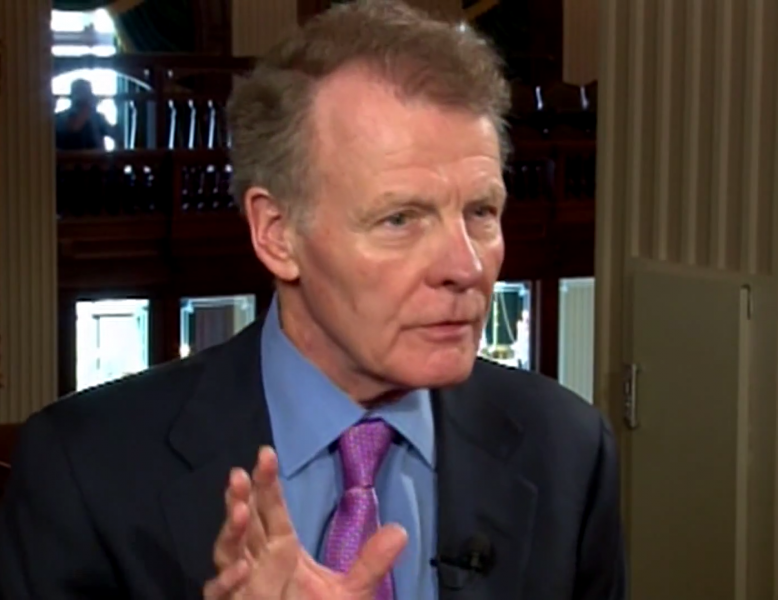

Former Illinois House Speaker Michael Madigan—the longest-serving State House Speaker in American history— announced last week that he will resign from his current seat in the Illinois House of Representatives, effective at the end of the month. Madigan has been a member of the Illinois House of Representatives for 50 years and served as Speaker of the House for 36 years, until being ousted from the position by fellow representatives last month.

His tenure as Speaker of the House has been plagued by scandal and a new federal investigation implicating him in a bribery and jobs scheme was the straw that finally broke the camel’s back. He leaves behind a state that is far worse financial shape, with a much less hospitable business tax climate than when he took over the Illinois House of Representatives in 1983.

As ATR’s Patrick Gleason notes in a Feb. 19 Forbes article, under Madigan’s iron-fisted rule the state has significantly lagged behind the rest of the nation when it comes to job and total real GDP growth. Throughout his tenure, jobs grew from 4.5 million in 1983 to 6.1 million in 2019—a 35% employment growth rate. However during this same period national employment grew from 90.2 million to 150.9 million nationwide—a 67% growth rate, almost double that of the Land of Lincoln.

Unfortunately, total real GDP growth in Illinois followed the same trend. From 1997, when Madigan resumed the Illinois House Speakership, until 2019 total real GDP in Illinois increased by 33%, whereas the national real GDP growth rate grew by 65%. Total real GDP and job growth aren’t the only things that have suffered under Madigan’s watch. Illinois is also now buried under a mountain of debt.

Around the time the former House Speaker assumed office state unfunded pension debt hovered around $6 billion. It’s now a whopping $144.4 billion and Illinois taxpayers are ultimately on the hook for it. As one can imagine, having that much pension debt does not bode well for a state’s credit rating. As such, the state’s credit rating went from perfect to sitting right above junk status—making Illinois don the lowest credit rating in the nation.

In addition to holding the nation’s lowest credit rating, Illinois now also dons the 6th highest tax burden in the nation, has the second highest debt to GDP ratio, and is the second most corrupt state. Even more disturbing, Illinois saw nearly 2,000 public corruption convictions from the time Madigan first took speakership, averaging at one conviction per week, making the Land of Lincoln the worst in the nation for public corruption between 1983 and 2018.

No politician can be a total failure. Some, like Madigan, serve as examples for how not to govern.

Though Madigan is gone the mess he left behind now needs to be addressed, which is the hard part. Unless Illinois lawmakers can get unsustainable state spending and ballooning pension liabilities under control, Illinois taxpayers will continue to face the prospect of future tax hikes, something that was an ever-present threat under Madigan’s rule and will continue to be until necessary spending and entitlement reforms are enacted in Springfield.