Several Senate Democrats are pushing to raise the federal corporate income tax rate to 25 percent in Biden’s upcoming infrastructure plan, according to an Axios report:

“The universe of Democratic senators concerned about raising the corporate tax rate to 28% is broader than Sen. Joe Manchin, and the rate will likely land at 25%, parties close to the discussion tell Axios.”

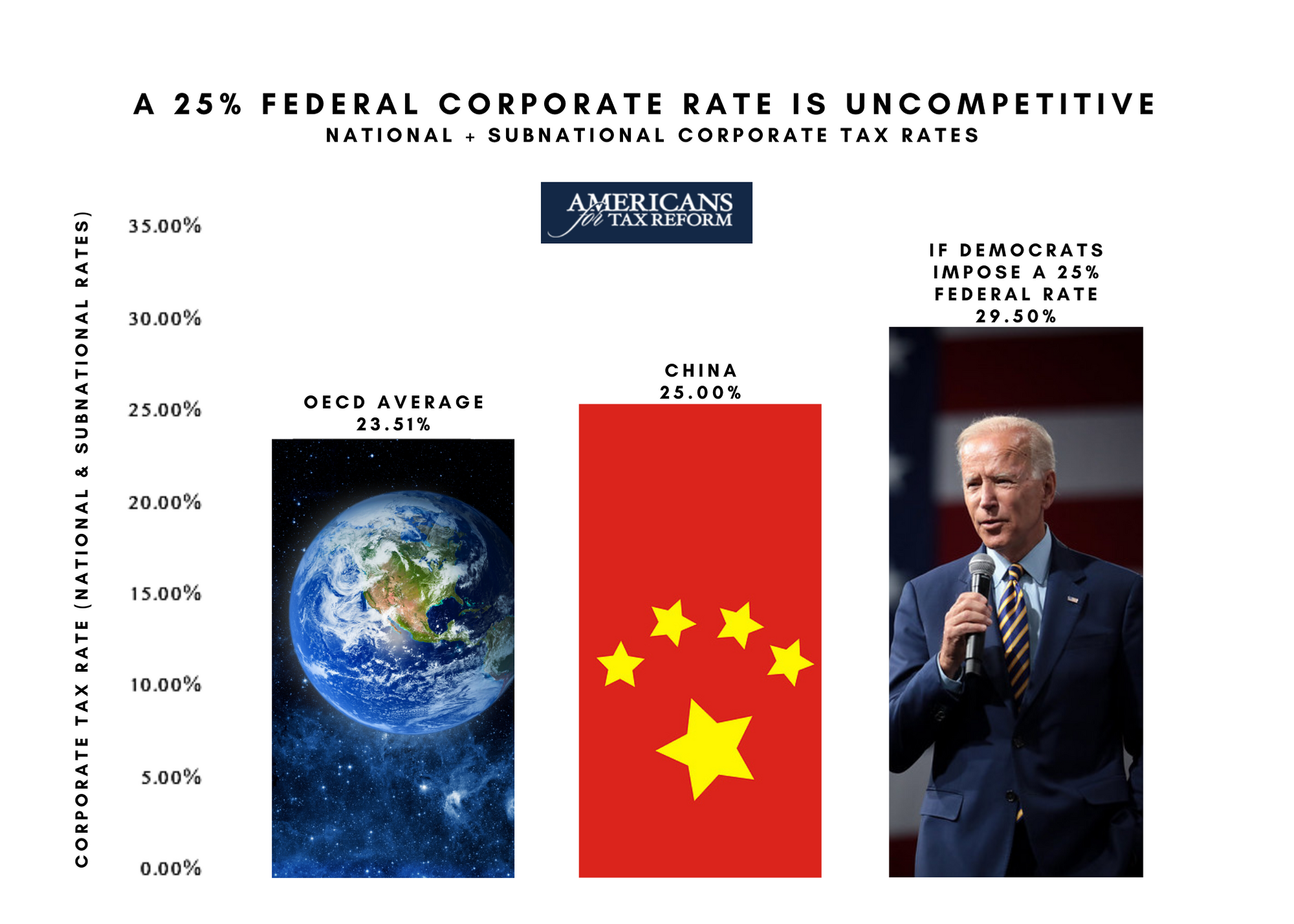

A 25 percent federal corporate rate would still leave the U.S. uncompetitive compared to the rest of the world.

The U.S. federal corporate tax rate is 21 percent. However, states also levy their own corporate tax rates, averaging an additional 6 percent. Because this state tax is deductible when paying the federal corporate rate, the combined national and subnational rate averages out to 25.77 percent.

A 25 percent federal rate would therefore result in a combined federal and state rate of 29.5 percent, higher than Communist China and higher than the average OECD rate.

OECD average national + subnational rate: 23.51%

China’s rate: 25%

U.S. national + subnational rate IF Democrats raise federal rate to 25 percent: 29.5%

Workers, consumers, and shareholders will bear the burden of an increased corporate tax rate. Such a hike will cause businesses to invest less in the United States and more overseas, resulting in fewer job opportunities and lower wages for American workers:

- A Treasury Department study estimated that “a country with a 1 percentage point lower tax rate than its competitors attracts 3 percent more capital.” This is because raising the corporate rate makes the United States a less attractive place to invest profits.

- According to the Stephen Entin of the Tax Foundation, labor (or workers) bear an estimated 70 percent of the corporate income tax in the form of wages and employment. As Entin notes, 50 percent, 70 percent, or even 100 percent of the corporate tax is borne by workers.

- A 2012 Harvard Business Review piece by Mihir A. Desai notes that raising the corporate tax lands “straight on the back” of the American worker and will see a decline in real wages.

- A 2012 paper at the University of Warwick and University of Oxford found that a $1 increase in the corporate tax reduces wages by 92 cents in the long term. This study was conducted by Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini and studied over 55,000 businesses located in nine European countries over the period 1996-2003.

- Even the left-of-center Tax Policy Center estimates that 20 percent of the burden of the corporate income tax is borne by labor.

Raising the corporate rate to 25 percent, as some Democrats are calling for, would leave America with a rate higher than many foreign competitors and harm American workers, businesses, and investment.