Elizabeth Warren falsely claimed that her Medicare for All plan will not raise taxes on middle income Americans.

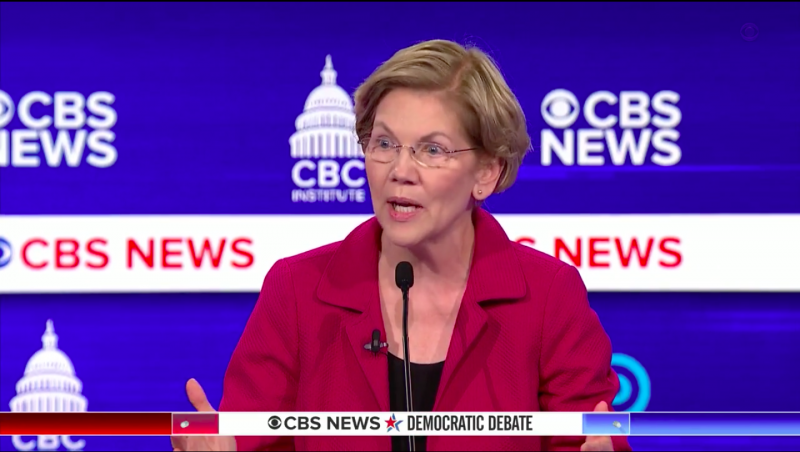

“It’s why I also have a way to pay for health care that doesn’t raise taxes on middle-class families,” Warren said Tuesday night during the Democratic debate on CBS.

Warren even doubled down on this lie on Wednesday when she claimed on her website that the healthcare plan does “not raise taxes on the middle class.”

In fact, her “Medicare for All” plan explicitly raises middle class taxes.

Her Medicare for All plan repeals the Tax Cuts and Jobs Act, which would impose a substantial tax increase on middle income households. Warren’s plan also contains a head tax borne by employees.

If Warren repealed the Trump Republican tax cuts:

-A family of four earning the median income of $73,000 would be stuck paying $2,000 more in taxes each and every year.

-A single parent with one child making $41,000 would pay $1,300 more in taxes each and every year.

The facts are, thanks to the Trump Republican tax cuts, middle class Americans received a tax cut. If you don’t believe us, just ask the New York Times, the Washington Post, CNN, and FactCheck.org:

- CNN: “The facts are, most Americans got a tax cut.”

- CNN: “In fact, estimates from both sides of the political spectrum show that the majority of people in the United States of America did receive a tax cut.”

- New York Times: “Most people got a tax cut.”

- Washington Post: “Most Americans received a tax cut.”

- FactCheck.org: “Most people got some kind of tax cut in 2018 as a result of the law.”

- FactCheck.org: “The vast majority (82 percent) of middle-income earners — those with income between about $49,000 and $86,000 — received a tax cut that averaged about $1,050.

- New York Times also noted the “sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase.”

- CBS News 60 Minutes: “Trump did give the middle class a tax cut.”

Thanks to the Tax Cuts and Jobs Act:

- A family of four earning the median income of $73,000 saw a $2,000 tax cut.

- A single parent (with one child) making $41,000 got a $1,300 tax cut.

- Millions of low and middle-income households are no longer stuck paying the Obamacare individual mandate tax.

- Utility bills across all 50 states went down as a direct result of the TCJA’s corporate income tax rate reduction.

- Small businesses saw a tax decrease because of the 20% deduction for small business income.

- Taxes went down in every state and every congressional district.

If you want to stay up-to-date on their threats to raise taxes, visit www.atr.org/HighTaxDems.