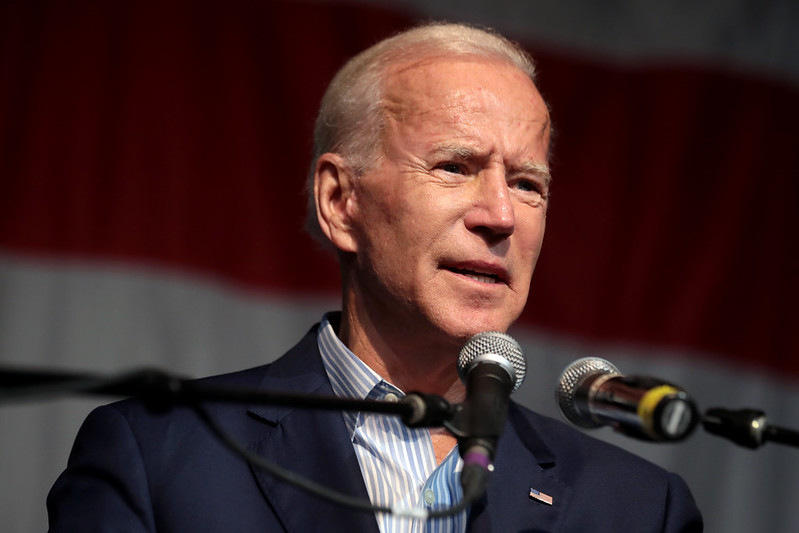

Democrats have snuck in a $31 billion tax increase on small businesses in President Joe Biden’s $1.9 trillion spending plan. This tax hike violates President Biden’s pledge not to raise one penny of taxes on any American earning less than $400,000 per year.

If Biden and Harris want to keep their pledge, they must veto the bill or instruct congressional Democrats to insert bill language exempting households making less than $400,000 in a given year.

The provision extends the $500,000 cap on passthrough businesses deducting excess business losses for one year – from 2025 to 2026. This could impact a restaurant, retailer, or other capital-intensive business that sees significant business losses in any year due to the cost of wages, rent, new equipment, inventory, and interest payments.

The cap was originally created by the Tax Cuts and Jobs Act passed by Congressional Republicans. It was used to offset the creation of the 20 percent deduction for passthrough businesses, which resulted in a net tax cut for taxpayers. Democrats are proposing to extend the cap, but not the 20 percent deduction.

A previous analysis of the provision by the Joint Committee on Taxation found that the cap could raise taxes on 45,000 filers making below $200,000 in Calendar Year 2020. While the analysis notes that business losses in 2020 were much higher because of the COVID-19 pandemic, it nevertheless shows that small businesses would be hit by extending the cap.

On over 50 occasions, President Biden and Vice President Kamala Harris made a pledge to each and every household making less than $400,000 that they would not raise any of their taxes a single penny.

Americans for Tax Reform has compiled the written and video documentation of the Biden-Harris pledge. “I give you my word as a Biden,” Biden said repeatedly.

This is not the first time that Democrats have proposed raising taxes on struggling businesses. Last month, Congressional Democrats called for a retroactive repeal of provisions allowing businesses to deduct net operating losses. This would be a $250 billion tax hike and would hit small and medium sized companies that have seen unprecedented challenges due to the Coronavirus pandemic.

While small businesses have been hit particularly hard with forced shutdowns and new government mandates, businesses of all size have struggled with a decline in revenues and additional expenses from implementing new technologies for remote work and retrofitting existing workspaces.

Democrats used to support expanding the ability of businesses to claim losses during an economic downturn. For instance, President Obama highlighted this tax relief as a “fiscally responsible economic kick-start,” in a 2009 press release:

“The Economic Recovery Act included a provision that allowed small businesses to count their losses this year against the taxes they paid in previous years. “Today, the President extended that benefit for an additional year and expanded it to medium and large businesses as well. Business losses incurred in 2008 or 2009 can now be used to recoup taxes paid in the prior five years. This provision is a fiscally responsible economic kick-start, putting $33 billion of tax cuts in the hands of businesses this year when they need it most, while enabling Treasury to recoup the majority of that funding in the coming years as these businesses regain their strength and resume paying taxes.”

Key Congressional Democrats including House Speaker Nancy Pelosi (D-Calif.) and Ways and Means Chairman Richie Neal (D-Mass.) also praised this tax relief when it was passed in 2009:

Speaker Pelosi: “The bill also has the net operating loss carryback, which businesses tell us is necessary for them to succeed and to hire new people, and also to mitigate some of the damage that has been done to the economy from past policies.”

Chairman Neal: “Finally, the bill provides net operating loss relief for many businesses that have been simply hanging on in this country over the last year. It is particularly important to retailers. Based on a bill that I filed with Representative Tiberi which became the basis for this provision, this relief for businesses, big and small, will provide quick capital at a time when it is currently impossible to find.”

If Biden and Harris want to keep their pledge, they must veto the bill or instruct congressional Democrats to insert bill language exempting households making less than $400,000 in a given year.

The Biden and Harris tax pledge documentation can be found below. They made the tax pledge on at least 56 occasions:

Click here for the short version of the video with 13 examples of the pledge.

Click here for the full version of the video with every instance of the pledge.

Joe Biden on CNBC, May 22, 2020: “Nobody making under 400,000 bucks would have their taxes raised. Period. Bingo.”

Joe Biden on ABC News, August 23, 2020:

David Muir, ABC News: “So, no new taxes, $400,000 and down?”

Biden: “No new taxes. There would be no need for any.”

Joe Biden in Kenosha, Wisconsin on September 3, 2020: “But here’s the deal. I pay for every single thing I’m proposing without raising your taxes one penny. If you make less than 400 grand, you’re not going to get a penny taxed.”

Joe Biden during a WFLA Interview on September 15, 2020: “Nobody making less than $400,000 have to pay a penny more in tax under my proposals.”

Joe Biden during a Telemundo Interview on September 15, 2020: “I’m not going to raise taxes on anybody making less than 400,000.”

Joe Biden on Twitter, September 17, 2020: “If you make under $400,000, you will not pay a penny more in taxes when I’m president.The super-wealthy and big corporations will finally pay their fair share — and we’ll invest that money in working families. We’re going to reward work — not wealth.”

Joe Biden on Twitter, September 17, 2020: “No surprise, Donald Trump is lying about my tax plan. Here’s the truth about how I’ll make corporations pay their fair share while ensuring Americans making under $400,000 don’t pay a penny more.”

Joe Biden in Hermantown, Minnesota on September 18, 2020 “And I’ll do it without raising anyone’s taxes if you make less than $400,000 a year.”

Joe Biden in Manitowoc, Wisconsin on September 21, 2020: “Under my plan nobody making less than 400,000 bucks — and I don’t make it and you don’t make it, I don’t think — in this country will see their taxes go up.”

Joe Biden in Greensburg, Pennsylvania on September 30, 2020: “And we’re going to do it without asking anyone who makes under $400,000 a year to pay one more penny in taxes. Guaranteed. My word on it.”

Joe Biden in Jonestown, Pennsylvania on September 30, 2020: “We’re going to do it all without raising a penny in taxes for anybody who makes less than $400,000 a year.”

Joe Biden in Grand Rapids, Michigan on October 2, 2020: “Anyone making less than $400,000 a year won’t pay a penny more.”

Joe Biden in Miami, Florida on October 5, 2020: “I’m not going to raise taxes on anyone who makes less than $400,000 a year. You won’t pay a penny more. I guarantee you.”

Kamala Harris during Vice Presidential Debate on October 7, 2020: “Joe Biden has been very clear. He will not raise taxes on anybody who makes less than $400,000 a year.”

Joe Biden on Twitter, October 7, 2020: “Let me be clear: A Biden-Harris Administration won’t increase taxes by a dime on anyone making less than $400,000 a year.”

Joe Biden in Las Vegas, Nevada on October 9, 2020: “It’s not going to raise a penny in tax for anyone making less than $400,000 a year. Not a penny.”

Kamala Harris on Twitter, October 9, 2020: “Joe Biden has been very clear: he will not raise taxes on anybody who makes less than $400,000 a year.”

Joe Biden in Erie, Pennsylvania on October 10, 2020: “I’m not going to raise taxes on anybody making less than 400 grand.”

Joe Biden in Toledo, Ohio on October 12, 2020: “I’m not going to raise taxes on anyone who makes less than $400,000 a year.”

Joe Biden in Pembroke Pines, Florida on October 13, 2020: “I’m not going to raise taxes on a single solitary American making less than $400,000 a year. You won’t pay a penny more. It’s a guarantee.”

Joe Biden on Twitter, October 15, 2020: “Let me be very clear: If you make under $400,000 you won’t pay a penny more in taxes under my administration.”

Joe Biden ABC Town Hall on October 15, 2020:

Anthony Archer (Voter): “Thank you, Mr. Vice President. You stated that anyone making less than $400,000 will not see one single penny of their taxes raised.”

Biden: “That’s right.”

Joe Biden in Michigan on October 16, 2020: “No one who makes less than $400,000 a year will pay a penny more.”

Kamala Harris in Orlando, Florida on October 19, 2020: “Joe Biden will not increase taxes on anyone who makes less than $400,000 a year, period.”

Kamala Harris in Jacksonville, Florida on October 19, 2020: “Taxes will not be raised on anyone making less than $400,000 a year.”

Kamala Harris in Milwaukee, Wisconsin on October 20, 2020: “We will not increase taxes for anybody making under $400,000 a year.”

Kamala Harris in Asheville, North Carolina on October 21, 2020: “Joe Biden is saying, I’m not going to raise taxes on anybody who makes less than $400,000 a year.”

Kamala Harris in Atlanta, Georgia on October 23, 2020: “Which is why Joe Biden and I are saying, “One, taxes will not be raised on anyone making less than $400,000 a year.”

Joe Biden in Bucks County, Pennsylvania on October 24, 2020: “None of you will have your taxes raised. Anyone making less than $400,000 will not see a penny in taxes raised.”

Joe Biden on CBS 60 Minutes, October 25, 2020:

Biden: “Nobody making less than $400,000 will pay a penny more in tax under my proposal.”

Norah O’Donnell, CBS: “That’s a promise?”

Biden: “That’s a guarantee. A promise. I give you my word as a Biden. That’s an absolute guarantee.”

Joe Biden in Atlanta, Georgia on October 27, 2020: “I guarantee you — no matter what you hear this president lying about — no one making less than $400,000 a year will have one penny in taxes raised. Not one penny. It’s a guarantee.”

Kamala Harris in Reno, Nevada on October 27, 2020: “Joe Biden says we’re not going to increase taxes on anyone making less than $400,000 a year.”

Kamala Harris in Las Vegas, Nevada on October 27, 2020: “Joe Biden says, that we’re not going to raise taxes on anyone making less than $400,000 a year.”

Joe Biden in Atlanta, Georgia on October 27, 2020: “No one making less than $400,000 a year will have one penny in taxes raised. Not one penny. It’s a guarantee.”

Kamala Harris in Phoenix, Arizona on October 28, 2020: “We are not going to raise taxes on anyone making under $400,000 a year.”

Kamala Harris in Tucson, Arizona on October 28, 2020: “Joe Biden who says, ‘You want to deal with the economy, then one, we will not raise taxes on anyone making less than $400,000 a year.'”

Joe Biden in Broward County, Florida on October 29, 2020: “We can do it without raising taxes on a single person making less than 400,000 bucks a year.”

Joe Biden in Tampa Bay, Florida on October 29, 2020: “And we can do it without raising taxes a single solitary penny on working class or middle class families. I guarantee you, my word as a Biden, no one making less than $400,000 will pay a single penny more in taxes. Not a penny.”

Kamala Harris in Fort Worth, Texas on October 30, 2020: “Joe Biden is committed to not raising taxes ever on anyone making less than $400,000 a year.”

Joe Biden in Des Moines, Iowa on October 30, 2020: “We can do it without raising a penny tax on the middle class. I guarantee you — give you my word as a Biden — no one making less than $400,000 a year will see a penny in their taxes raised, no one.”

Kamala Harris: in McAllen, Texas on October 30, 2020: “Let’s deal with the economy and not raise taxes for anyone who makes less than $400,000.”

Joe Biden in St. Paul, Minnesota on October 30, 2020: “I promise you, you have my word, if you make less than $400,000 a year, you won’t pay a penny more in taxes.”

Joe Biden in Milwaukee, Wisconsin on October 30, 2020: “I give you my word as a Biden, if you make less than $400,000 — if I’m elected president — you’re not going to see a penny of your taxes go up, not a penny.”

Kamala Harris in Houston, Texas on October 30, 2020: “Joe Biden says we will not raise taxes on anyone that makes less than $400,000 a year.”

Kamala Harris in Fort Worth, Texas on October 30, 2020: “Which is why Joe Biden is committed to not raising taxes ever on anyone making less than $400,000 a year.”

Joe Biden in Detroit, Michigan on October 31, 2020: “Under my plan if you make less than $400,000 I guarantee you’re not going to pay a penny more in taxes.”

Joe Biden in Flint, Michigan on October 31, 2020: “Under my plan, if you make less than $400,000 a year, you’re not going to pay a penny in additional taxes.”

Joe Biden on Twitter, November 1, 2020: “Under my tax plan, no one making under $400,000 will see their taxes go up. But it’s time large corporations and the wealthiest Americans pay their fair share.”

Joe Biden in Cleveland, Ohio on November 2, 2020: “Under my plan, if you make less than $400,000, you won’t pay a single penny, more in taxes. You have my word on it.”

Joe Biden in Beaver County, Pennsylvania on November 2, 2020: “We’re not going to raise taxes on anybody making less than 400,000 bucks a year.”

Joe Biden in Pittsburgh, Pennsylvania on November 2, 2020: “Under my plan I commit to you no one making less than 400 grand is going to see a penny in taxes raised.”

Kamala Harris in Pittsburgh, Pennsylvania on November 2, 2020: “Let me be clear, Joe and I will not increase taxes on anyone making under $400,000 a year, period.”

Joe Biden in Pittsburgh, Pennsylvania on November 2, 2020: “Under my plan, as Kamala said, if you make less than 400,000 bucks, you’re not going to pay a penny more in taxes.”

Kamala Harris in Detroit, Michigan on November 3, 2020: “That’s why Joe says we’re not passing any taxes on anybody making less than $400,000 a year.”

Kamala Harris on Twitter, November 11, 2020: “As president, @JoeBiden will make corporations and the wealthiest finally pay their fair share—and he won’t ask a single person making under $400,000 per year to pay a penny more in taxes.”

Kamala Harris on Twitter, November 21, 2020: “Let’s be clear: if you make under $400,000 a year, you won’t pay a penny more in taxes under a Biden-Harris administration.”