President Biden and congressional Democrats routinely say that we need massive tax increases so that “the rich pay their fair share.”

But the tax code is already steeply progressive, as shown in a new report from the Joint Committee on Taxation:

Taxpayers making $1 million and up pay an average federal tax rate of 31.5% while the bottom half of income earners ($63,179 or less) pay an average federal tax rate of 6.3%. That’s nearly five times as much in taxes as a percentage of income.

According to JCT:

- Taxpayers with income of $1 million or more pay an average federal tax rate of 31.5% and an average federal income tax rate of 26.3%.

- Taxpayers with income of $50,000 and 75,000 pay an average federal tax rate of 13.6% and an average federal income tax rate of 2.4%.

- Taxpayers with income of $30,000 to $40,000 pay an average federal tax rate of 7.2% and an average federal income tax rate of NEGATIVE 3.3%. In other words, they receive money back from the federal government due to refundable tax credits.

- The bottom half of income earners pay an average rate (of all federal taxes) of 6.3%, while the top 0.01 percent pay 32.9%.

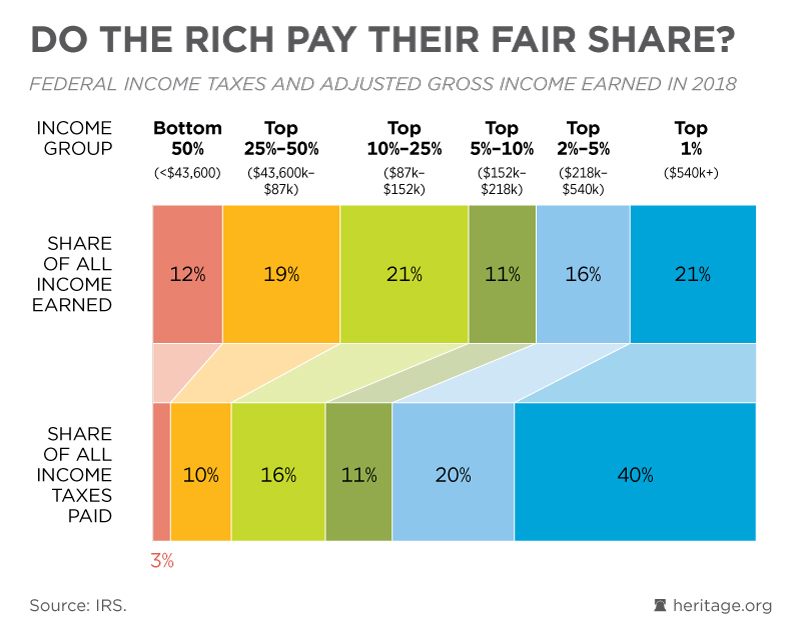

Despite Democrat rhetoric, the U.S. has one of the most progressive tax codes in the developed world. As noted by AEI’s James Pethokoukis, the U.S. tax system is considerably more progressive than most of Europe. This is shown in recent government data which finds that the top one percent of income earners paid 40 percent of all federal income taxes, while the top 10 percent paid 71 percent of federal income taxes.

As the Heritage Foundation shows in the below graphic, the top 1 percent earned 21 percent of all income, but paid 40 percent of all income taxes. Further, the top 10 percent earned 48 percent of all income, but paid 71 percent of all income taxes.

The tax code is already extremely progressive.