Regulations imposed by Dodd-Frank have crippled America’s community banks. In the years following its passage, the financial services industry has witnessed a steady decline in the number of community banks operating in America. As these banks disappear, so does the valuable services that they provide communities and small businesses every day.

The Dodd-Frank Act was an attempt by Washington to impose a new regulatory regime upon the financial services industry. With the goal of promoting financial stability and protecting consumers, Dodd-Frank brought about some of the most significant changes to financial regulation since the Great Depression. The result has been over 22,000 pages of large and complex regulations affecting the entire industry.

These regulations have not only made American banks less competitive, but also led to the decline in community banks. While larger banks can afford to hire compliance personnel, smaller banks simply do not have the same capacity to read and understand, let alone comply, with these complex, burdensome regulations.

According to a study by the Mercatus Center, 90 percent of banks stated that compliance costs have increased since the passage. These higher compliance costs have forced community banks to discontinue certain products and services. This trends has only continued as the Consumer Financial Protection Bureau (CFPB) has begun to actively regulate mortgage lending, which has further led to increased costs faced by community banks. According to the report a majority of banks are considering changing or even eliminating certain services such as residential mortgages, home equity lines of credit, and overdraft protection.

These added costs have led to smaller banks being sold to larger banks, leading to an unprecedented trend of consolidation in the financial services industry. According to one article, since the passage of Dodd-Frank one in five American banks have disappeared and virtually no new banks have been formed within the same time period. Community banks find themselves competing with larger banks that have vastly more resources.

In most cases, as we have seen over the past 6 years since Dodd-Frank has been enacted, has been to close completely. Leading communities across the country to lose the kind of detailed and personally tailored services that only community banks can provide.

Fortunately, the House Financial Services Committee approved H.R. 5983, the Financial CHOICE Act, to ensure the survival of American community banks. This piece of legislation, introduced by Representative Jeb Hensarling (R-Texas), undoes the regulations imposed by Dodd-Frank and helps create a fairer environment for community banks to compete in.

The efforts made by Representative Hensarling and other lawmakers are greatly needed in order to ensure that communities across the country continue to receive the crucial services that community banks provide.

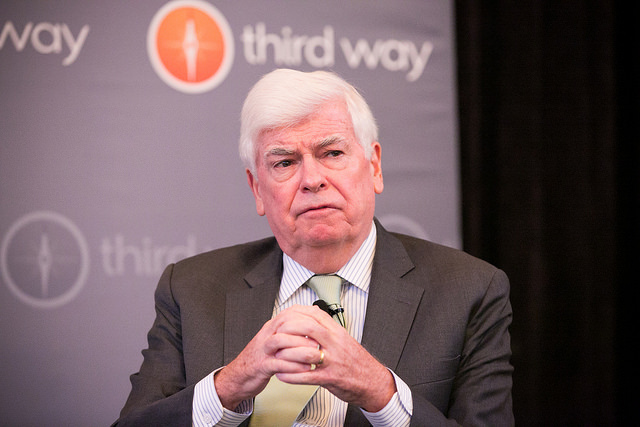

Photo Credit: Third Way Think Tank