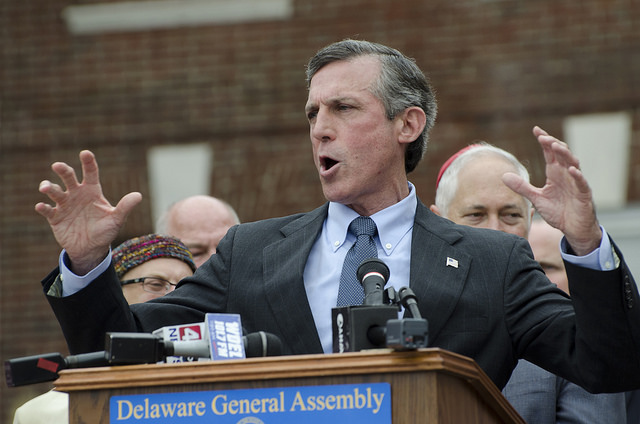

Yesterday in the Blue Hen State, Governor John Carney (D-Del.) signed off on a new budget, avoiding any tax hikes and retaining a surplus. The plan increases spending by 5.2 percent compared to last year’s budget. In contrast to last year’s budget, which was debated well into July, this year’s plan was completed days before the June 30th deadline.

Incredibly, state employees and teachers will be enjoying a government version of the Trump tax reform bonus.

On top of the $4.2 billion budget, the legislature passed a $49 million supplemental appropriation that includes bonuses for state workers, a $500 bonus for current workers and $400 pension check bonus for retired state employees.

Teachers and state workers also received salary increases in the operating budget.

The Delaware News Journal reports, “…lawmakers are relying on an anticipated $340 million spike in revenue from existing tax sources, such as a jump in personal income tax tied to the federal tax cuts championed by President Donald Trump.”

What a difference a year and some federal tax reform makes. After facing deficits in 2018’s budget process, the state is dishing out bonuses and was left with a $47 million surplus a year later.

Looking to help taxpayers before paying out new obligations to state workers would have been an improvement. However, the legislature dodged significant tax increases, such as proposed taxes on opioid pain medication.

Two varieties of the tax were pushed, one in the Senate and one in the Assembly. Neither would have been good for Delaware residents. These policies would only raise costs for families and businesses, driving up insurance premiums, while doing little to correctly address the problem of addiction.

Given the legislature’s propensity to use added funds to pad their priorities, Delaware taxpayers have a new reason to thank Trump tax reform. Without it, threatened tax hikes and another deficit-fueled late budget battle would have been far more likely.