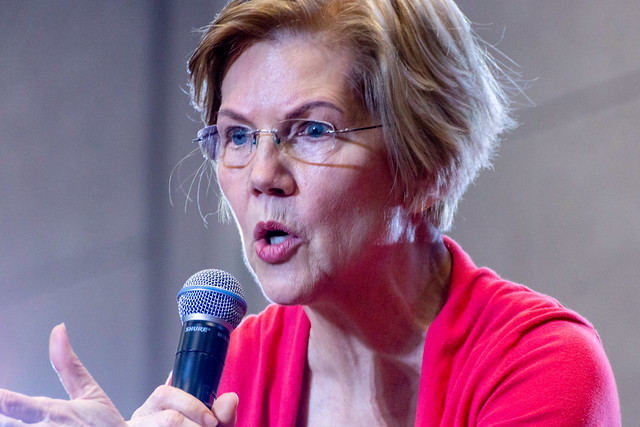

Democratic presidential hopeful and U.S. Senator Elizabeth Warren (D-Mass.) today proposed a new, $1 trillion tax on American businesses.

Warren’s proposal would impose a 7 percent tax on the revenues of American corporations. This new tax would apply on top of the 21 percent corporate income tax and would apply to worldwide income of American companies that has already been taxed in the country where it was earned. According to her estimates, this plan would raise $1 trillion over a decade.

This proposal would increase the amount of money the federal government collects from corporations by 30 percent and also increase compliance costs for businesses, as calculating the surcharge requires a different accounting method.

This tax hike is also likely just the tip of the iceberg as Warren told POLITICO she intends to propose more corporate tax increases: “our corporate tax code is so littered with loopholes that simply raising the regular corporate tax rate alone is not enough.”

Increasing taxes on businesses will make America less globally competitive and will undercut today’s strong economic growth, growing wages, record job openings, and lower utility bills.

This is just the latest tax hike coming from Democrats in the House and Senate:

- Days into the new Congress, the new House Democrat Majority changed the rules to make it easier to raise taxes on the American people.

- Alexandria Ocasio Cortez (D-NY) has proposed a top income tax rate of 70 percent. Many others have suggested applying this rate to capital gains income.

- House Speaker Nancy Pelosi (D-Calif.) has called for repeal of the entire GOP tax cuts. This would see 90 percent of wage earners face higher taxes, and a family of four earning $73,000 in annual income seeing a tax increase of roughly $2,000 per year.

- Bernie Sanders has proposed over $16 trillion in higher taxes as part of his proposal for a government takeover of the American healthcare system.

- Warren has called for a wealth tax which would force some Americans to hand over 3 percent of their wealth to the government every year.

- Democrats rejected a proposal by Ways and Means Ranking Member Kevin Brady (R-Texas) to extend middle class tax relief. This amendment would have made the $2,000 child tax credit (up from $1,000) and the $24,000 standard deduction for families (up from $12,000) permanent for American families.

- House Majority Whip Jim Clyburn (D-SC) has proposed legislation that would raise the corporate rate in order to restore non-profit deductibility of fringe transportation benefits. While the bill proposes a modest rate hike to 21.03 percent, it would undermine the success of the GOP tax cuts and open the door to additional corporate rate hikes to pay for leftist spending priorities.

- Senator Brian Schatz (D-HI) and Congressman Peter DeFazio (D-Ore.) have introduced legislation that would institute a financial transactions tax of 0.1 percent on the sale of any stocks, bonds, and derivatives.