise $3.42 trillion over the next decade.

A recent study from the left-wing Tax Policy Center estimates that the Biden tax plan would raise taxes on Americans by $4 trillion over the next decade.

The Penn Wharton Business Model projects that Biden’s tax hikes would raise between $2.3 trillion (including macroeconomic effects) and $2.6 trillion (excluding macroeconomic effects), $1 trillion less Biden’s estimate.

Either way, none of these estimates would come close to raising the $4.8 trillion Biden needs to enact his wishlist of liberal policies.

Joe Biden fashions himself a moderate Democrat, but his tax plan is firmly in line with the radical left. Here are Biden’s tax increases.

1. Tax capital gains as ordinary income

If elected, Biden would tax capital gains as ordinary income. Currently, the capital gains rate is 20 percent. Biden has said that he would nearly double the rate to 39.6 percent.

Capital gains are already taxed twice under the current system –– the capital gains tax is levied on income that has already been subjected to the individual income tax and is then reinvested in the economy. This investment spurs job creation, economic growth, and economic productivity.

In fact, taxing capital gains as ordinary income would decrease GDP by more than 3 percent over the long term and cost 700,000 jobs according to the Tax Foundation. In contrast, eliminating the double taxation of capital gains would increase household income across the board by an average of 3.8 percent, would lead to 2.7 percent higher GDP, and would create more than 500,000 new jobs.

This is an $800 billion tax hike over the next decade.

2. Raise the corporate tax rate

Biden has repeatedly stated that he wants a full repeal of the Trump Tax Cuts and Jobs Act, which would raise the corporate tax rate to 35 percent.

On other occasions, Biden has stated that he would raise the corporate tax rate to 28 percent, a drastic increase from the 21 percent corporate tax rate established under the Trump tax cuts.

Even if he “only” raised it to 28 percent, the higher Biden corporate rate would be levied on top of the average state corporate rate of 4 to 5 percent, giving the U.S. a higher rate than the United Kingdom (19 percent), China (25 percent), Canada (26.8 percent), and Ireland (12.5 percent). It would also impose a tax rate higher than the current combined corporate rate across the 36 member Organization for Economic Development and Cooperation (OECD), which is currently 23.7 percent.

An increase in the corporate tax rate would also directly raise the cost of utility bills in all 50 states. In contrast, the Trump 21 percent corporate rate has unleashed American competitiveness at home and abroad, and has directly led to economic growth and job creation.

Raising the corporate rate to 28 percent would be a $730 billion tax hike over the next decade.

3. Death tax increase

Under current law, when an individual dies and bequeaths property to an heir, the property’s cost basis receives a “step-up” to its fair market value at the time of the original owner’s death.

Stepped-up basis protects the new owner from double taxation by eliminating the capital gains liability for any appreciation in value that occurred during the previous owner’s lifetime. Without stepped-up basis, the new owner would pay capital gains tax on accumulated value during the original owner’s life on top of the death tax.

Biden would eliminate stepped-up basis, exposing taxpayers to double taxation and needless compliance costs.

This is a $440 billion tax hike over the next decade.

4. 15 percent corporate minimum tax

Biden has proposed a “minimum book tax” of 15 percent on corporations that generate $100 million or more in revenue. This tax would essentially function as an Alternative Minimum Tax (AMT) for firms, and would inject needless complexity and confusion into the tax system.

As such, the new Biden book tax would prevent American companies from using lawful deductions and credits upheld by bipartisan majorities in Congress and the Obama Administration.

What Biden fails to realize is that companies can end up with a federal corporate tax bill of zero by using a lawful deductions and credits routinely upheld and extended by bipartisan Congressional majorities. This is not tax evasion –– these provisions, like the research and development credit, are vital for stimulating investment in the economy and American workers.

The ironic twist here is that President Obama supported many of the same deductions and credits Biden now rails against.

This is a $400 billion tax hike over the next decade.

5. 21 percent tax on overseas income

The Trump Tax Cuts and Jobs Act enacted several new provisions designed to move the U.S. closer to a territorial system of taxation by reducing the double taxation of American businesses and allowing trillions of dollars in previously stranded foreign income to be repatriated into our economy.

One of these provisions, Global Intangible Low Income Tax (GILTI), was designed to counteract base erosion.

Biden would double this tax to 21 percent, taxing businesses on income that has already been taxed overseas. Raising taxes on overseas income in this fashion further undermines the TCJA’s territorial system and moves the U.S. once again towards a worldwide system of taxation.

This is a $340 billion tax hike over the next decade.

6. Impose a 28 percent cap on the value of itemized deductions

Biden revives an Obama-era idea to cap the value of itemized deductions at 28 percent, a move that would effectively eliminate tax deductions for mortgage interest, charitable contributions, out-of-pocket medical expenses, and HSA contributions, among others.

This is a $310 billion tax hike over the next decade.

7. Sanctions for “tax avoidance”

Biden would impose sanctions on places like Ireland, the Netherlands, the Cayman Islands, and Bermuda for “tax avoidance.” It is unclear how Biden would actually implement this. he

This is a $200 billion tax hike over the next decade.

8. Raising the top income tax rate to 39.6 percent

Biden would increase the top tax bracket from 37 percent to 39.6 percent.

This is part of Biden’s ultimate plan to repeal the Trump tax cuts in full. If Biden got his way,

- A family of four earning the median income of $73,000 would see a $2,000 tax increase.

- A single parent (with one child) making $41,000 would see a $1,300 tax increase.

- Millions of low and middle-income households would be stuck paying the Obamacare individual mandate tax.

- Taxes would rise in every state and every congressional district.

- Millions of households would see their child tax credit cut in half.

- Millions of households would see their standard deduction cut in half.

Raising the top tax rate is a $90 billion tax hike over the next decade.

9. Close real estate “loopholes”

Biden would repeal several tax provisions used by real estate.

One of these provisions, like-kind exchanges, exists under Section 1031 of the tax code to promote investment. This allows an investor to defer paying taxes on certain assets when they use those earnings to invest in another, similar asset. This can be done again and again until the investor ultimately cashes out and protects against a lock out effect that would otherwise discourage investment.

Section 1031 is a vital and commonsense provision. Because there is a continuity of investment from any 1031 eligible transaction, there is no reason to arbitrarily punish reallocation of resources. If anything, this provision should be expanded so all capital gains are treated the same as like-kind exchanges.

This is a $70 billion tax hike over the next decade.

10. Energy tax hikes

Biden supports a longheld left-wing priority of eliminating several deductions for fossil fuel companies.

Biden mischaracterizes standard cost recovery practices employed by oil and natural gas producers as subsidies. Namely, Biden would eliminate expensing of exploration costs, a move that would make it even more costly for oil and natural gas companies to create energy.

The Trump Tax Cuts and Jobs Act allowed all businesses to fully deduct the cost of new investments in the year they were purchased instead of deducting the cost gradually over several years. This drastically decreased tax complexity for businesses and incentivized more capital to flow into the American economy.

Biden would prevent fossil fuel companies from fully expensing their assets solely to serve the far-left’s climate religion.

Eliminating full-business expensing for fossil fuel companies would result in higher prices at the pump, increased utility bills, and fewer American energy jobs as companies flee the U.S. to avoid these industry-crippling tax hikes.

This is a $40 billion tax hike over the next decade.