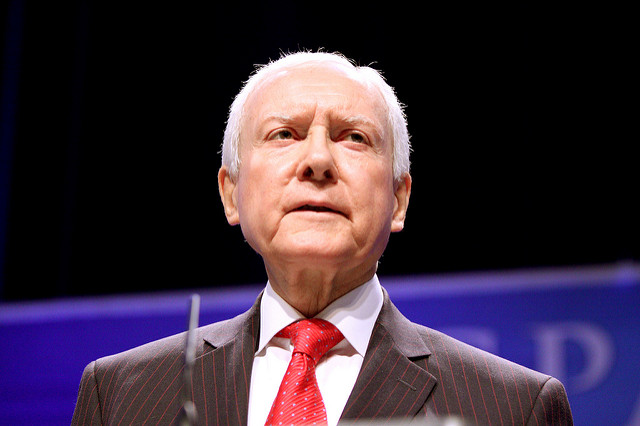

At a Senate Finance Committee hearing this week, committee members examined the roll energy tax policy plays in both hindering and helping U.S. consumers and businesses. While a number of topics were addressed, Senate Finance Committee Chairman Orrin Hatch (R-Utah) used the hearing to deliver statements speaking out against a federal carbon tax.

In Chairman Hatch’s remarks, he made it clear that he did not agree with the Obama Administration’s reckless attack on affordable energy, nor misguided lawmakers that similarly advocate for a carbon tax. Hatch opened by saying that:

“When it comes to these ‘carbon tax’ proposals, I’m…disappointed in my friends on the other side of the aisle. Typically when they have a proposal they know is going to put the financial screws to the American people, they give it a more clever name.”

Sadly Chairman Hatch is exactly right. A carbon tax would “put the financial screws to the American people.” Sen. Hatch went on to say that under a carbon tax, Americans would receive:

- Higher taxes in the form of increased energy costs; and

- Reduced wages relative to the cots of living.

It is abundantly clear that the impact of a carbon tax on energy costs would ripple throughout the country, with energy prices estimated to see cost increases of 20 to 30 percent. The U.S. economy would also see a drop in total GDP of roughly $146 billion by the year 2030, impacting both investment and labor. Families would also be hit with an increase in the cost of consumer goods.

Hatch went on to say that carbon tax proponents, and those favoring increased regulations like the Obama Administration, are “intent on raising the cost of producing and consuming energy…even if it means increased hardships on middle-class and lower income families.”

Comments from Chairman Hatch on a carbon tax were echoed in testimony by Karen Harbert, President and CEO of the U.S. Chamber of Commerce’s Institute for 21st Century Energy. Harbert said a carbon tax would hurt the poor and elderly and have a “constraining effect” on the U.S. economy. Harbert also pointed out that the energy sector supports millions of jobs and contributes to a significant amount of government revenue.

Senator Hatch’s comments opposing a carbon tax are considerably timely, given Senator Roy Blunt (R-Mo.) recently introduced a Senate resolution that expresses the sense of Congress that a carbon tax would be detrimental to American families and businesses. Sen. Blunt’s resolution comes as the House recently voted overwhelmingly to support a companion resolution offered by Rep. Steve Scalise opposing a carbon tax.

It is clear the idea of a carbon tax finds little support in Congress, and lawmakers realize the disastrous economic impact such a tax would have on American families, businesses, and U.S. competitiveness in general.

Photo credit: Gage Skidmore