Reducing the capital gains tax leads to higher revenues over the short term, based on data released by the Treasury Department.

Indexing capital gains taxes to inflation – as has been proposed by Members of Congress led by Senator Ted Cruz (R-Texas) and Congressman Devin Nunes (R-Calif.), conservative groups, and economists – would give the Trump administration stronger growth and higher revenues to buy down the deficit.

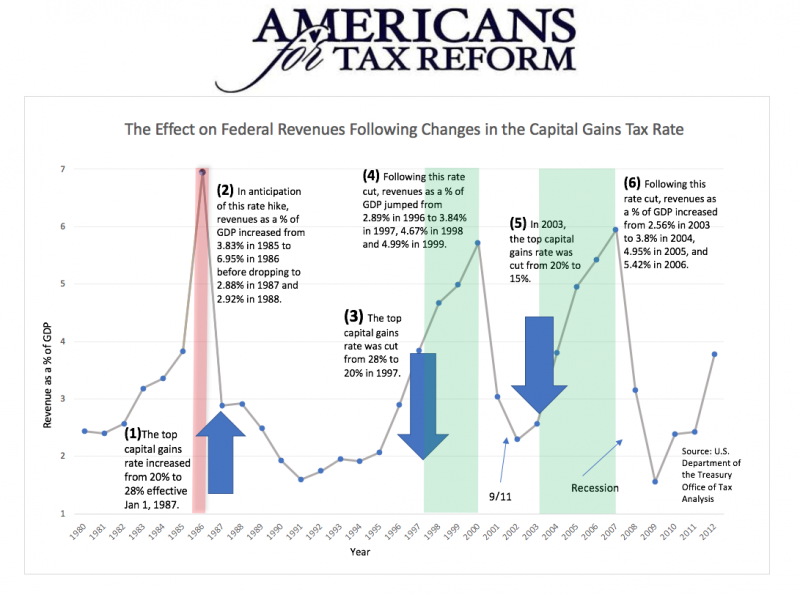

When the capital gains tax was cut by President Clinton from 28% to 20% in 1997, revenue as a % of GDP rose from 2.89% in 1996 to 3.84% in 1997, 4.67% in 1998 and 4.99% in 1999.

Similarly, President George W. Bush’s capital gains tax cut from 20% to 15% resulted in revenue rising from 2.56% of GDP in 2003 to 3.8% in 2004, 4.95% in 2005, and 5.42% in 2006.

Increasing the capital gains tax also distorts economic decision making. The top capital gains rate increased from 20% to 28% effective Jan 1, 1987. In anticipation of this rate hike, revenues as a % of GDP increased from 3.83% in 1985 to 6.95% in 1986 before dropping to 2.88% in 1987 and 2.92% in 1988.

This data should not be surprising. Cutting the capital gains tax creates an “unlocking effect,” where pent-up gains they had built up over time are realized at greater rates than they otherwise would be.

The capital gains tax is a tax on investment and economic productivity, which negatively impacts wages and jobs.

Lowering the capital gains rate would encourage the formation of more capital and would result in the creation of more jobs. In turn, worker productivity and wages would be higher.

Lower capital gains taxes also result in higher federal revenues because the government collects additional revenue from taxes on the higher levels of economic activity. In fact, the government could collect higher income and payroll taxes on wages, higher income taxes on corporate and non-corporate business profits, and additional excise taxes and tariffs because of increased economic activity.