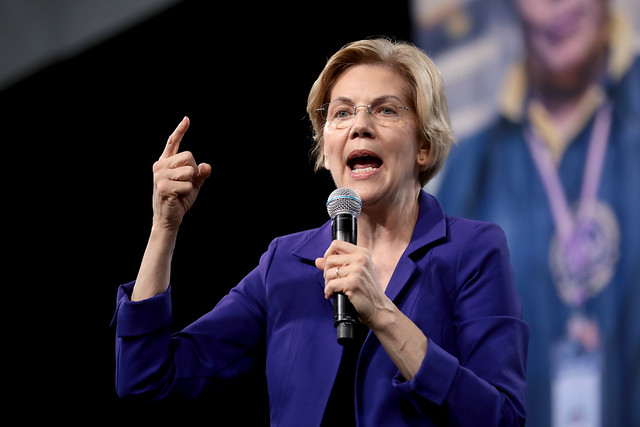

Massachusetts liberal and 2020 Democrat presidential hopeful Elizabeth Warren today released yet another proposal that would raise taxes on millions of Americans and businesses. This proposal would disproportionately impact small businesses that operate on tight margins, and the plan’s multiple tax hikes will eventually hit every American.

Warren’s plan, entitled “Expanding Social Security,” imposes a new 14.8 percent payroll, or “FICA,” tax on individuals making more than $250,000 a year. The Warren tax is evenly split between employers and employees at 7.4 percent each. This new tax is levied on top of the current 12.4 percent FICA tax, which is split evenly between employees and employers at 6.2 percent each.

The plan also imposes a new 14.8 percent tax on investment income for individuals making over $250,000 a year and families making more than $400,000 a year. This new tax is modeled after Obamacare’s disastrous National Investment Income Tax (NIIT), a 3.8 percent surtax on investment income that ended up targeting retirees and the disabled.

The Warren plan levies these new taxes to fund an unsustainable benefit increase. Under her proposal, beneficiaries will receive an extra $200 a month or $2,400 a year. This benefit increase applies to all current and future beneficiaries.

The Warren plan is nonsensical on its face. Instead of working sensibly to reform Social Security by raising the retirement age or means testing benefits, Warren doubles down on the existing failed structure.

As it stands right now, the Social Security Trust Fund is heading towards complete collapse. A recent report from the nonpartisan Social Security Trustees forecasts that the fund will be totally depleted by 2035. This insolvency will automatically trigger 20 percent across-the-board benefit cuts for retirees. As of 2018, Social Security provides income to approximately 67 million Americans.

While Warren claims that her plan targets the rich to “fix” Social Security, her misguided tax hikes would eventually ensnare every taxpayer. As mentioned before, the annual salary cap for FICA increases year over year. Eventually, the 12.4 percent payroll tax cap will reach $250,000. This will lead to Americans making between $0 and $250,000 in wages paying a 6.2 percent tax every dollar they earn, and Americans making more than $250,000 paying an additional 7.4 percent tax on every dollar they earn in perpetuity. This assumes that Warren does not immediately raise the wage cap to $250,000 (she is unclear about this in her proposal) or does not raise the FICA payroll tax.

This plan is simply one amongst many tax hikes that Warren has proposed. Since launching her campaign, Warren has proposed a wealth tax, a gun tax, a $1 trillion business tax hike, a carbon tax, and full repeal of the Tax Cuts and Jobs Act. Warren has also endorsed socialist Senator Bernie Sanders’ (I-Vt.) Medicare for All proposal and far-left Rep. Alexandria-Ocasio Cortez’s (D-N.Y.) Green New Deal, plans that would raise taxes on millions of Americans.

The Warren plan for Social Security is simply another tax hike on American individuals and businesses alike. While Warren frames her proposal as raising taxes on the wealthy, the reality is that it would eventually ensnare all Americans and small businesses in a massive tax hike trap.