In the coming months, Congress will debate numerous policies in response to the economic damage caused by the Coronavirus.

One of the most important policies to ensuring a strong recovery is full business expensing.

The Tax Cuts and Jobs Act moved in the right direction on expensing by allowing most assets (those with 20 years or less of depreciable life) to be expensed in the year of purchase until 2022. After 2022, the provision begins phasing out through the end of 2026.

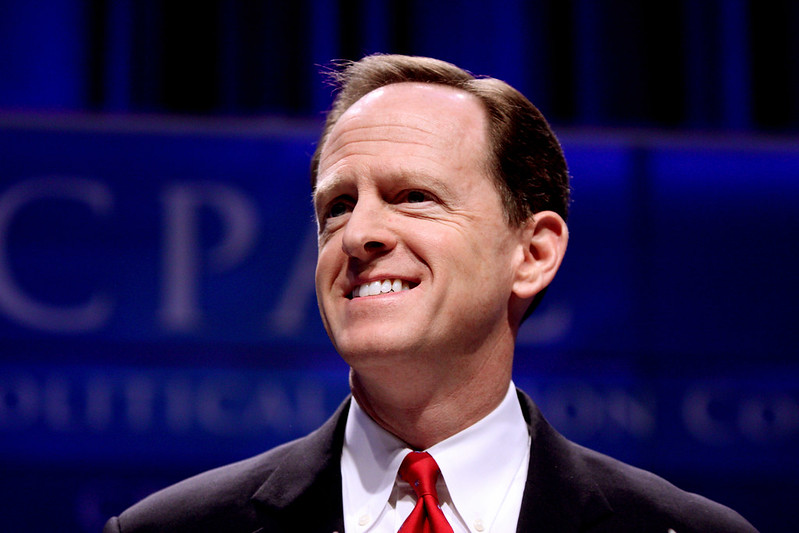

Moving forward, Congress should make expensing permanent and expand it, as proposed by Senator Pat Toomey (R-Pa.) and Rep. Jodey Arrington (R-Texas) in the Accelerate Long-Term Investment Growth Now (ALIGN) Act.

What is Expensing?

Full business expensing reduces taxes by allowing businesses to deduct the cost of new investments (machinery, equipment etc.) in the year they are made.

There are several benefits to this policy. First, it incentivizes new investment, leading to greater economic productivity, job growth and higher wages. Second, it simplifies the tax code by equalizing the tax treatment of new investments with other business expenses such as wages, rent, and healthcare costs.

In a post COVID-19 world, expensing will help businesses make vital investments in the coming months and years as they seek to bring workers back, onshore manufacturing capabilities, and ramp up production in a post COVID-19 world.

Full Business Expensing Creates Jobs and Grows the Economy

Allowing immediate expensing gives businesses the equivalent of a zero percent rate on new investments. This has two benefits – it means more money for businesses to create jobs and increase pay, and it creates an incentive to increase capital investment, which leads to stronger economic growth, more jobs, and higher wages.

A 2018 Tax Foundation study estimates that making full business expensing permanent will increase GDP by 0.9 percent, creating over 172,000 jobs over the next decade. It is also important to note that this estimate accounts for only a fraction of the full benefits of expensing, because expensing is already law for much of the 10-year budget baseline.

Previous research by the Tax Foundation has estimated that over a decade, expensing can increase GDP by five percent and increases wages by 4 percent, creating more than one million jobs.

Expensing Makes the Tax Code Fairer and Simpler

By allowing businesses to write off the cost of new investments immediately, full business expensing removes a bias in the tax code. Prior to the enactment of expensing, businesses were forced deduct, or “depreciate” the cost of new investments over multiple years depending on the asset they purchase, as dictated by complex and arbitrary IRS rules.

These rules create needless complexity and increase compliance costs. A business could write off a box of paper clips immediately but had to wait five years to recover the full cost of purchasing a computer, or seven years to recover the full cost of purchasing a desk.

This forced business owners to make decisions based on tax reasons, while full business expensing treats all assets and business expenses equally.

There is Strong Support for Full Business Expensing

Expensing has the support of conservative groups, economists, and key House Republicans such as Ways and Means Ranking Republican Kevin Brady (R-Texas).

The ALIGN Act introduced by Senator Toomey and Rep. Arrington also has significant support. Co-sponsors include Senators Mike Braun (R-Ind.), Shelley Moore Capito (R- W.Va.), Kevin Cramer (R-N.D.), Ted Cruz (R-Texas), Cory Gardner (R-Colo.), Jim Inhofe (R-Okla.), James Lankford (R-Okla.), Jerry Moran (R-Kan.), David Perdue (R-Ga.), Rob Portman (R-Ohio), Jim Risch (R-Idaho), Marco Rubio (R-Fla.), Tim Scott (R-S.C.), Thom Tillis (R-N.C.), John Thune (R-SD), and Kelly Loeffler (R-Ga.).

The House version is supported by Rep. Drew Ferguson (R-Ga.), Rep. Jason Smith (R-MO), Rep. Guy Reschenthaler (R-Pa), Rep. Tom Rice (R-SC), Rep. David Schweikert (R-Ariz.), and Rep. Brad Wenstrup (R-Ohio)

While many on the left equate full business expensing as a “loophole,” this was not always the case. Former Obama Economic Adviser Jason Furman has long supported full business expensing, and the policy was included in several Obama budgets (albeit as part of a net tax increase).

The Obama White House correctly noted that the provision would help businesses and workers in press releases and fact sheets:

“If a business bought an additional $1 million worth of equipment next year, they would be able to deduct the full $1 million up front, potentially accelerating hundreds of thousands of dollars in tax cuts. That’s real money that businesses… could use to expand or hire new workers right now, and provides a strong incentive to increase investment now, creating even more jobs.”

President Obama is right. Full expensing helps workers, businesses, and the economy. As lawmakers look to turn the economy around, they must preserve and enhance expensing.