Hillary Clinton has adopted the proposal of socialist Bernie Sanders to increase the top Death Tax rate to 65 percent.

Clinton previously called for a hike to the top Death Tax rate, from 40 to 45 percent, as part of a more than $1,000,000,000,000 (one trillion) net tax increase on the American People over the next ten years. The true net tax hike figure is likely much higher because Clinton’s campaign has not released specific details for many proposals. To date, the campaign has proposed multiple capital gains tax hikes, an income tax increase, a business tax increase, a tax on stock trading, an “Exit Tax” and even a “fairness” tax.

Clinton’s tax plan offers no tax rate reduction for any individual or business.

And now, Hillary is proposing Death Tax brackets of 50 percent, 55 percent, and 65 percent.

As noted by the Wall Street Journal:

The left claims only the super-wealthy will pay high rates, but the Sanders plan that Mrs. Clinton is copying did not index exemption levels for inflation. One reason a bipartisan movement emerged to reform the death tax in the 1990s was because the then 55% rate engulfed ever more taxpayers over time. Mrs. Clinton would also end the “step-up in basis” on stock valuations for many filers, triggering big capital gains taxes for a much broader population.

She also knows most of her rich friends will set up foundations, as she and Bill Clinton have, to shelter most of their riches from the estate tax. As Americans have learned, these supposed charities can be terrific vehicles for employing political operatives while they wait for Chelsea to run for the Senate.

While Hillary continues to push for a steep Death Tax on the American people, when it comes to her own finances, it is a different story. Clinton’s newly released tax returns show she still uses tax avoidance strategies to shield her Death Tax liability.

According to a 2014 report by Bloomberg News, the Clintons created trusts in 2010 and shifted ownership of their New York home to it in 2011. In doing so, they will avoid paying hundreds of thousands of dollars in future death taxes.

As Bloomberg reports:

To reduce the tax pinch, the Clintons are using financial planning strategies befitting the top 1 percent of U.S. households in wealth. These moves, common among multimillionaires, will help shield some of their estate from the tax that now tops out at 40 percent of assets upon death.

The Clintons created residence trusts in 2010 and shifted ownership of their New York house into them in 2011, according to federal financial disclosures and local property records.

But Hillary Clinton’s official campaign website, in calling for a steep Death Tax hike, scolds:

She will also close complex loopholes, including methods that people can now use to make their estates appear to be worth less than they really are.

Oh! Let’s go back to the Bloomberg article:

Among the tax advantages of such trusts is that any appreciation in the house’s value can happen outside their taxable estate. The move could save the Clintons hundreds of thousands of dollars in estate taxes, said David Scott Sloan, a partner at Holland & Knight LLP in Boston.

“The goal is really be thoughtful and try to build up the nontaxable estate, and that’s really what this is,” Sloan said. “You’re creating things that are going to be on the nontaxable side of the balance sheet when they die.”

Interesting.

Clinton said that “the estate tax has been historically part of our very fundamental belief that we should have a meritocracy.”

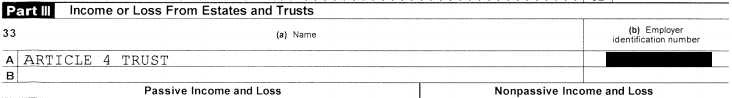

The newly released Clinton tax return shows the continued use of an Article 4 Trust, as shown on Schedule E, page 2.

Hillary has a long history of opposing Death Tax relief:

– In 2001, Clinton voted no on H.R. 1836, “the Economic Growth and Tax Reconciliation Act,” which contained a series of tax cuts, one of which increased the Death Tax exemption level to $3.5 million.

– In 2005, Clinton voted no on H.R. 8, “the Death Tax Repeal Permanency Act of 2005,” which fully repealed the Death Tax.

– In 2006, Clinton voted no on H.R. 5970, “the Estate Tax and Extension of Tax Relief Act of 2006,” which increased the Death Tax exemption level to $5 million.

– In 2008, Clinton voted no on S.Amdt.4191, legislation to increase the Death Tax exemption level to $5 million.

To learn more about Hillary’s tax hike plan, visit ATR’s dedicated website, www.HighTaxHillary.com