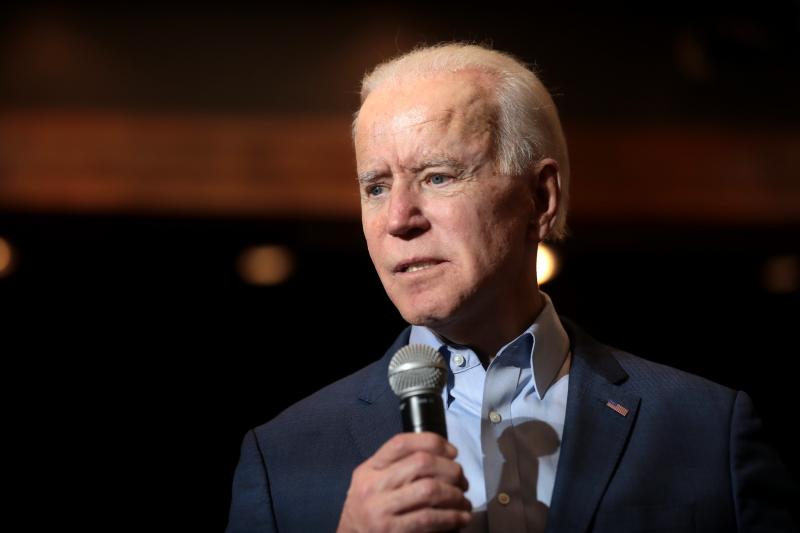

During a speech in Pennsylvania today, Joe Biden said this of the U.S. corporate tax rate:

“I’m gonna raise it back up to 28 percent.”

So even during a pandemic, Biden vowed to raise the current 21 percent U.S. corporate tax rate all the way up to 28 percent — a 33 percent increase in the rate.

Biden would impose on Americans a higher corporate tax rate than Communist China’s 25%.

President Trump and congressional Republicans lowered the federal corporate tax rate from the Obama-Biden era 35 percent rate down to the current 21 percent rate as part of the Tax Cuts and Jobs Act. Before Trump took office, America’s corporate rate was the highest in the developed world.

Biden also wants to double the capital gains tax to 40 percent for everyone:

- On Oct. 23, 2019 Biden said: “So every single solitary person, their capital gains are going to be treated like real income and they are going to pay 40 percent on their capital gains tax.”

- On Sept. 30, 2019 Biden said: “I’m gonna double the capital gains rate to 40 percent.”

- On Oct. 15, 2020: Biden said: “I would raise the capital gains tax to the highest rate of 39.5 percent, I would double it.”

- On Aug. 21, 2019: Biden said: “The capital gains tax should be at what the highest minimum tax should be, we should raise the tax back to 39.6 percent instead of 20 percent.”

Biden also vows to “eliminate” the Tax Cuts and Jobs Act which provided across the board tax cuts for households and small businesses. Such a repeal would raise taxes on a median income family of four by $2,000 per year, and raise taxes on a median income single parent with one child by $1,300 per year.

Keep track of Biden’s tax hikes at www.ATR.org/HighTaxJoe