Congressional Democrats want to retroactively repeal section 6751(b) of the tax code, a provision that protects taxpayers by requiring IRS agents to receive supervisory approval before imposing penalties on taxpayers.

By removing this taxpayer protection, Democrats would make it easier for IRS bureaucrats to levy substantial fines and penalties on taxpayers.

Repealing section 6751(b) would make it easier for the IRS to target taxpayers and could even result in a taxpayer having their assets seized by the agency. It would exacerbate existing problems with the IRS including its inability to help taxpayers, its lack of respect for due process, and its abuse of power.

What is Section 6751(b)?

In 1998, Congress passed the IRS Restructuring and Reform Act (RRA 98) which reined in the agency and instituted numerous taxpayer protections. One of these protections, Internal Revenue Code Section 6751(b), prohibits IRS agents from levying a fine or penalty without written approval of that agent’s supervisor. Specifically:

“No penalty… shall be assessed unless the initial determination of such assessment is personally approved (in writing) by the immediate supervisor of the individual making such determination or such higher-level official as the Secretary may designate.”

Democrats have proposed repealing this provision. H.R 5376, the house-passed version of the Build Back Better Act, repeals this provision in Section 138403 of the Rules Committee Print. The Senate version of the BBB Act, as released by Senate Finance Committee Chairman Ron Wyden (D-Ore.), retained this provision.

To make matters worse, repeal of Sec. 6751(b) would be applied retroactively all the way back to when the provision was enacted in 1998. This will allow the IRS to target taxpayers after the fact and provide a precedent for further retroactive changes in the future.

The tax code must be applied with consistency, certainty, and fairness. Taxpayers cannot reasonably or confidently comply with the law if they believe the federal government will change these laws after the fact. In applying tax rules retroactively, the government would further erode Americans’ confidence in the tax code.

Repealing Sec. 6751(b) Would Harm Taxpayers

While the protection granted by Sec. 6751(b) is relatively straightforward, its importance to taxpayers is substantial. As it stands, the IRS has repeatedly failed to follow this law when it comes to fairly applying Sec. 6751(b), leading to successful lawsuits costing the agency millions of dollars. If anything, this provision should be strengthened, not repealed.

Penalties should not be imposed on a taxpayer at the behest of a single IRS agent. Supervisors are also helpful in weeding out honest mistakes and, perhaps, identifying agents who are overzealous and improperly doing their job. Granting a single agent the power to penalize a taxpayer creates the potential for abusing this power based on personal, political, or religious reasons.

Requiring supervisor approval will also help the IRS better do its job, as noted by Nina Olson, former National Taxpayer Advocate, “supervisor approval helps ensure consistent and equitable treatment for taxpayers… Laying a second set of eyes and judgement on the case can smooth out the edges of differing value systems and mindsets of examiners.”

This repeal would even apply to assessable penalties which require the taxpayer pay the penalty in full before even being able to dispute that penalty.

Under this type of penalty, taxpayers have no rights until their assets have already been seized by the agency. A taxpayer could even have their passport revoked because of this penalty. Such drastic actions should never be dependent on a single agent’s assessment, particularly because these kinds of cases can ruin people’s lives.

This is not a hypothetical. As noted in a Forbes op-ed by tax professional Guinevere Moore, there have been cases where taxpayers could not seek redress until they had paid the full IRS penalty. This was the case with John Larson, who was unable to dispute $67 million imposed of penalties wrongly imposed on him:

“The IRS agreed that the assessable penalty it imposed on him was wrong – to the tune of $67 million dollars… Larson was not able to get his day in court on whether he owed the assessable penalty at all. Why? Because he could not pay in full to get that day in court.”

Repealing Sec. 6751(b) would be particularly harmful to low-income taxpayers.

NTA research studies found that IRS agents were intentionally disregarding rules and regulations to impose two-year bans of the Earned Income Tax Credit (EITC). In 2019, in 54 percent of cases, IRS employees did not obtain supervisory approval before imposing the penalty and, in 84 percent of cases, notices to the taxpayer did not contain adequate information on why they were banned from using the EITC.

If IRS agents could legally avoid receiving supervisory approval, low-income Americans would be penalized more often and without meaningful recourse.

Repealing Sec. 6751(b) Would Exacerbate Existing Problems with the IRS

Taxpayers are already all too often left feeling powerless in the face of IRS investigations and penalties. Repealing Sec. 6751(b) would make this problem worse.

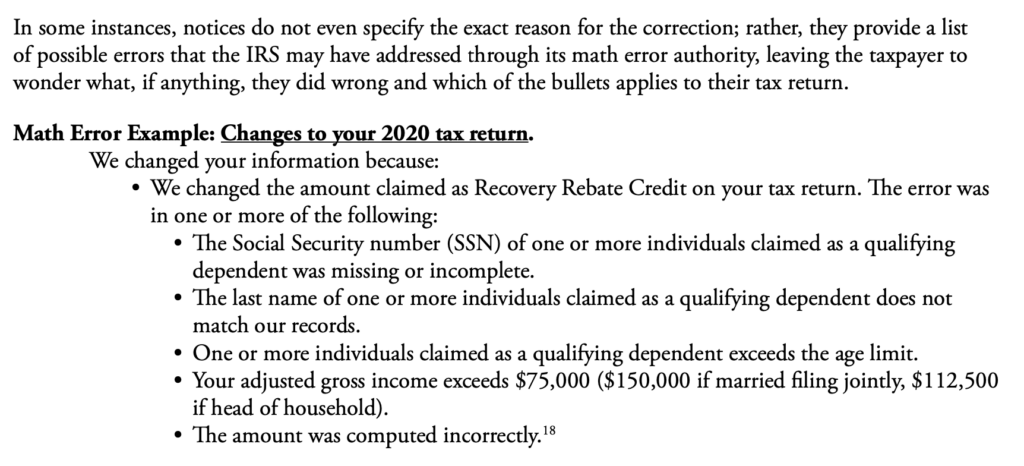

For instance, National Taxpayer Advocate (NTA) report notes that the IRS frequently fails to provide basic information and instead provides confusing and inaccurate information when issuing taxpayers with a notice for failing to follow the law.

For example, when the IRS issues notices because of potential math errors related to the recovery rebate credit claimed on a taxpayers 2020 return, they do not explain why the refund is being reviewed but instead list several reasons that they might be reviewing your tax return:

A provision that limits taxpayer protections and empowers agents to operate unilaterally is the last thing lawmakers should do.

The IRS has not been a good steward of the power they hold, making this policy even more concerning. The Obama IRS was caught unfairly denying conservative groups non-profit status ahead of the 2012 election.

Last year, thousands of Americans’ private taxpayer files were stolen and several tax documents were published by the progressive news outlet ProPublica to push their own political agenda. Still, the IRS has not provided any substantive response to this scandal.

A 2017 Treasury Inspector General for Tax Administration (TIGTA) report found that the IRS routinely skirted or ignored due process requirements when investigating taxpayers. The inspector general uncovered violations of the Eighth Amendment and failure to provide the taxpayer of their basic rights.

Given the fact that the IRS already abuses its power, repealing section 6751(b) would empower bad actors at the agency. It would also empower the agency in its existing incompetence.

Repealing section 6751(b) will leave taxpayers vulnerable to the whims of a single IRS agent and would empower the agency to further target and harass taxpayers. Rather than repealing this policy, lawmakers should look to limit the power of the IRS and ensure taxpayers are protected from government overreach.