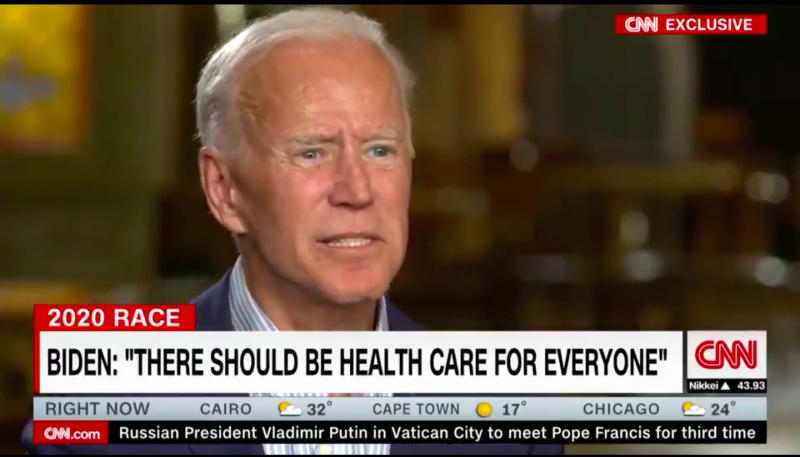

Joe Biden said during a CNN interview in July that he would re-impose the $695 – $2,085 Obamacare individual mandate tax if he is elected president.

Here’s The Key Exchange:

Chris Cuomo: “Would you bring back the individual mandate?”

Joe Biden: “Yes. Yes, I’d bring back the individual mandate.”

The Obamacare individual mandate was one of at least seven Obama-Biden tax hikes that directly hit low and middle income households — a violation of Biden’s promise not to raise any form of any tax on any American making less than $250,000.

Biden lied to the American people when he ran for Vice President in 2008 when he repeatedly said he would not support any form of any tax that imposed even “one single penny” of tax increase on anyone making less than $250,000. Biden shattered that promise upon taking office.

The Obama-Biden mandate tax imposed hefty penalties of $695 for individuals and $2,085 for families.

Thankfully the penalty was zeroed out in the Tax Cuts and Jobs Act, enacted by congressional Republicans and President Trump.

The vast majority of households forced to pay the mandate tax had an annual income of under $50,000.

In tax year 2017, 4,654,990 households paid a total of $3,666,084,000 in individual mandate tax penalties. 74 percent of those households have a yearly income of less than $50,000. 32 percent of those households have a yearly income of less than $25,000.

In addition to levying the American people with this tax, Biden also wants to repeal the Tax Cuts and Jobs Act. Such repeal would raise taxes on low and middle income households.

If the TCJA is repealed, as Biden has promised:

- A family of four earning the median income of $73,000 would see a $2,000 tax increase.

- A single parent (with one child) making $41,000 would see a $1,300 tax increase.

- Millions of low and middle-income households would be stuck paying the Obamacare individual mandate tax.

- Utility bills would go up in all 50 states as a direct result of the corporate income tax increase.

- Small employers will face a tax increase due to the repeal of the 20% deduction for small business income.

- The USA would have the highest corporate income tax rate in the developed world.

- Taxes would rise in every state and every congressional district.

- The Death Tax would ensnare more families and businesses.

- The AMT would snap back to hit millions of households.

- Millions of households would see their child tax credit cut in half.

- Millions of households would see their standard deduction cut in half, adding to their tax complexity as they are forced to itemize their deductions and deal with the shoebox full of receipts on top of the refrigerator.

If you want to stay up-to-date on their threats to raise taxes, visit www.atr.org/HighTaxDems.