California residents are fleeing the state because of big government, high taxes and high cost of living. Instead of becoming more taxpayer-friendly, the state is now attempting to tax those who are leaving.

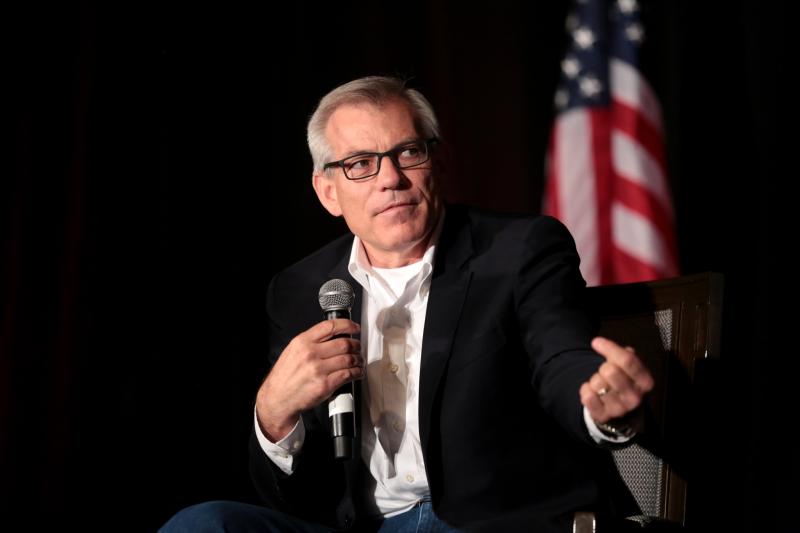

In light of this attempt to tax residents who leave California for greener pastures, Congressman David Schweikert (R-Ariz.) has introduced the Exit Tax Prevention Act of 2021 legislation that will ensure tax competition and protect the rights of Americans to live where they please.

Rep. Schweikert’s bill would prohibit California and other blue states from taxing residents that have left their state:

SEC. 2. PROHIBITION ON CERTAIN STATE AND LOCAL TAXATION.

A State, or taxing jurisdiction in a State, may not impose an obligation for the collection of an income tax, wealth tax, or any similar tax on a resident who has relocated permanent residence to another State or a taxing jurisdiction of another State.

California state lawmakers are pushing a 0.40 percent annual tax on a taxpayer’s worldwide wealth above $30 million. This tax would be imposed on a taxpayer at the end of each calendar year based on the fair market value of assets. Part-time residents would pay a prorated tax based on the number of days spent in California each year.”

If this tax were imposed, former California residents would be required to pay the state’s new wealth tax for 10 years after having left. The first year they would owe 0.4 percent and this would gradually decrease to 0.04 percent by the tenth year.

This tax is likely unconstitutional. It violates the right to travel and the “dormant” commerce clause. Article I, Section 8 of the U.S. Constitution authorizes Congress “to regulate Commerce with foreign Nations, and among the several States, and with Indian Tribes.” This clause has been interpreted both as a positive authority to Congress and as an implied prohibition on state laws and regulations that interfere with interstate commerce.

Even though it would almost certainly be ruled unconstitutional by the courts, Rep. Schweikert should be applauded for his legislation and for highlighting California’s attempt to tax Americans that leave the state.

If allowed to stand, this tax would create dangerous precedent.. If states can simply impose taxes on permanent residents in another state, states can no longer be true “laboratories of democracy.” It is vital that states have autonomy, as it is consistent with the founders’ vision for the U.S. and is also the best informant we have for determining policy effectiveness.

Between 2010 and 2018, California’s tax base shrank by $24.6 billion. Instead of trying to make up for lost revenues by taxing fleeing residents, California should investigate and address the root of the problem: the undesirability of living there. If they wish to retain residents and tax revenue, they should consider lowering taxes, not perpetually making the state more expensive and undesirable.

California already has incredibly high taxes. The state has the highest income tax rate, the highest state sales tax rate, and the highest gas tax in the country.

The state also doesn’t need more revenue. Even during the pandemic, the state’s tax revenue is more than $10 billion above projections and it already has a $22 billion budget surplus.

California’s attempt to tax residents leaving the state is unconstitutional and shameful. Congressman David Schweikert should be applauded for highlighting this issue and introducing the Exit Tax Prevention Act in order to preserve state tax competition. Lawmakers should support this important legislation.