Brad Little for Governor https://www.facebook.com/bradlittleforidaho

Brad Little for Governor https://www.facebook.com/bradlittleforidaho

Idaho become the 24th state to move to a flat tax after a lawmakers returned to Boise for a single-day special session on September 1. The legislature overwhelmingly approved a proposal by Governor Brad Little to streamline and lower personal income and corporate tax rates, marking another major victory for Gem State taxpayers and businesses.

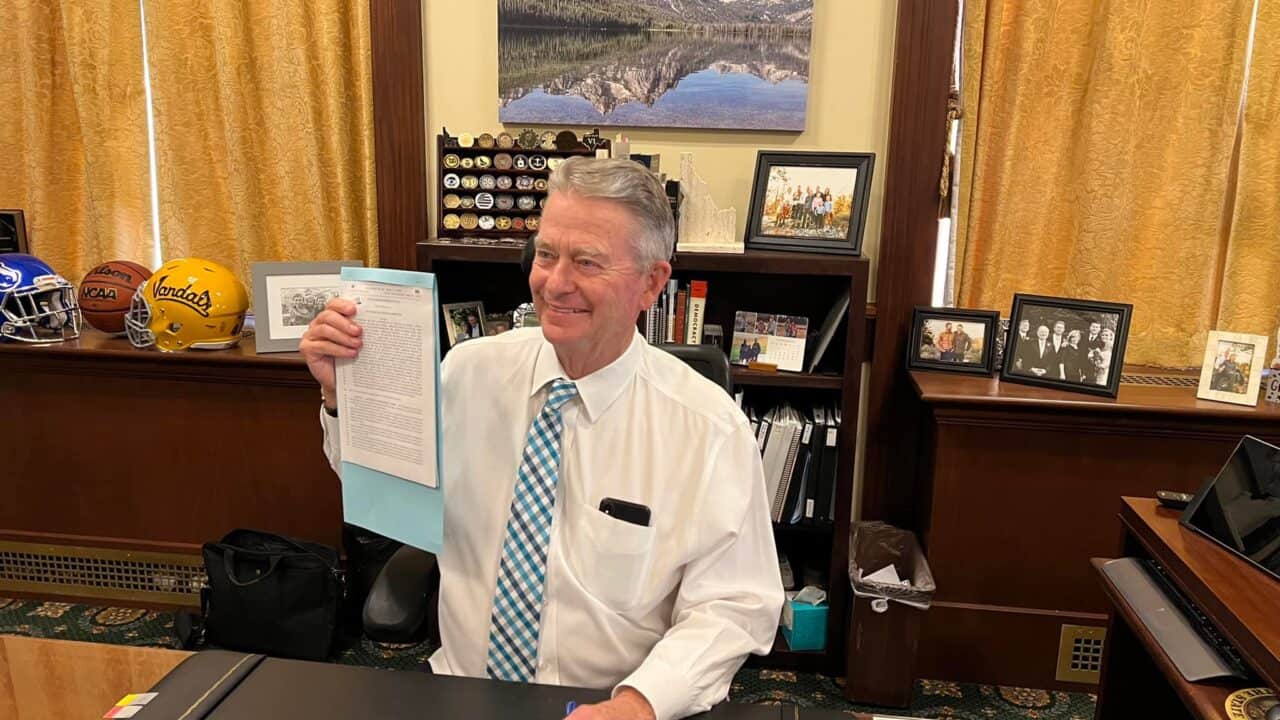

HB 1, signed into law by Gov. Little just minutes after the Senate adjourned, moves Idaho to a flat 5.8% personal income tax. The Gem State currently has a progressive tax code with four brackets and a top rate of 6% that kicks in at less than $8,000 in annual income. Though progressive on paper, most households are already paying the top marginal rate, making Idaho’s current code not much different from a flat tax.

HB 1 makes common-sense simplifications to the tax code while excluding the first $2,500 in income from taxation for single filers and the first $5,000 for joint filers. The new zero-tax brackets are inflation-adjusted, shielding taxpayers from bracket creep and a higher future tax burden.

The new law also lowers the state’s corporate tax rate from 6.0% to 5.8%, while providing for a third round of taxpayer rebates. Drawing on a record $2 billion surplus, HB 1 will return $500 million of state funds to taxpayers – approximately 10% of an individual’s 2020 income tax liability. Individuals will receive a minimum of $300 and joint filers will receive $600.

The passage of HB 1 is the third permanent tax cut by Idaho policymakers in just 16 months, reinforcing Idaho’s standing as a national leader in pro-growth tax reform. Idaho, which already boasts one of the highest in-migration rates and fastest growing economies in the country, will now become an even more attractive destination for individuals, families, employers, and investors.

Notably, HB 1 protects Idahoans from a slew of harmful provisions in Proposition 1, an education funding measure on the ballot this November whose poorly written language and dramatic tax hikes likely sparked Gov. Little’s call to special session last month. Known as the Quality Education Act, Proposition 1 creates a brand-new tax bracket for individuals earning over $250,000 and sets the top personal income tax rate at 10.925% – nearly double the current top rate of 6%. It also imposes a 33% increase in the corporate tax rate to 8%, giving Idaho a higher rate than New York, Oregon, and all its regional competitors.

Moreover, by inadvertently reprinting old income tax brackets that utilize higher 2021 rates, Prop. 1 threatens to totally reverse the historic tax cuts signed into law by Gov. Little this February and increase the tax burden even for low- and middle-income earners. Worse yet, the ballot measure indexes inflation in the wrong direction by inverting the correct equation. Instead of matching the real value of income as it changes over time, the new top rate will progressively lower the $250,000 threshold, applying the new 10.925% income tax rate to more taxpayers every year.

Thanks to the special session work by Gov. Little and Idaho policymakers, these regressive provisions will lose their bite. The provisions set forth in HB 1 will kick in on January 3, 2023, meaning that the new flat tax will supersede the tax hikes in Prop. 1 even if it is ultimately approved this November. Meanwhile, HB 1 allocates $410 million in education funding, well over the $323 million proposed by Prop. 1, all while streamlining the system and putting dollars back into the wallets of Idahoans during a time of rampant inflation.

The income tax reform enacted by HB 1 is a commendable step in the right direction, but states like Illinois and Massachusetts still boast lower income tax rates than Idaho. Legislators should work to make further improvements to Idaho’s tax code, particularly in light of the growing list of no-income-tax states. By further reducing the state income tax rate and keeping state spending increases below the combined rate of population growth plus inflation, Idaho will be better able to compete for jobs and investment with the likes of Texas, Florida, and Tennessee, while remaining a regional and national leader in pro-growth tax reform.