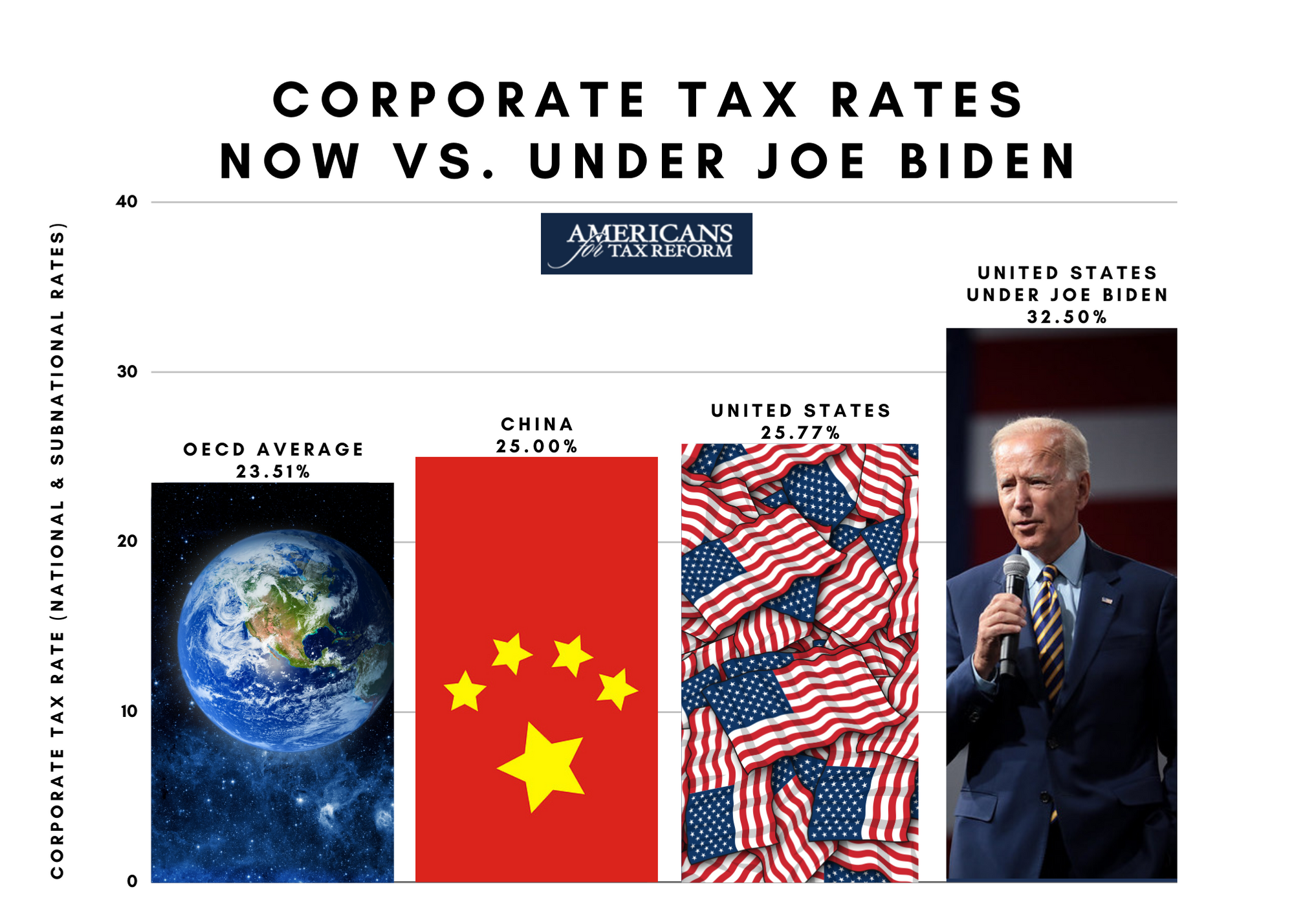

According to Nancy Cook of Bloomberg, President Joe Biden is planning to increase the corporate tax rate from 21 percent to 28 percent in order to pay for trillions of dollars in new spending.

This increase would impose on Americans a higher corporate tax rate than Communist China’s 25%.

Current rate: 21%

China’s rate: 25%

Biden’s rate: 28%

Biden’s 28 percent tax rate (resulting in a combined federal/state corporate tax rate of about 32 percent) is also higher than the United Kingdom (19 percent), Canada (26.8 percent), and Ireland (12.5 percent).

In 2017, Republicans lowered the federal corporate tax rate from the Obama-Biden era 35 percent rate down to the current 21 percent rate as part of the Tax Cuts and Jobs Act. When Trump took office, America’s corporate rate was the highest in the developed world.

The corporate tax cut was the cornerstone of the previously robust American economy. Before COVID-19, the Trump economy routinely created well over 100,000 private sector jobs per month. Nominal wage growth enjoyed 19 consecutive months of over 3 percent growth, and unemployment was consistently below 4 percent, a 50-year record low.

Because corporate tax hikes encourage companies to do business elsewhere, less money will be invested into the U.S. economy. The result is less jobs, lower wages, and a slower recovery.

A study released by EY found that American companies suffered a net loss of almost $510 billion in assets between 2004 and 2017 due to the high U.S. rate. If the corporate rate was lower between 2004 and 2017, the study estimates that U.S. companies would have acquired a net of $1.2 trillion worth of assets, meaning that more than $1.7 trillion in assets were lost because of the uncompetitive U.S. rate.

A Treasury Department study found https://home.treasury.gov/system/files/136/archive-documents/07230-r.pdf that “a country with a 1 percentage point lower tax rate than its competitors attracts 3 percent more capital.” This is because raising the corporate rate makes the United States a less attractive place to invest profits.

If Joe Biden raises the corporate tax rate, he will discourage businesses from investing in the United States. Capital is mobile, so a tax increase can result in this jobs and investment going overseas.

As a Harvard Business Review piece explains:

“When capital is invested elsewhere, real wages decline, and if product prices are set globally, there is no place for the corporate tax to land but straight on the back of the least-mobile factor in this setting: the American worker. The flow of capital out of the United States only accelerates as opportunities in the rest of the world increase. This is the key to understanding why, despite political rhetoric to the contrary, reforming the corporate tax is central to improving the position of the American worker.”

The coronavirus pandemic has caused incredible harm to American businesses and workers. Still, Joe Biden is championing the idea of increasing the corporate tax rate to fulfill his misguided, poorly thought-out promise to punish “greedy corporations.” Instead, he will punish American workers and the U.S. economy.