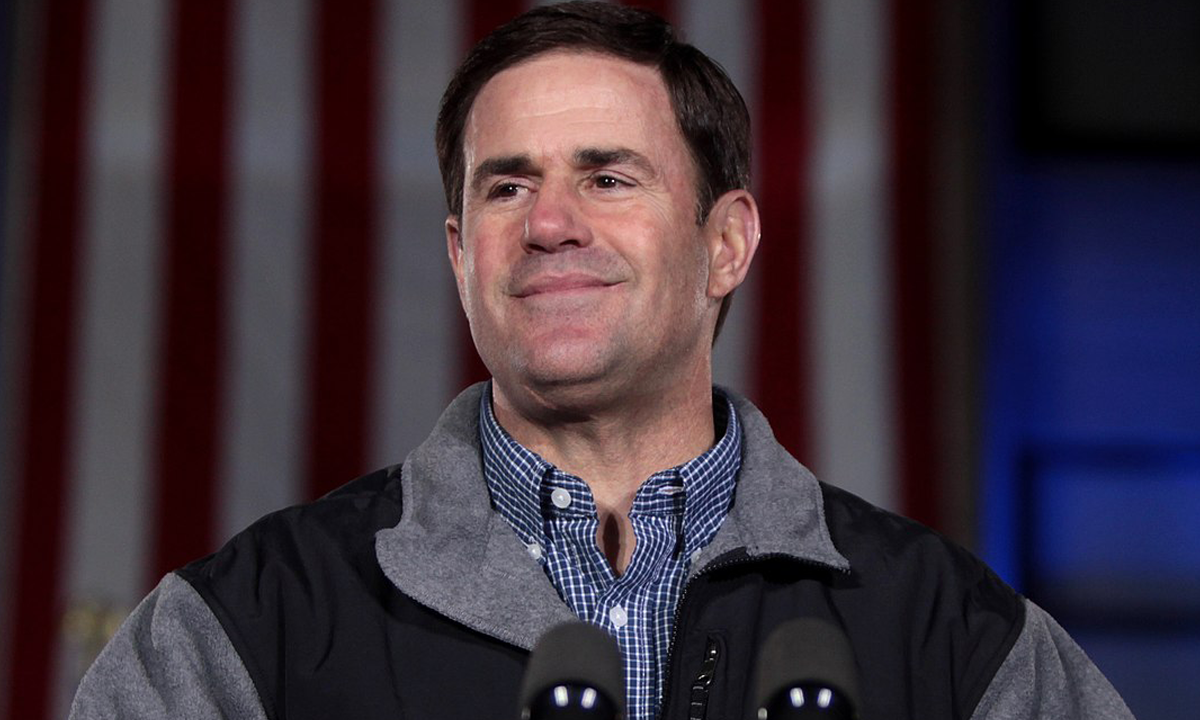

Doug Ducey by Gage Skidmore is licensed under CC BY-SA 2.0

Doug Ducey by Gage Skidmore is licensed under CC BY-SA 2.0

Arizona Governor Doug Ducey (R) vetoed a bill that would have facilitated a sales tax increase. This bill – opposed by a number of Republicans in the legislature – would have put Arizonans at risk for losing more of their hard-earned money at a time when they can least afford it.

The bill – H.B. 2685 – would have helped reimpose the Maricopa Country half cent sales tax hike that was approved in 2004 and, by law, is scheduled to expire in 2025. The intentions behind this bill were to spend more hard-earned tax dollars on local transit projects.

“Politicians have a bad habit of asking taxpayers to pay for a ‘temporary’ tax hike and then (skipping over their bad habit of lying to voters) demand that it be made permanent. Arizona decided not be fooled again,” said Grover Norquist, president of Americans for Tax Reform.

For decades, consultants and proponents of big government have been traveling around the country in hopes of selling politicians on the “benefits” of light rail, street cars, and the like. As many people across the country and even in Arizona have learned the hard way, these undertakings never turn out as planned. Ridership projections are grossly overestimated while price tags are grossly underestimated, and taxpayers are left on the hook for millions of dollars.

“HB2685 was Build Back Broke transportation policy which allowed billions of dollars to be siphoned away from freeways and roads to pay for local pet projects and transit boondoggles. Equally bad, the bill tried to obfuscate these wildly unpopular policies from voters by rigging the ballot language and holding the election in the spring of next year to take advantage of low voter turnout,” said Scot Mussi, president of the Arizona Free Enterprise Club.

ATR sent a letter to legislators warning that a vote in support of this legislation is support for a tax hike since the threatened tax hike could not occur without this legislative facilitation. It is a clear violation of the Taxpayer Protection Pledge.

ATR commends Gov. Ducey, one of 16 Governors who have signed the Taxpayer Protection Pledge, along with the following 9 senators and 21 representatives sustained the veto of this tax increase:

- Sen. Nancy Barto*

- Sen. Sonny Borrelli

- Sen. David Gowan

- Sen. Vince Leach

- Sen. Javan Mesnard

- Sen. Warren Peterson*

- Sen. Wendy Rogers*

- Sen. Kelly Townsend

- Sen. Michelle Ugenti-Rita

- Rep. Leo Biasiucci*

- Rep. Walt Blackman*

- Rep. Shawnna Bolick

- Rep. Judy Burges*

- Rep. Neal Carter

- Rep. Joseph Chaplik*

- Rep. David Cook

- Rep. Lupe Diaz

- Rep. John Fillmore*

- Rep. Mark Finchem

- Rep. Travis Grantham

- Rep. Gail Griffin*

- Rep. Jake Hoffman*

- Rep. Steve Kaiser

- Rep. John Kavanagh*

- Rep. Quang Nguyen*

- Rep. Jacqueline Parker*

- Rep. Kevin Payne

- Rep. Beverly Pingerelli

- Rep. Ben Toma

- Rep. Jeff Weninger

Note: An asterisk (*) represents those who have signed the Taxpayer Protection Pledge. To see the full list of Arizona Taxpayer Protection Pledge signers, click here.