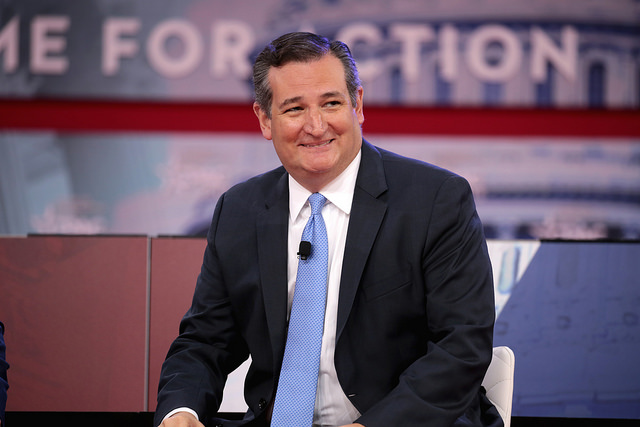

Sen. Ted Cruz (R-Texas) has introduced S.2688, the “Capital Gains Inflation Relief Act of 2018.”

This key legislation, co-sponsored by Sen. Jim Inhofe (R-Okla.), would end the taxation of inflationary gains by indexing the calculation of capital gains taxes to inflation. ATR urges all Senators to support the bill.

Under current law, the capital gains tax fails to account for gains that are based on inflation. This unfairly exposes taxpayers to additional taxation. For example, an investor makes a capital investment of $1,000 in 2000 and sells that investment for $2,000 in 2017 will be taxed for a $1,000 gain at a top capital gains tax rate of 23.8 percent. After adjusting for inflation, the “true gain” is much lower – just $579. (1,000 in 2000 – $1,421 in 2017).

According to a 2013 analysis by the Tax Foundation on individual capital gains taxes, the average effective rate excluding gains from inflation between 1950 and 2012 was 42.5 percent, nearly twice today’s 23.8 percent top capital gains tax rate.

As noted by Senator Cruz, indexing capital gains corrects a flaw in the tax code and will lead to stronger economic growth, higher wages, and the creation of new and better jobs:

“Indexing capital gains for inflation means you would be taxed on actually what you’ve gained, on the increase above and beyond inflation. It is a pro-growth, pro investment policy decision because what it would do is encourage people to put more capital, to invest more capital in businesses. When you’re investing more capital in businesses, it means you’re hiring more people. It means you’re buying more equipment. It means you’re raising wages. You’re driving economic growth.”

At the same time Senator Cruz is working to get the bill through congress, the inflation tax can and should be ended through the Treasury Secretary’s regulatory authority.

There is strong legal precedent and historic support from Congress and within the administration for having the Treasury Department indexing capital gains taxes to inflation through a regulation:

- The Treasury Department has the legal authority to index capital gains taxes to inflation, as noted by Lawyers Charles J. Cooper, Michael A. Carvin and Vincent Colatriano in a 1993 legal memo published in Virginia Tax Review, and again by Cooper and Colatriano in a 2012 legal memo published in the Harvard Journal of Law and Public Policy.

- Larry Kudlow, the Director of the National Economic Council, supports using Treasury’s regulatory authority to index capital gains taxes to inflation. In a CNBC op-ed published on August 11, 2017, he described indexation as a way to promote economic growth and prosperity:

- President Trump’s absolutely best economic policy so far has been his relentless rampage against onerous, burdensome, costly, prosperity-killing regulations on business. And the taxation of inflationary capital gains fits right in there. It is an unfair and misguided policy that punishes risk and success. The president should use his executive authority — as he so often has to drain the swamp — to remove this prosperity-killing practice.

- Current and former members of Congress, led by Vice President Mike Pence, support indexing capital gains taxes to inflation. Pence introduced legislation in 2007 with 88 co-sponsors including now-Office of Management and Budget Director Mick Mulvaney, House Speaker Paul Ryan (R-Wis.) and House Ways and Means Chairman Kevin Brady (R-Texas).

- Economist Richard Rahn voiced support for indexation in a Washington Times op-ed published on April 9, 2018. Rahn stated that indexation would “spur economic growth and job creation, increase government revenues, and most importantly stop the immoral practice of taxing government-caused inflation.”