In episode 39 of the Grover Norquist Show, ATR President Grover Norquist discusses presidential candidate and Taxpayer Protection Pledge signer Rick Santorum’s tax reform plan.

Under Santorum’s plan, income would be taxed at a flat 20% rate, encompassing all sources of income. He would also lower the corporate tax rate to 20%. Additionally, he would help families by maintaining a $2,750 personal tax credit and maintain the child credit. Furthermore, he would eliminate the marriage penalty, death tax, alternative minimum tax, all Obamacare taxes, and all income tax deductions except for charity and home mortgage deductions. On the business side, Santorum would allow full expensing for business expenses and reduce corporate loopholes.

The non-partisan Tax Foundation projects that Sen. Santorum’s tax plan would be great for the economy. His plan would increase GDP 10% more than expected, increase capital investment by 29%, wages by 7%, and create 3 million additional jobs.

Sen. Santorum outlines a detailed tax plan that will lead to growth. To learn more about his Sen. Santorum’s Tax plan, listen to the podcast below.

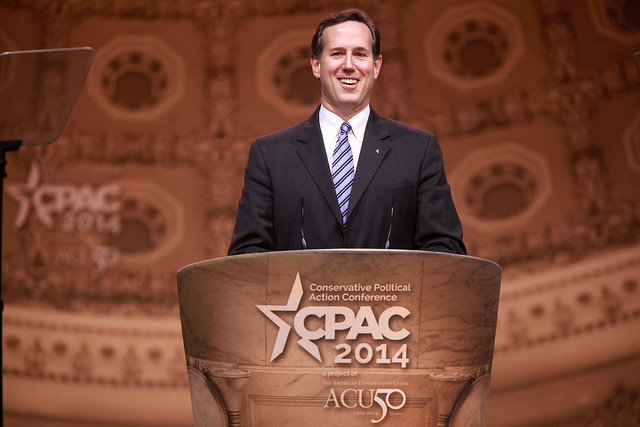

Photo Credit: Gage Skidmore