Update: Congressman Ted Budd has introduced the Pandemic Healthcare Access Act in the House of Representatives.

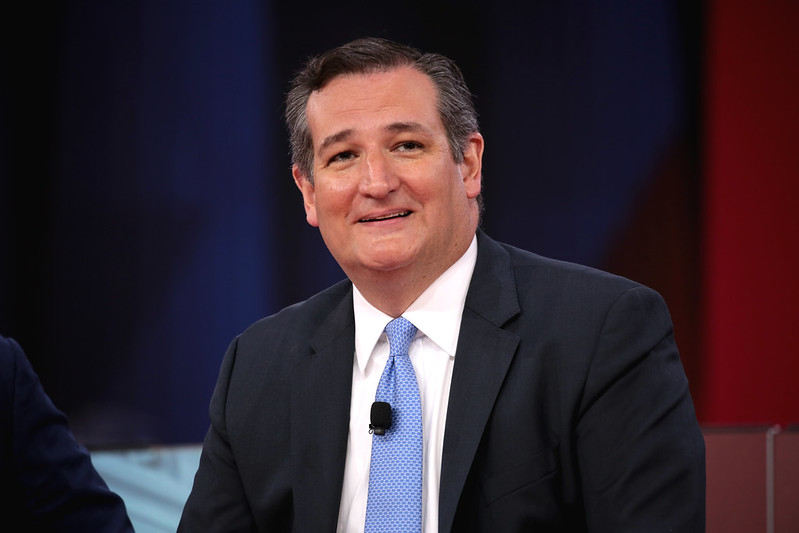

ATR President Grover Norquist led a letter of 30 organizations in support of Senator Cruz’s Pandemic Healthcare Access Act. This legislation allows all healthcare plans to use Health Savings Accounts during the duration of the Coronavirus pandemic.

[Click here to read the full letter]

Currently, there is a mandate that any American wanting to open or contribute to an HSA must be on a high-deductible health plan.

Senator Cruz’s legislation would pause this mandate in order to help mitigate the pandemic by Americans in Medicare, Affordable Care Act health plans, TRICARE, the VA, Indian Health Service and any employer plan to use HSAs. It will also help individuals pay for their deductible or any increased health care costs, allow HSA funds to pay for direct primary care, and allow telemedicine below the deductible.

As lawmakers continue working through proposals to address the pandemic, they should support and pass the Pandemic Healthcare Access Act.

You can read the full letter here or below:

Dear Leader McConnell:

As you continue working to address the Coronavirus pandemic, we urge policymakers to temporarily de-couple Health Savings Accounts (HSAs) from high-deductible health plans (HDHPs) as has been proposed by Senator Cruz and Congressman Ted Budd in the Pandemic Healthcare Access Act.

This proposal will help mitigate the public health crisis by allowing Americans in Medicare, Affordable Care Act health plans, TRICARE, the VA, Indian Health Service and any employer plan to use HSAs. It will also help individuals pay for their deductible or any increased health care costs, allow HSA funds to pay for direct primary care, and allow telemedicine below the deductible.

HSAs are currently used by almost 30 million American families and individuals. They empower healthcare mobility and choice, reduce taxes, and are a powerful tool for savings.

However, there is currently a mandate that any American wanting to open or contribute to an HSA must be on a high-deductible health plan. This restricts how funds can be spent and which plans qualify for an HSA.

Ending this mandate would give millions of individuals and families access to a portable, tax-advantaged savings vehicle, that can be used on healthcare expenses. This will especially benefit high-risk populations like seniors that consume greater levels of care.

Suspending the HSA HDHP mandate will help strengthen public health and ensure that Americans have access to the care they need at a time when they are required to self-quarantine to prevent mass infection. As you continue working to mitigate this pandemic, we hope you will support this request.

Sincerely,

Grover Norquist

President, Americans for Tax Reform

Jim Martin

Founder/Chairman, 60 Plus Association

Saulius “Saul” Anuzis

President, 60 Plus Association

Bob Carlstrom

President, AMAC Action

Phil Kerpen

President, American Commitment

Brent Wm. Gardner

Chief Government Affairs Officer, Americans for Prosperity

Robert Alt

President, The Buckeye Institute

Norm Singleton

President, Campaign for Liberty

Matthew Kandrach

President, Consumer Action for a Strong Economy

Ryan Ellis

President, Center for a Free Economy

Andrew F. Quinlan

President, Center for Freedom and Prosperity

Jeffrey Mazzella

President, Center for Individual Freedom

David McIntosh

President, Club for Growth

Katie McAuliffe

Executive Director, Digital Liberty

Timothy Head

Executive Director, Faith & Freedom Coalition

Adam Brandon

President, FreedomWorks

George Landrith

President, Frontiers of Freedom

Naomi Lopez

Director of Healthcare Policy, Goldwater Institute

John Goodman

President and CEO, Goodman Institute for Public Policy Research

Jessica Anderson

Vice President, Heritage Action for America

Dan Perrin

Executive Director, HSA Coalition

Beverly Gossage

President, HSA Benefits Consulting

Andrew Langer

President, Institute for Liberty

Heather Higgins

CEO, Independent Women’s Voice

Seton Motley

President, Less Government

Pete Sepp

President, National Taxpayers Union

CL Gray, MD

President, Physicians for Reform

Jonathan Bydlak

Director of the Fiscal/Budget Policy Project, R Street Institute

David Williams

President, Taxpayer Protection Alliance

Jenny Beth Martin

Honorary Chairman, Tea Party Patriots Action

Amy Kremer

Chairman, Women for America First

Cc:

President Donald Trump

HHS Secretary Alex Azar

Treasury Secretary Steven Mnuchin

National Economic Council Director Larry Kudlow

Senate Finance Committee Chairman Chuck Grassley

House Republican Leader Kevin McCarthy

House Ways and Means Republican Leader Kevin Brady

All GOP Members of the House and Senate