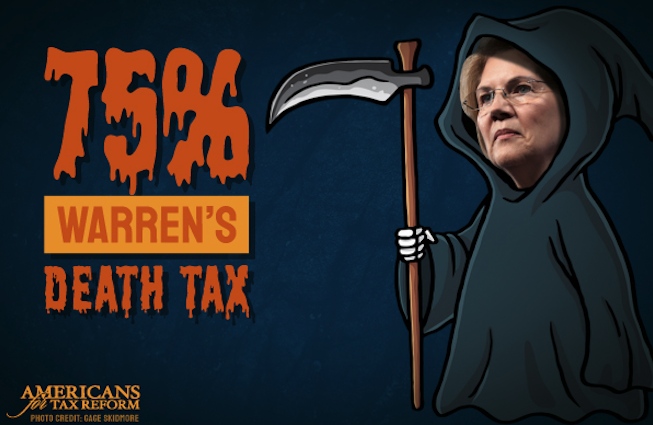

Happy Halloween! Instead of dressing up as Pocahontas this year, 2020 Democrat Elizabeth Warren is dressing up as the Grim Reaper.

Warren recently introduced spooky legislation that would tax Americans at death with a top rate of 75 percent.

Warren’s legislation would impose a heavier tax burden at death by severely chopping the death tax exemption from the current $11.4 million down to $3.5 million. Warren’s top death tax rate would be an astronomical 75 percent.

Hillary Clinton also supported a version of this plan, and we all know how that turned out.

Luckily, the Republican-passed Tax Cuts and Jobs Act raised the death tax exemption, leading to countless small businesses and family farms being spared from dealing with the IRS agent at the same time they deal with the undertaker.

Here’s why we should repeal the spooky death tax for good:

Repeal of the Death Tax will spur economic growth.

In 2016, the Tax Foundation estimated that repeal of the Death Tax would create 150,000 jobs. Additionally, the Joint Economic Committee reported that the Death Tax has suppressed over $1.1 trillion of capital in the United States’ economy since being introduced. Much of this comes from small businesses, who are the core of America’s economy. This loss of capital ultimately results in fewer jobs and lower wages for American workers.

The Death Tax is bad for jobs and repeal would give families a raise. Again according to the Tax Foundation the Death Tax is an economy killer. They have a macroeconomic “dynamic” model to see what killing the Death Tax would do to the job market. This model projects that killing the death tax would create 139,000 jobs, increase private business hours by 0.1 percent, and increase wages by 0.7 percent.

Numerous studies have found that majority of Americans oppose the Death Tax and support its repeal. For example, a recent report by NPR found that 76 percent of Americans support full, permanent repeal of the Death Tax.

In addition, the Death Tax contributes a miniscule amount of revenue relative to the size of federal government. In all, it makes up only one half of one percent of all federal revenue. Because the Death Tax is so economically destructive, almost all the revenue lost would be offset by increased economic growth. As noted by the Tax Foundation, repealing the Death Tax would result in $240 billion in lower taxes over a decade. However, the economic growth created by repealing the Death Tax would produce $221 billion in federal revenue because of increased wages and more jobs.

Repeal of the Death Tax pays for itself. The same Tax Foundation report says that the death tax would increase the economy by 0.8 percent (or $137 billion in today’s dollars). Because this additional economic growth would be subject to taxation all its own, it would more than make up for the revenue lost by repealing the Death Tax–it would make up the $20 billion per year, plus yield an extra $8 billion per year on top of that. You heard that right–we’d actually collect more tax revenue if we stopped collecting the Death Tax.