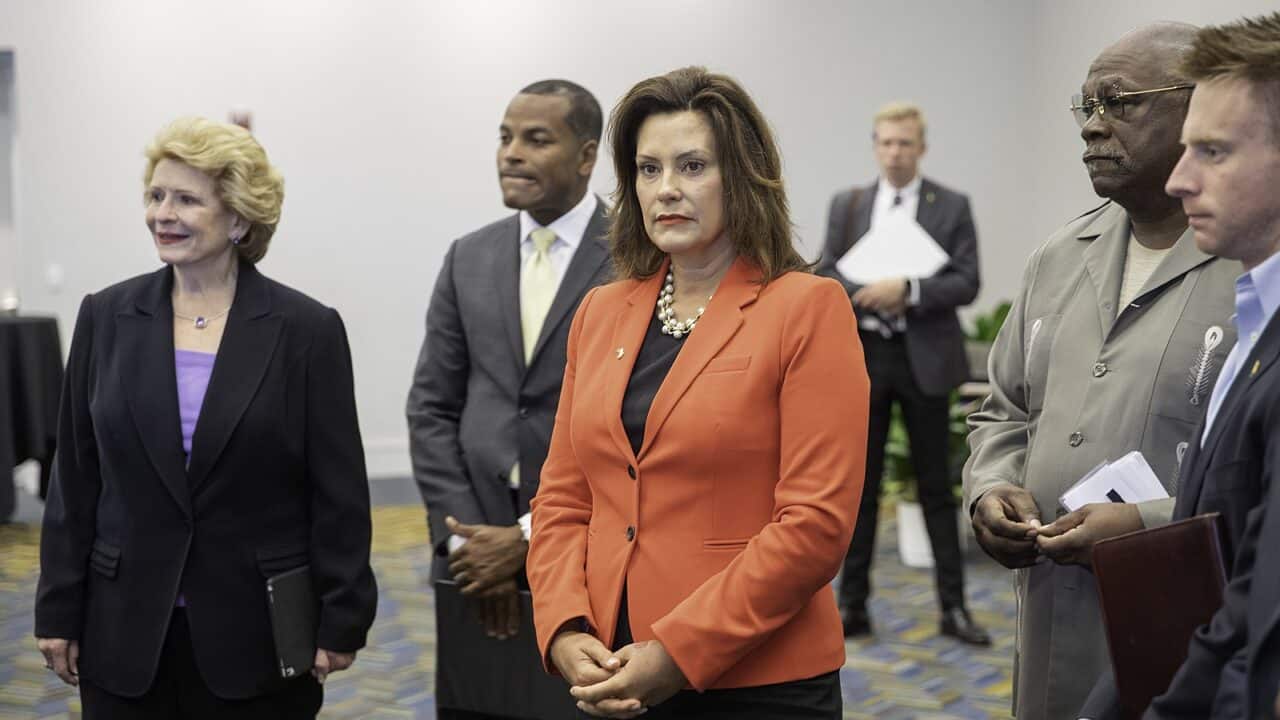

Duggan-Whitmer-Stabenow Cobo Hall change to TCF by the City of Detroit is licensed under Public Domain Mark 1.0

Duggan-Whitmer-Stabenow Cobo Hall change to TCF by the City of Detroit is licensed under Public Domain Mark 1.0

Once again, Michigan Governor Gretchen Whitmer has rejected much-needed tax relief for the people of the Great Lake State.

The Family Inflation Relief Plan, proposed by Representative Matt Hall (R-63) and supported by Senate Majority Leader Mike Shirkey (R-16), would ease the tax burden on struggling taxpayers. This plan would lower the personal income tax rate from 4.25% to 4%, boost the earned income tax credit from 6% to 20%, increase the personal income tax deduction from $4,900 to $6,700, raise the senior personal tax exemption, and allow taxpayers to claim a $500 per child non-refundable tax credit.

Michiganians are struggling under the highest inflation in four decades. This tax cut would provide much-needed support.

“We are fighting to lower taxes so residents can better afford record-high inflation and gas prices. But, unfortunately, Democrats in the state Legislature and our governor have fought efforts to reduce taxes every step of the way,” said Senator Aric Nesbitt, R-Lawton.

This isn’t the first time Governor Whitmer vetoed legislation that would have helped Michigan taxpayers.

Earlier this year, she vetoed the bipartisan HB 5570, which would have temporarily paused the state’s gas tax from April 1, 2022 through September 30, 2022. This would have decreased the average gas price in Michigan which currently stands at $5.22, $2.12 more than the same time last year.

She also vetoed Senate Bill 768, which would have cut income and corporate income taxes down from 4.25% and 6%, respectively, to 3.9%. It also would have given taxpayers a $500 dependent child tax credit and more than tripled the Earned Income Credit.

With both vetoes, Governor Whitmer cited worries that these bills would hurt the state’s budget while confusingly touting Michigan’s massive surplus at the same time. If Governor Whitmer cared for the hardworking taxpayers of Michigan, she would work to pass these tax cuts and make the Great Lake State a better place to live, work, and raise a family