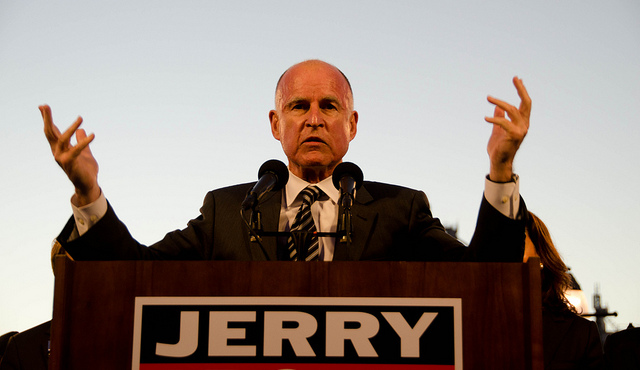

A number of Democrat Governors have raged against the GOP Tax Cuts and Jobs Act (TCJA). California Governor Jerry Brown described the bill as “evil in the extreme.” New York Governor Andrew Cuomo called it an “economic missile.”

At the heart of their complaint is the $10,000 State and Local Tax Deduction (SALT) cap, which they claimed would hurt their wealthier taxpayers and drive them away. Of course, pursuing policies at the state and local level to relieve tax burdens on these residents has not been at the top of these Governors’ priorities.

As the Wall Street Journal Editorial Board points out, their complaining has not stopped their state coffers from benefitting from a major tax reform provision.

State governments have seen a sudden spike in tax revenue due to a provision of the TCJA allows companies to repatriate overseas financial holdings back to the U.S. for free after paying a one-time tax. The combination of growing company profits and repatriated cash has yielded a boom for state corporate tax revenue.

Despite their wailing, Democratic states have greatly benefited from the TCJA. Before the tax cut, Connecticut was at risk of hitting its debt limit. This year it collected $1.3 billion more than the projected in the most optimistic estimates. California and New York also exceeded their budget projections by $3.8 billion and $315 million respectively.

If opportunistic politicians keep lying about federal tax reform, don’t fall for it.