|

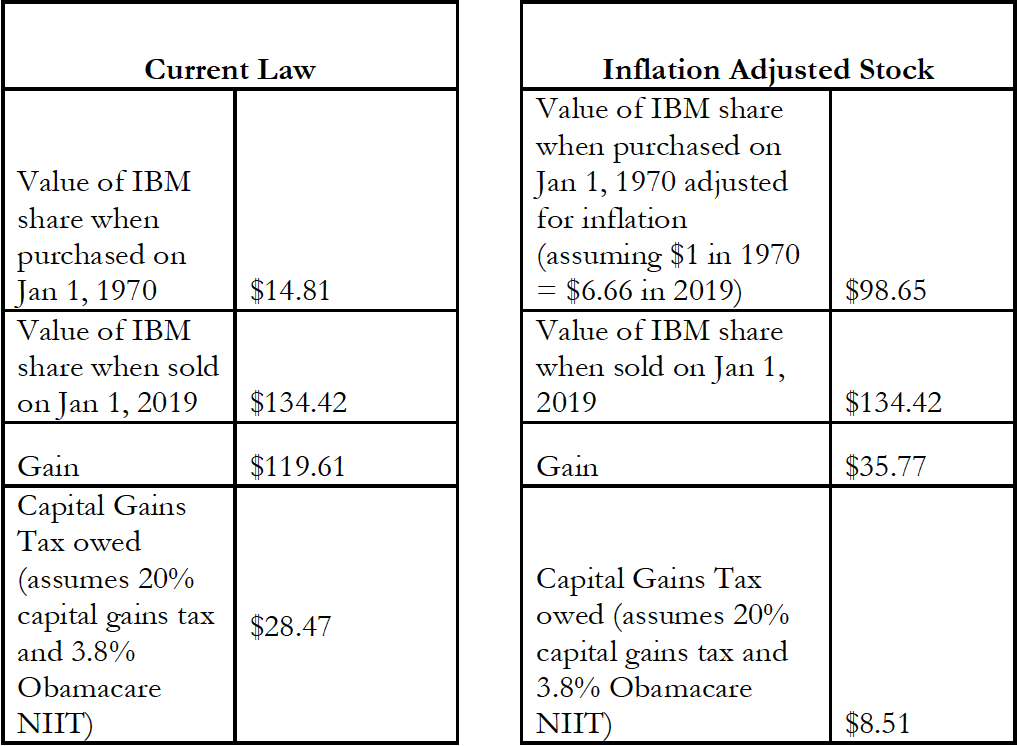

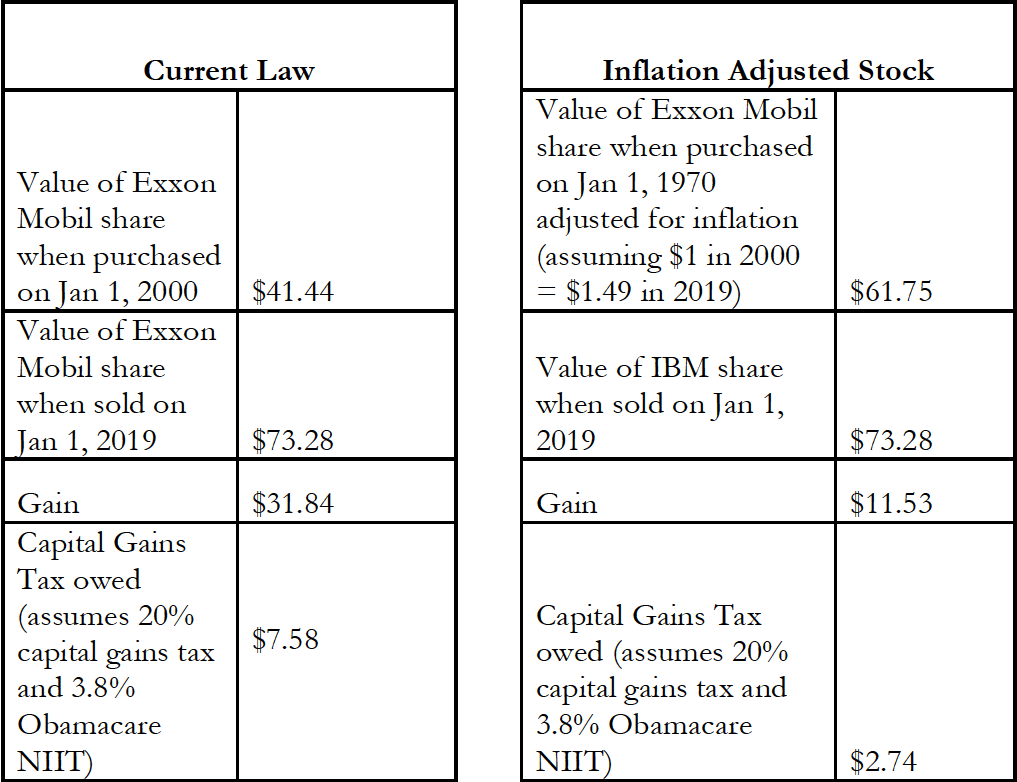

Recent media reports suggest that the Trump administration is considering using its regulatory authority to index capital gains taxes to inflation through regulation. This would have clear, immediate economic benefits and will increase the wealth of Americans across the country. In many cases, inflation comprises a significant portion of the gain when paying capital gains taxes. [Click here for a PDF of this memo.] Inflation Comprises 70 Percent of Tax Owed on IBM Shares Purchased in 1970 For example, a taxpayer purchasing one share of IBM stock at the beginning of 1970 would have paid $14.81. If they sold their share at the beginning of 2019, the total value would be $134.42. This would mean the gain is $119.61 and total tax owed – assuming the 20 percent capital gains tax and the 3.8 percent Obamacare net investment income tax – is $28.47. Under an inflation adjustment, the value of a dollar in 1970 equals $6.66 dollars today. Therefore, if inflation were accounted for, the value of the share would be adjusted to $98.65 and the gain ($134.42 – $98.65) would be just $35.77. Under this example, tax owed would be $8.51 instead of $28.47 as inflation accounts for 70 percent of the gain. Inflation Comprises 64 Percent of Tax Owed Exxon Mobil Shares Purchased in 2000 In another example, a taxpayer purchasing one share of Exxon Mobil stock in 2000 would pay $41.44. The value of the share at the beginning of 2019 is $73.28 so the gain is $31.84. Tax owed – assuming the 20 percent capital gains tax and the 3.8 percent Obamacare net investment income tax – would be $7.58. Under an inflation adjustment, the value of a dollar in 2000 equals $1.49 today. Therefore, if inflation were accounted for, the value of the stock would be $61.75. The true, inflation-adjusted gain is just $11.53 and total tax owed is $2.74. This means that inflation makes up nearly 64% of the increase in value of the share.

|

|||||

|

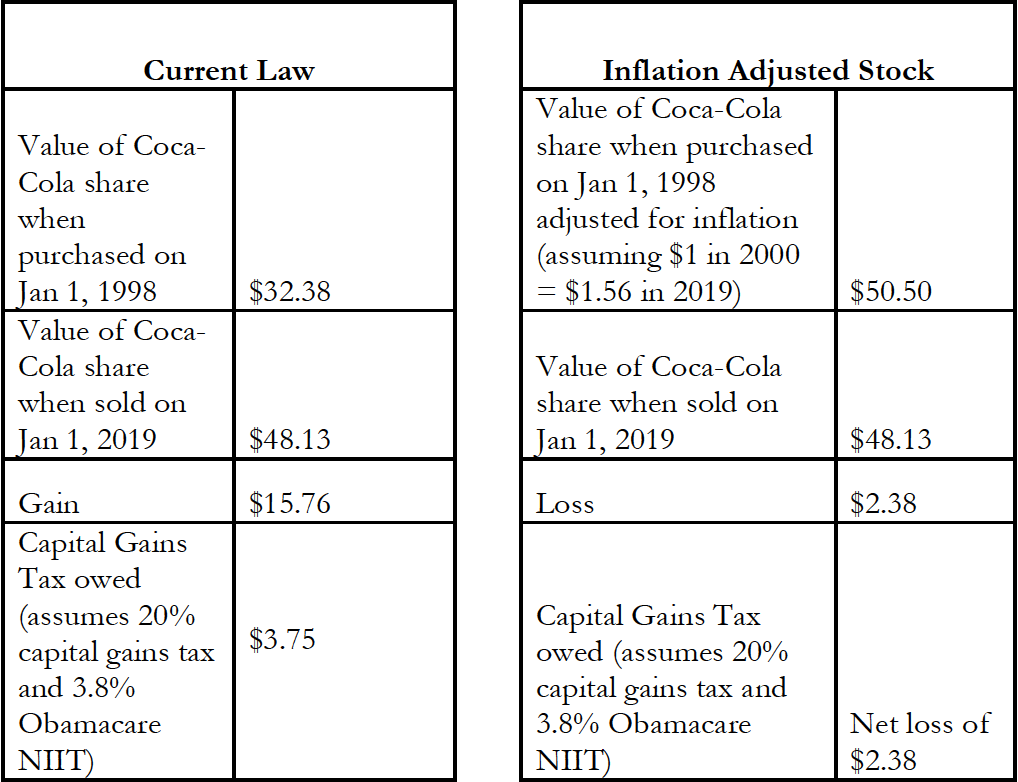

Inflation Comprises the Entire Gain of Gain of Coca-Cola Shares Purchased in 1998 In some cases, inflation makes up the entire gain and the taxpayer actual has a loss when inflation is accounted for. A taxpayer that purchases one share of Coca-Cola stock in 1998 would have paid $32.38 per share. Today, that share would be worth $48.13 with a gain of $15.76 and a tax liability of $3.75. However, because of inflation, the value of a dollar in 1998 is worth $1.56. The inflation adjusted value of the stock is therefore $50.50 and the taxpayer has an inflation adjusted loss of $2.38.

Inflation adjustments calculated through Bureau of Labor Statistics inflation calculator: https://data.bls.gov/cgi-bin/cpicalc.pl |

|||||

|

|