Joe Biden by Gage Skidmore is licensed under CC BY-SA 2.0

Joe Biden by Gage Skidmore is licensed under CC BY-SA 2.0

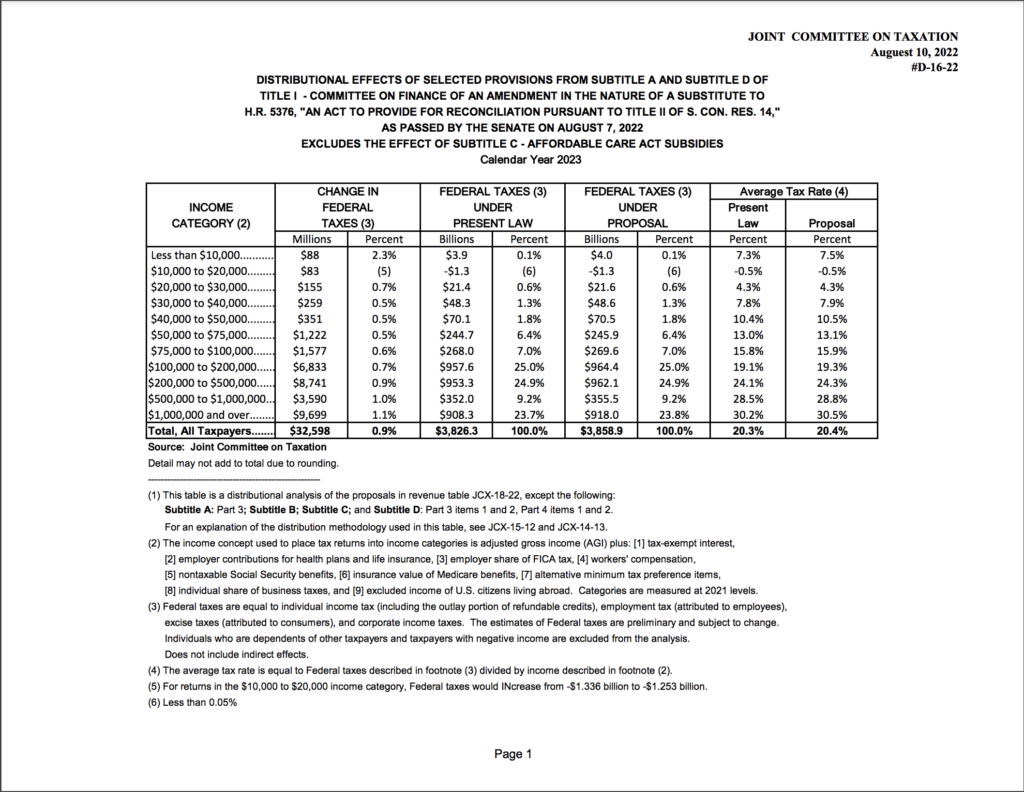

The Joint Committee on Taxation (JCT) released its updated distributional analysis of Democrat’s reckless tax and spend spree which found the bill would raise taxes on nearly every income group. The analysis confirms President Biden intends to break his promise to not raise taxes on anyone earning less than $400,000.

President Harris made the $400,000 tax pledge a key part of their 2020 presidential campaign, clearly stating the commitment no less than 60 times.

More than half of tax burden will fall on individuals earning less than $400K

According to JCT’s distributional analysis, taxes will increase on individuals by more than $32 billion across all income brackets in calendar year 2023.

Those making under $200,000 account for nearly $10.6 billion of the tax hike.

Individuals earning between $200,000 and $500,000 account for roughly $9.7 billion of the tax hike

Roughly 98 percent of all tax returns filed by those in the $200,000 to $500,000 range are filed by those earning between $200,000 and $400,000, with at least three-fourths of the income in the $200,000 to $500,000 category also coming from those below $400,000.

Not only is the tax hike a violation of Biden’s tax pledge, it puts the majority of the burden on individuals earning less than $400,000. Those are the very taxpayers Biden promised would not see a single penny of tax increases.

While Democrats sell their bill as a tax increase only hitting the wealthiest Americans, the work of the Joint Committee on Taxation shows that American families can expect a more burdensome tax bill in 2023.