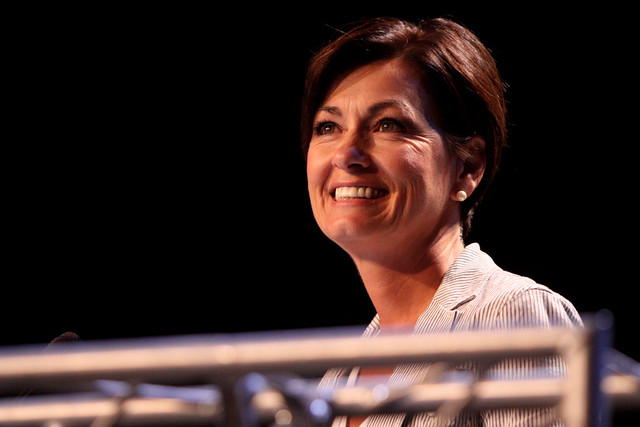

Iowa Governor Kim Reynolds (R) signed a bill into law last week that adds transparency and taxpayer safeguards to local property tax increases.

Thanks to this new law, local city councils and county boards are now required to hold public hearings when discussing property tax issues. These hearings must be made known on the county’s website as well as social media, and hearing notices must include a “statement of the major reason for the increase.” This transparency will allow for greater input from those who will be affected most by changes.

Chris Ingstad, President of Iowans for Tax Relief—who has played a key role in advocating for property tax relief—says that this reform is a huge win for Iowans and empowers taxpayers.

“When the first public hearing of property tax reform was held in March, Iowans for Tax Relief advocated that an open conversation between local government and their constituents is needed. This bill accomplishes that goal. Transparency, citizen input, and local government accountability will all be increased,” said Ingstad.

In addition, this new law also requires any property tax hike that would generate a revenue increase of 2 percent or more to receive a two-thirds majority vote in order to pass. The higher threshold for passage acts as a safeguard for taxpayers, as it makes it difficult for local lawmakers to pass large property tax hikes without broad support. Unfortunately, a property tax increase of 2 percent or less would be able to pass with just a simple majority vote.

This property tax transparency law comes one year after Gov. Reynolds enacted the largest tax cut in state history. Once fully implemented, the 2018 tax reform package will both simplify the tax code and reduce tax rates. The individual income tax will change from a nine-bracket tax system with a top marginal rate of 8.98 percent to a four-bracket system with a top rate of 6.5 percent. In addition, the corporate tax rate will be lowered from 12 percent to 9.8 percent. The pro-growth reforms included in the 2018 tax reform package will save Iowa taxpayers $2.86 billion over the next six years.

Rising property taxes have long been an issue in the Hawkeye State. A Des Moines Register/Mediacom poll conducted in February found that 55 percent of Iowans view their property tax as being too high. While this law itself does not provide tax relief, it will make unwanted tax hikes more difficult to impose.