Hillary and Bill Clinton’s decades-long pattern of dishonesty shows up in their tax returns

A new review of Hillary and Bill Clinton’s previous tax returns show the Clintons blatantly overvalued their non-cash donations and illegally reduced their tax burden. They didn’t pay the taxes they owed.

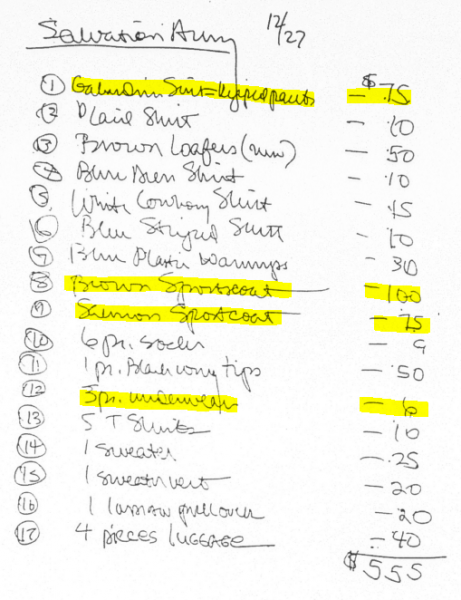

Hillary and Bill Clinton famously donated Bill’s used underwear and took a $2 per-pair tax deduction on their 1986 tax return. In Bill’s own handwriting, here is the line from the 1986 Clinton tax return, claiming a $6 deduction for “3 pr. underwear”:

Most press reports have focused on the strangeness of the used underwear donation and tax deduction. But the new examination of handwritten notes reveals the Clintons cheated on their taxes by significantly overstating the value of their donated clothing. These are not simple rounding errors of a few percentage points: The Clintons overstated the value of their used clothing by a factor of several hundred percent.

And not just the underwear, but many items of clothing including suits, pants, and sports coats.

When the Washington Post investigated the matter in 1993, they hit a brick wall when trying to get an explanation. The White House “over the course of a week didn’t respond to repeated phone calls seeking answers.”

To this day, the Clintons have not answered questions about their overvaluing of non-cash donations, and Hillary Clinton’s campaign website does not make available her tax returns for the years in question.

Let’s review the case against the Clintons, starting with the judgement question of donating used underwear (likely briefs) and having the gall to take a tax deduction for it. As noted by the Washington Post:

“Several experts were consulted about Clinton’s tax-deductible donations, especially of underwear. Paul Offenbacher, a longtime Washington-area tax accountant, said it is highly unusual to take an itemized deduction on donated underwear; indeed, he had never heard of such a thing.”

The Washington Post also talked to one of the recipient organizations:

“We don’t get too much underwear here; I don’t think people want that too much,” said Joe Cheslow, a senior resident at the Union Rescue Mission, a haven for homeless people in Little Rock, Ark., that has been a frequent beneficiary of the Clintons’ tax-deductible largess.

This author obtained handwritten notes of the Clinton’s donation lists to the Salvation Army and Goodwill Industries. Over the years the Clintons consistently overvalued donated items, by as much as 10 times the IRS standard.

The IRS allows deductions for non-cash donations to charity, but taxpayers must value the items truthfully. For tax year 1986, that meant using the “Thrift Shop Value” of items (the same basic standard applies to this day) as noted in IRS instructions.

The Clinton’s 1986 tax returns include a handwritten list showing they declared the value of a “gabardine suit – ripped pants” at $75, the “Brown Sports coat” at $100 and the “Salmon Sports coat” at $75. And of course the famous “3pr. underwear” at $6.

Pictured below: Bill Clinton’s handwritten list of non-cash donations to the Salvation Army for tax year 1986.

Using any calculation method, the Clintons were dishonest:

-Goodwill Industries and Salvation Army both publish guides for valuing used clothing donations. In 2016 dollars, Goodwill Industries values men’s suits at $10 – $30, and sports coats at $6 – $12. There is no listing for men’s used underwear.

-The Salvation Army values suits at $15 – $60. There is no listing for men’s used underwear.

-The TurboTax “ItsDeductible” calculator values items based on a combination of eBay and thrift store prices. Men’s suits are valued at $29, sports coats at $18. Underwear is listed, but at just $1.

Basically what the Clintons did is akin to walking into a Goodwill store today, donating a sports coat and deducting $220 from their taxes for it. Or donating a pair of used underwear and deducting $4.40.

Below are ten of the worst valuations found on multiple handwritten notes from the Clinton’s tax return for a single tax year, 1986:

Just this selection of 10 overvaluations adds up to $1,375 – $1,518 in 2016 dollars.

“Hillary and Bill Clinton clearly overstated the fair market value of the clothing donated,” said Ryan Ellis, an IRS Enrolled Agent and noted tax policy expert.

What are the consequences to a normal American of grossly overvaluing donations in the manner of the Clintons?

“If a taxpayer overstates a deduction like this, they could be held liable under audit by the IRS for back taxes, interest, and a failure-to-pay penalty,” said Ellis.

Hillary Clinton has been preaching for ‘fairness’ and ‘paying what you owe’ on the campaign trail. Her own estate is specifically designed to shield herself from the Death Tax.

The embarrassing incident of the used underwear tax deduction seems to have masked the more serious issue of blatant overvaluation that happened on a consistent basis. Perhaps this is why the Clintons refuse to answer questions about their dishonesty on these tax returns.

“Hillary and Bill Clinton didn’t pay the taxes they owed. The press has focused only on the giggle factor of the underwear, but fail to mention the Clintons broke the law,” said Grover Norquist, president of Americans for Tax Reform. “Meanwhile, Hillary has pushed a national gun tax, a soda tax, a payroll tax hike on middle income households, a Death Tax hike, a capital gains tax hike and several other tax hikes totaling $1.4 trillion over a decade.”

Americans for Tax Reform is tracking the complete Clinton tax record at www.HighTaxHillary.com