Photo by Eddie Bugajewski on Unsplash

Photo by Eddie Bugajewski on Unsplash

In the most recent version of the legislative text released Saturday, Democrats altered the language of the new 15 percent book minimum tax to now impact small to midsize businesses with profits well below the $1 billion in profits threshold Democrats claim.

As written, the provision now appears restructured to define any company with private equity in its capital structure to be considered a subsidiary of that private equity firm for purposes of the tax. This means that these companies would now be swept up in the new 15 percent tax on book income.

This provision would greatly expand the reach of the book minimum tax to apply to small and midsize companies that require capital investment to grow their business.

Below is the relevant provision included in Sec. 10101 of the bill (page 6):

(D) SPECIAL RULES FOR DETERMINING APPLICABLE CORPORATION STATUS.—

‘‘(i) IN GENERAL.—Solely for purposes of determining whether a corporation is an applicable corporation under this paragraph, all adjusted financial statement income of persons treated as a single employer with such corporation under subsection (a) or (b) of section 52 (determined with the modifications described in clause (ii)) shall be treated as adjusted financial statement income of such corporation, and adjusted financial statement income of such corporation shall be determined without regard to paragraphs (2)(D)(i) and (11) of section 56A(c).‘‘(ii) MODIFICATIONS.—For purposes of this subparagraph—

‘‘(I) section 52(a) shall be applied by substituting ‘component members’ for ‘members’, and

‘‘(II) for purposes of applying section 52(b), the term ‘trade or business’ shall include any activity treated as a trade or business under paragraph (5) or (6) of section 469(c) (determined without regard to the phrase ‘To the extent provided in regulations’ in such paragraph (6)).

‘‘(iii) COMPONENT MEMBER.—For purposes of this subparagraph, the term ‘component member’ has the meaning given such term by section 1563(b), except that the determination shall be made without regard to section 1563(b)(2).

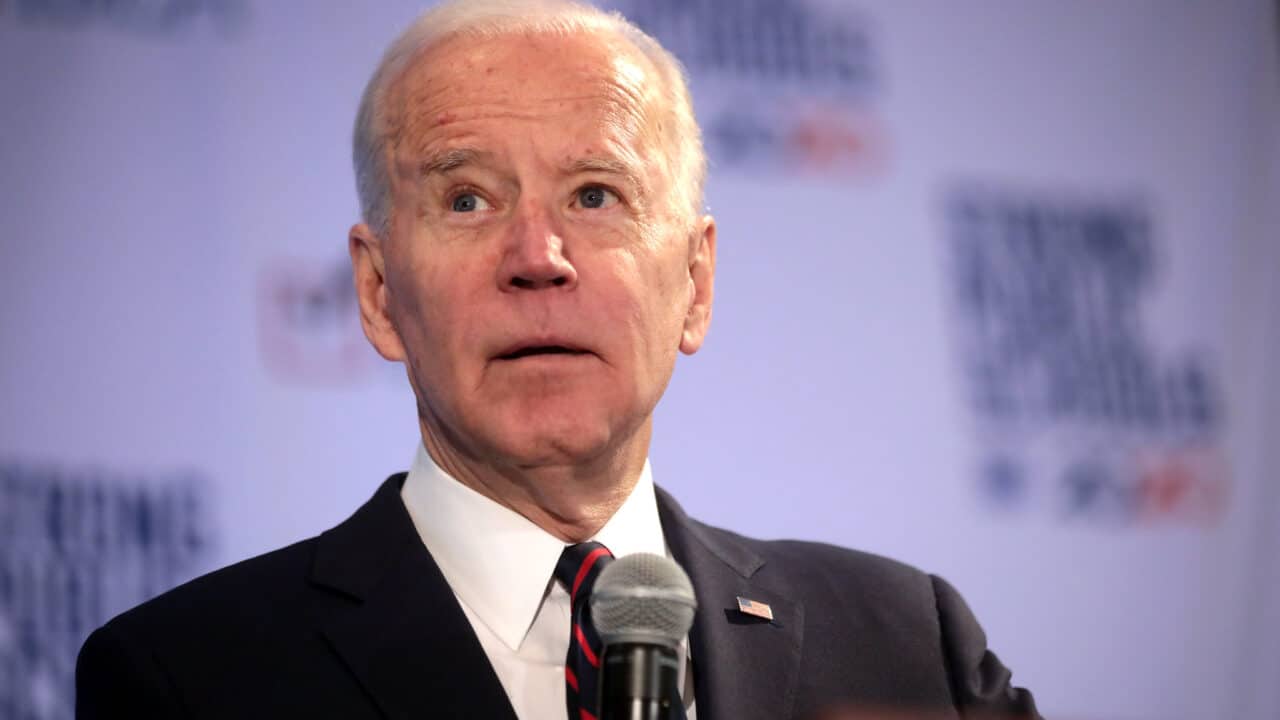

This provision would violate President Biden’s campaign pledge to small businesses: “Taxes on small businesses won’t go up.”