The IRS has released 2018 Statistics of Income (SOI) data.

This data shows that middle income American families saw the biggest tax cut – measured as the percentage decrease in “total tax liability” between 2017 and 2018 – from the Trump-Republican Tax Cuts and Jobs Act (TCJA).

Total tax liability includes federal income taxes as well as taxes listed on IRS form 1040 such as social security taxes on self-employment income and tax applicable to individual retirement arrangements (IRAs).

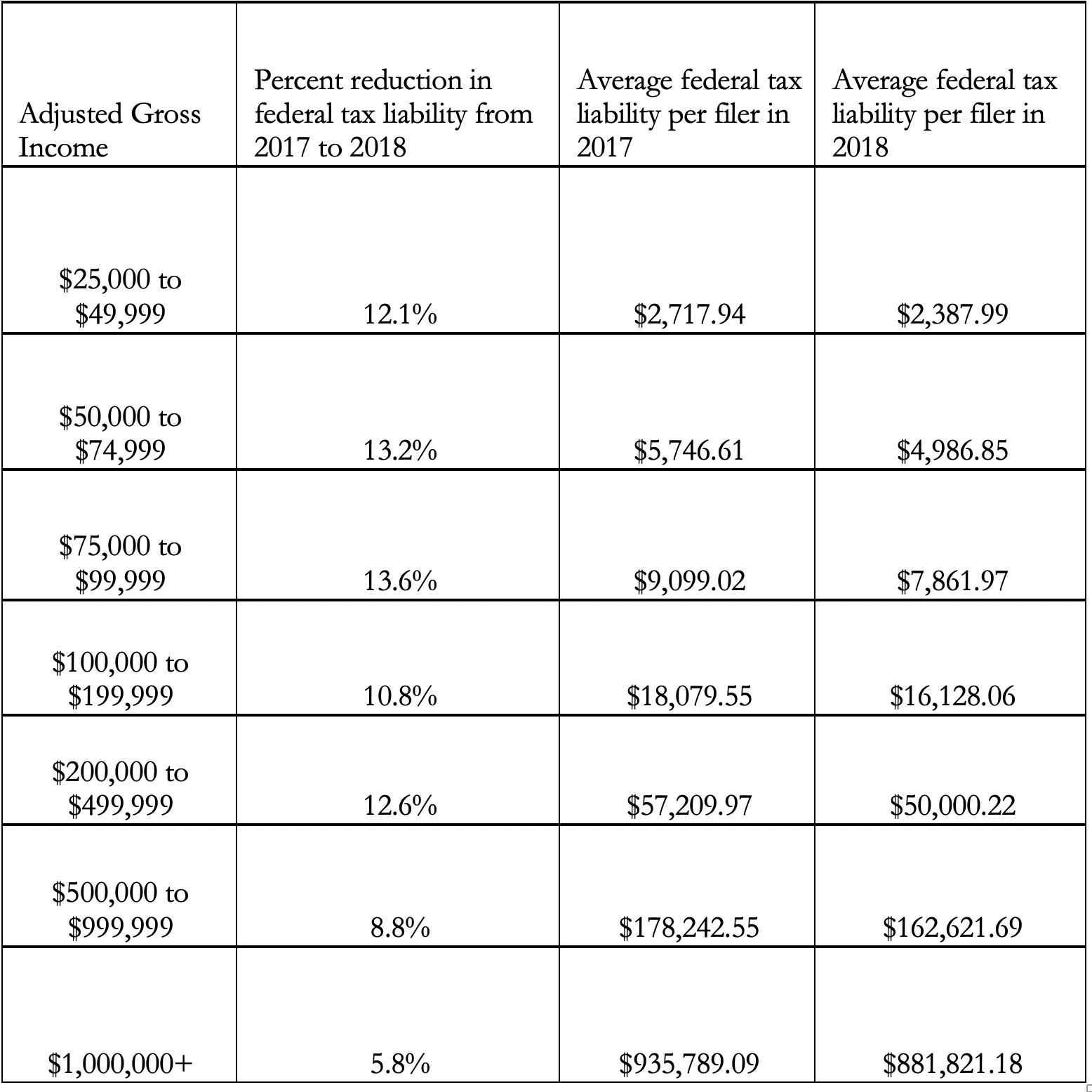

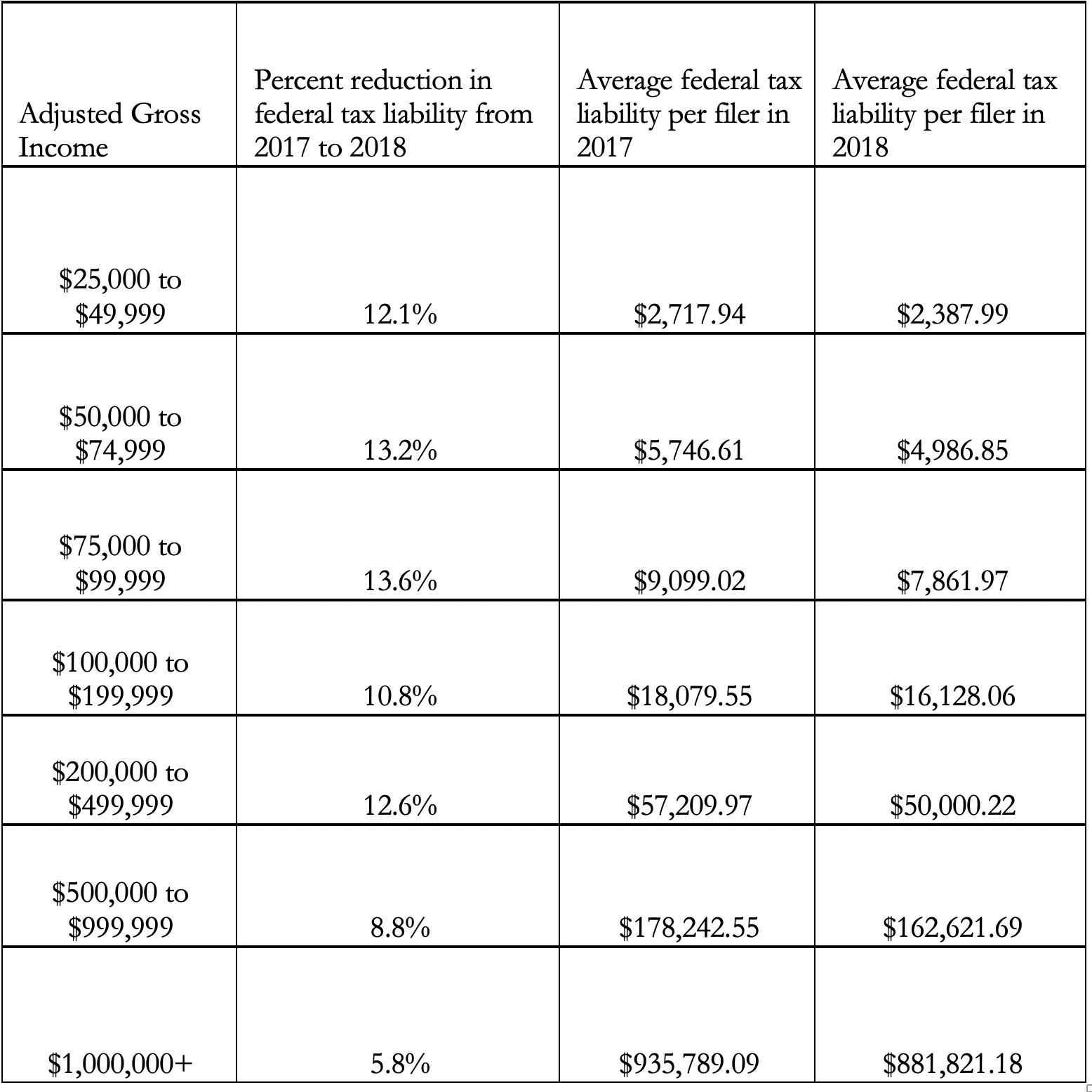

As the data notes, Americans with incomes between $50,000 and $100,000 saw their tax liability drop by twice as much as Americans with income above $1 million:

-Americans with adjusted gross income (AGI) of $50,000 to $74,999 saw a 13.2 percent reduction in average tax liabilities between 2017 and 2018.

-Americans with AGI of between $75,000 and $99,999 saw a 13.6 percent reduction in average federal tax liability between 2017 and 2018.

-Americans with AGI of $1 million or above saw a 5.8 percent reduction in average federal tax liability between 2017 and 2018, less than half the tax cut seen by Americans with AGI between $50,000 and $100,000.