Small American banks have been hit with a brutal one-two punch over the past decade. First, it was the Financial Crisis. And five years ago today, the Government decided to kick small banks while they were down by passing Dodd-Frank.

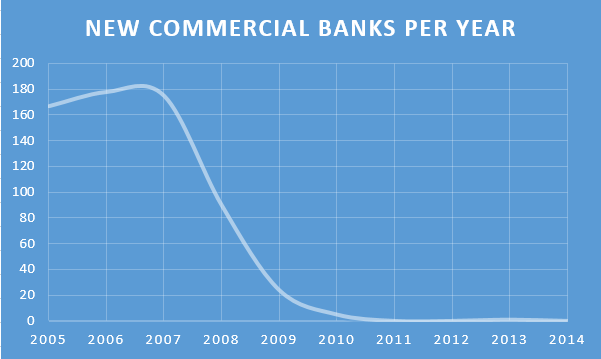

Since Dodd-Frank, there has been only one new FDIC-insured bank. You read that correctly, only one new bank since 2010. Bank of Bird-In-Hand in Amish Country, with their horse-and-buggy drive-through, stands alone. In the three decades prior to Dodd-Frank, an average of more than one hundred banks opened annually. And even after past recessions, new banks have opened by the dozens. But since the recession and Dodd-Frank, new banks have been almost non-existent.

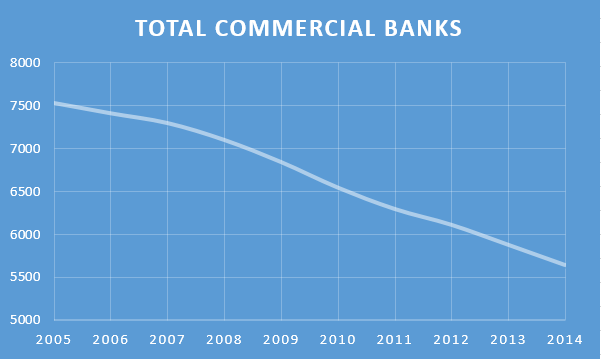

And it is not just a lack of new banks, it’s a decline of existing banks. Mergers and failures have erased thousands of independent banks. Since 2006, there has been a decline of 1,762 banks, one of the most precipitous declines in American history.

While Dodd-Frank was intended to target big institutions, it is becoming clear that small banks are being driven into insolvency as a result of heightened regulations and compliance costs.. A Harvard Kennedy School Report finds that community banks have seen their banking asset share decline by 12.4% percent while large banks (excluding the 5 biggest) have seen their asset share grow by 11.4%.

According to the Mercatus Center, there are nearly 27,000 regulations associated with Dodd-Frank, more regulations than associated with all other laws passed during the Obama administration – combined. It is a basic fact of business that large institutions can better adapt to regulatory pressure than smaller ones. Small banks have stunted growth because all new resources must go into hiring compliance officers and potential new banks are daunted by the regulatory wall barring them from entering the market.

These developments should be viewed with grave concern. Not only do local banks provide more personalized services, but they also provide a critical life-line for small businesses seeking loans. Small banks – those with less than $1 billion in assets – account for only 8 percent of all banking assets, but make one-third of all small business loans. The decline of these banks will be a major blow to American innovators and entrepreneurs seeking investment.

The damage does not end there. More than a third of Dodd-Franks regulations have yet to be finalized. This means more regulations, costs, and uncertainty for small banks. To stop the decline of community banking and a concentration of banking assets in fewer and fewer banks, Congress must not celebrate Dodd-Frank’s birthday and instead address the problems with the law.