Increasing the corporate income tax would disproportionately harm American workers, retirees, and small businesses, according to an analysis performed by the non-partisan Joint Committee on Taxation (JCT). The report, which was released by Senate Finance Committee Ranking Member Mike Crapo (R-Idaho) and House Ways and Means Ranking Member Kevin Brady (R-Texas) found within 10 years, 169 million taxpayers earning less than $500,000 or less will bear the burden of the corporate tax increase.

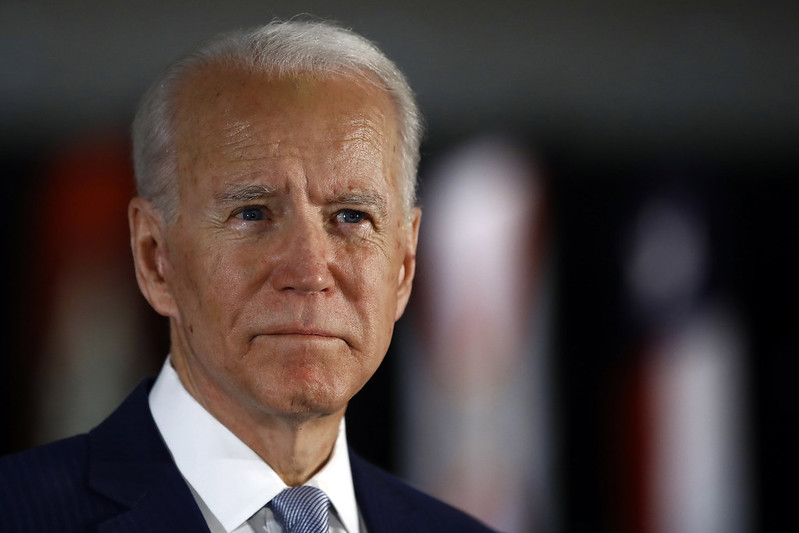

President Biden’s FY 2022 budget proposed 29 tax increases on top of the 28 percent corporate tax proposal, including a global minimum tax, doubling the capital gains tax, creating a Second Death Tax, and more. In the Senate Democrat’s $3.5 trillion plan, many of these tax hikes will be included.

Small businesses and working families would be hit by Biden’s plan to raise the corporate tax rate. About 1.4 million small businesses are organized as C-corporations, meaning they are hit directly by an increase in the corporate income tax.

Under a 28 percent corporate tax, as President Biden has proposed, almost 60 percent of the tax would be borne by taxpayers making less than $500,000. Of those impacted by a 28 percent corporate income tax hike, 98.4 percent earn less than $500,000.

“This study supports what we’ve long known–corporate tax hikes are primarily borne by workers and retirees, and certainly the middle class–those making well below $400,000 a year,” Sen. Crapo and Rep. Brady explained. “America’s health and economic recovery remain very fragile, and may get worse again before getting better. Unemployment is still too high and inflation is a real concern. Now is not the time to raise taxes on the very people we are asking to lead us out of this crisis.”

The analysis also detailed how low- and middle-income Americans have a stake in the success of U.S. corporations through ownership of stocks, bonds, pensions, IRAs and other retirement accounts. There are 107.8 million U.S. taxpayers with ownership stake in U.S. corporations, 97.7 percent of which earn less than $500,000 a year.

These findings should not come as a surprise. Several studies have previously proven that corporate tax hikes will increase consumer prices, reduce workers’ wages, and cost the economy jobs:

- According to the Stephen Entin of the Tax Foundation, labor (or workers) bear an estimated 70 percent of the corporate income tax in the form of wages and employment. As Entin notes, 50 percent, 70 percent, or even 100 percent of the corporate tax is borne by workers.

- A National Bureau of Economic Research paper found that 31 percent of the corporate tax rate is borne by consumers through higher prices

- A 2012 paper at the University of Warwick and University of Oxford found that a $1 increase in the corporate tax reduces wages by 92 cents in the long term. This study was conducted by Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini and studied over 55,000 businesses located in nine European countries over the period 1996-2003.

- A 2015 study by Kevin Hassett and Aparna Mathur found that a 1 percent increase in corporate tax rates leads to a 0.5 percent decrease in wage rates. The study analyses 66 countries over 25 years and concludes that workers could see a greater reduction in wages than the federal government raises in new revenue from a corporate income tax increase.

- A 2006 study by William Randolph of the Congressional Budget Office found that 74% of the corporate tax is borne by domestic labor.

- A 2007 study by Alison Felix estimated that a 1 percentage point increase in the marginal corporate tax rate decreases annual wages by 0.7 percent. She concluded that the wage reductions are over four times the amount of collected corporate tax revenue.

Even the left-of-center Tax Policy Center concluded that Biden’s budget would result in higher taxes for 74.1 percent of middle income-quintile households. By 2031, the TPC found that 95 percent of this income group will see a tax increase due to the expiration of middle-class tax cuts and corporate tax increase.

President Biden and Democrats continually claim their tax hikes will hold middle class families and small businesses harmless. However, the facts do not support this case. If Democrats have their way and raise taxes, millions of main street businesses, low- and middle-income workers, and retirees will be hit.