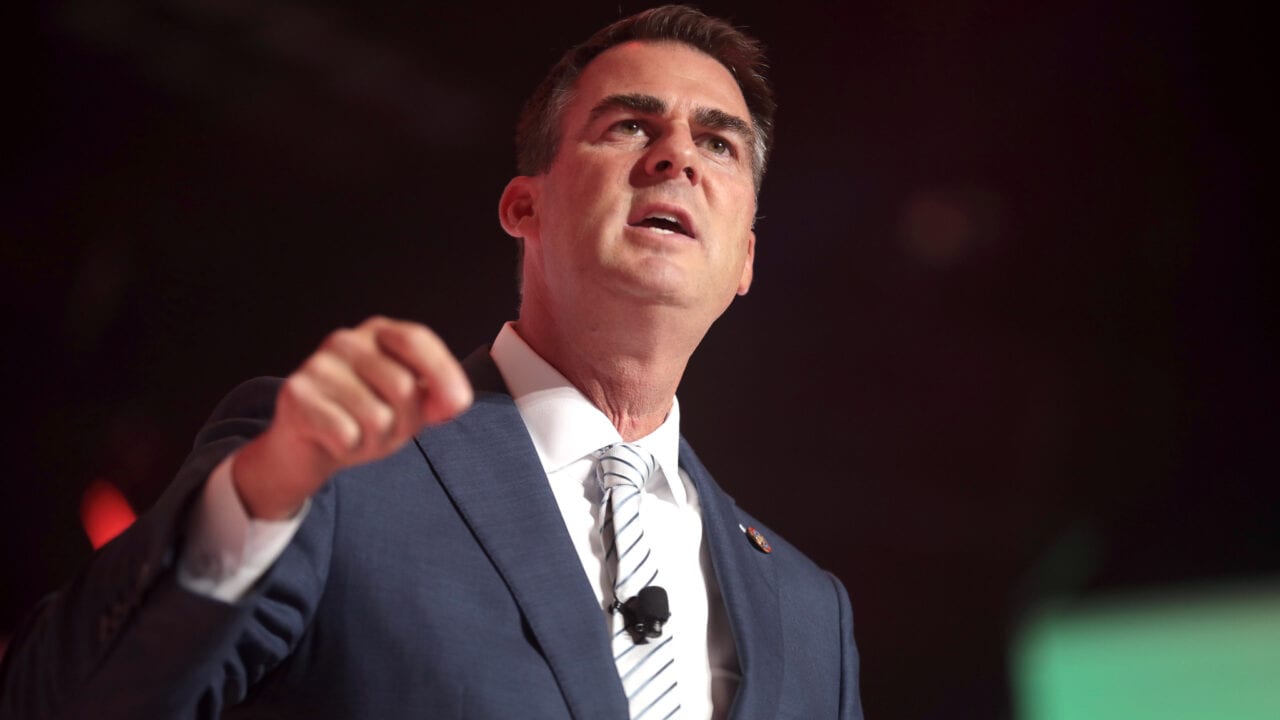

Governor Kevin Stitt by Gage Skidmore is licensed under CC BY-SA 2.0

Governor Kevin Stitt by Gage Skidmore is licensed under CC BY-SA 2.0

This week, Oklahoma Governor Kevin Stitt called for a special session of the state legislature to cut taxes. The session is set to commence on October 3.

Gov. Stitt has expressed the three things he hopes to achieve in this session. First, a tax cut that will put the state on the path towards income tax elimination. Second, the implementation of more budget transparency measures to help ensure that Oklahomans understand where and how their tax dollars are being spent. Lastly, the passing of a “trigger law,” meant to promote tax fairness across the state.

Stitt has been vocal about zeroing out the state income tax. Stitt said, “we have one job – to serve and protect all four million Oklahomans … I am calling on the Legislature to put Oklahoma on a path to zero income tax … If not now, when?” The state currently holds more than $4 billion in savings, making this the perfect time to slash taxes. House Speaker, Charles McCall, has echoed these sentiments, stating that “[the] state is long overdue for personal income tax cuts.”

The legislature has worked on plans to reduce, flatten, and eliminate the state income tax over recent years. The House, in particular, has advanced and passed legislation to both create a lower flat tax rate and to eliminate the income tax. Oklahoma most recently cut the personal income tax in 2021, with a 0.25% rate reduction to all brackets.

Oklahoma leaders can see that more needs to be done, as states like Louisiana pass tax reductions, and neighboring Texas remains a leading no-income-tax state. Speaker McCall commented on this trend, stating that “for Oklahoma to be competitive, and to have a robust and strong economy, this Legislature… [will] have to figure out the way to get that [tax] rate to zero.” Major tax reform that put Oklahoma on the path to zero income tax would entice more people and businesses to move and grow in the state, which would supercharge the economy.

During these difficult times of high inflation, Oklahomans are deserving of tax relief.