The Joint Committee on Taxation last week released its distributional analysis of the updated Senate tax bill. Unlike previous analyses of the Tax Cuts and Jobs Act, this new JCT study shows a tax increase on Americans at certain income levels.

However, these findings are based on JCT’s flawed methodology which overstates the impact that the Obamacare individual mandate has on compelling individuals to purchase insurance. The Senate tax bill does not increase taxes on Americans of any income level and is not repealing or modifying eligibility for the Obamacare tax credit.

In fact, a separate analysis of the Tax Cuts and Jobs Act that excludes the JCT’s assumptions on the individual mandate shows strong tax reduction for Americans at every income level.

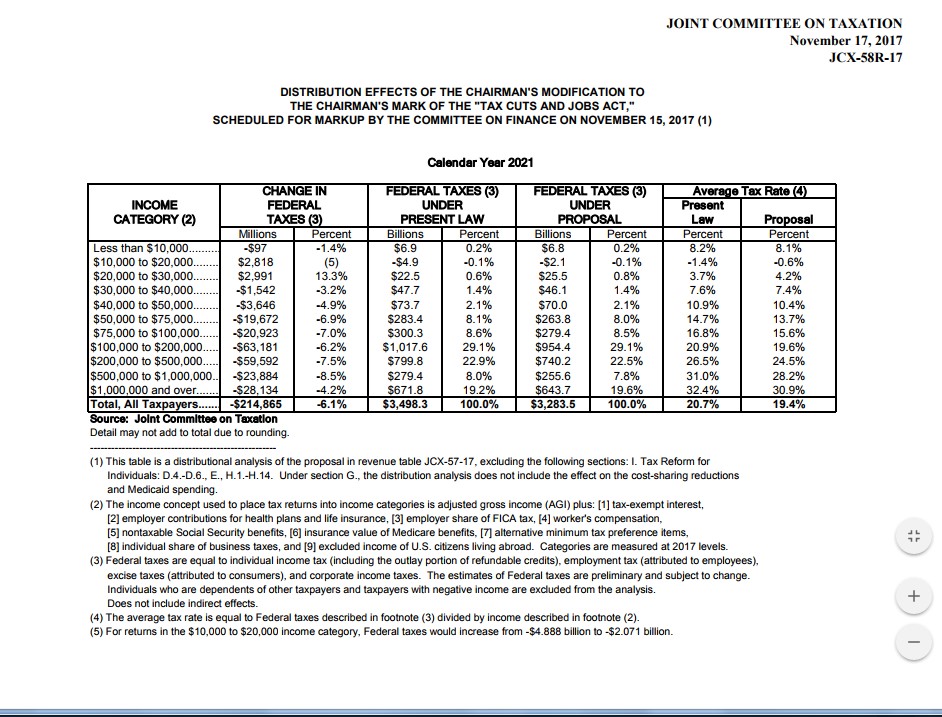

JCT Analysis of the Tax Cuts and Jobs Act With Repeal of The Mandate

Starting in calendar year 2021, the JCT analysis of the most recent version of the Senate’s Tax Cuts and Jobs Act shows a tax increase on those earning between $10,000 and $30,000. According to this analysis, individuals and families earning between $10,000 and $20,000 would see a tax increase of 5 percent, while those making between $20,000 and $30,000 would see a 13.3 percent increase in their federal tax liability.

As was the case in other versions of the Tax Cuts and Jobs Act, every other income category sees strong tax reduction (figure 1 – click to expand).

The Senate’s Tax Cuts and Jobs Act reduces taxes across the board, so these findings are based solely on the assumption that repeal of the individual mandate tax penalty will mean millions of Americans choose not to purchase costly, Obamacare health insurance. Under this assumption, millions will also no longer recieve subsidies to purchase Obamacare, including the advanced refundable tax credit.

As a result, JCT is assuming that individuals will choose to increase their own taxes by choosing to not purchase insurance and not receive the refundable tax credit.

It is important to note that the Obamacare tax credit is not being repealed or limited in any way. As noted by Senator Pat Toomey (R-PA), no one is losing eligibility from health insurance programs and no one is losing subsidies or tax credits for these programs.

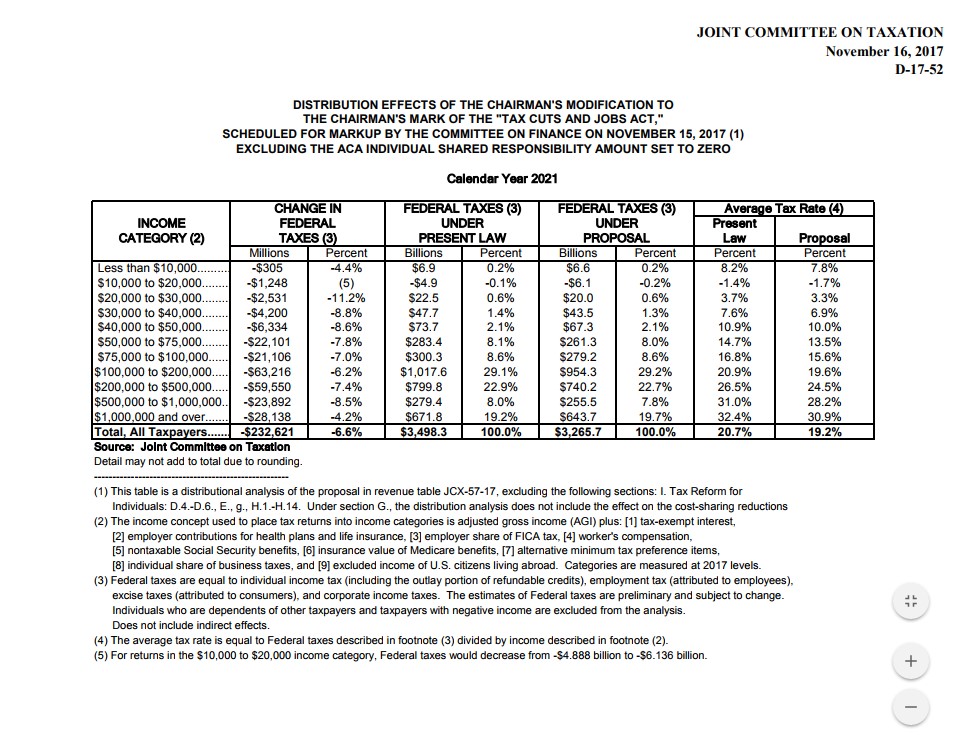

JCT Analysis of the Tax Cuts and Jobs Act Without Repeal of the Individual Mandate

Case in point, the JCT analysis of the Senate tax bill without the repeal of the individual mandate shows strong tax relief for Americans of all income levels. In 2021, JCT projects those earning between $10,000 and $20,000 see a five percent tax cut, while those earning between $20,000 and $30,000 see an 11.2 percent tax cut (figure 2 – click to expand).

Absent JCT’s flawed analysis of the individual mandate, the biggest winners of the Tax Cuts and Jobs Act are those making between $20,000 per year and $50,000 per year, with each of these income categories receiving an average tax cuts of at least eight percent.

This is not the first time that the individual mandate’s effectiveness has been overstated by government models. The Congressional Budget Office has repeatedly overstated the number of Americans that would purchase Obamacare, because it the model gave too much weight to the power that the the mandate had in compelling individuals to purchase insurance.

As a result, the agency predicted that 25 million people would be enrolled on Obamacare exchanges. In reality, only 12 million individuals enrolled on exchanges.