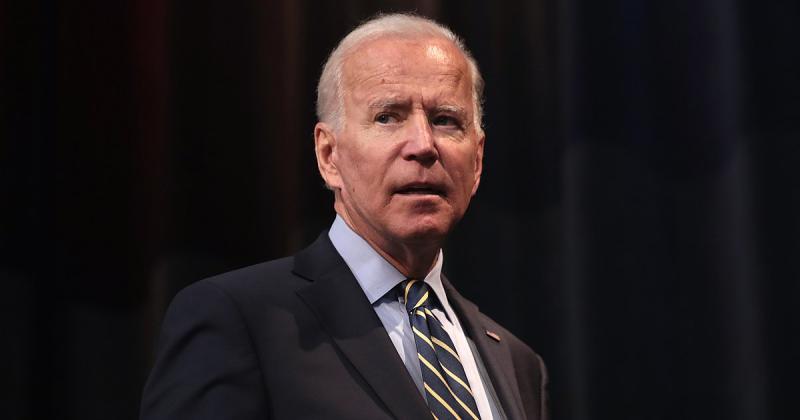

In yet another move to increase the federal government’s presence in your life, the Biden administration wants to sic the IRS on your Venmo account.

Biden has proposed $80 billion in funding for additional IRS enforcement. As part of this proposal, banks and third-party payment providers, like Venmo and CashApp would be required to report account holders’ aggregate account outflows and inflows.

“The proposal would require banks to report annual account inflows and outflows to the Internal Revenue Service. The requirement would also extend to peer-to-peer payment services such as Venmo,” notes the Wall Street Journal.

President Biden claims that this proposal is designed to “crack down on millionaires and billionaires who cheat on their taxes.” However, it is unclear how monitoring Venmo accounts – many of which are held by younger Americans – contributes to this goal.

The average Venmo transfer amount is $60 and is popular among young people, with over 7 million Venmo users belong in the 18-34 age group. For users who have undergone identity verification, the weekly spending limit is $7,000. These trends exist for most third-party payment providers.

It is hard to see how millionaires and billionaires are using Venmo or CashApp to launder mass amounts of money.

This is just another effort to expand the power of the IRS. Rest assured, the IRS will use these powers against Americans of all income levels.

At a time when Americans are already struggling, these new reporting rules would create unnecessary burdens. As noted in this excerpt from Forbes:

It may create problems, however, that should be considered and addressed as this plan works its way through Congress. For example, consider a young couple saving up to buy a home. All savings are put into the “dream home” savings account. Then, when it comes time to make the down payment, the $50,000 dream home savings goes into the regular checking account, which is then wired to the seller’s escrow account. Buying a home is not a taxable event (at least for federal income tax), selling one is. Will the IRS receive information from the financial institutions that leads to an audit?

Paul Merski, vice president of congressional relations at Independent Community Bankers of America, voiced his criticism of the proposal:

Banks already report millions of transactions a day to the Financial Crimes Enforcement Network in the form of currency transaction reports, in addition to suspicious activity reports, which are required when potential illicit activity is detected by a bank. Banks are required to submit currency transaction reports when a deposit or withdrawal is $10,000 or more, a threshold that’s already very low, Merski said.

Merski said the proposal, as written, is akin to “sending your bank statement to the IRS every month,” which would be opposed by the banking industry because of the reporting burdens already required by federal regulators.

“The federal government can’t track all of that—any more requirements would be adding more hay to that haystack,” he said.

As also noted by the Wall Street Journal, the bank account snooping will give the IRS an “enormous” quantity of new data:

It would also create an enormous flow of information that the IRS would have to learn how to manage and use.

—

Congress will have to weigh the potential burdens and privacy concerns against the revenue gains as it considers the plan.

Observers are rightly skeptical that this plan will be able to generate anywhere near the $780 billion promised by the Biden administration. As noted in this excerpt from Yahoo News:

Previous government estimates put the benefits of increased IRS funding much lower. Last year, the Congressional Budget Office estimated that an additional $40 billion of funding over 10 years would increase government revenues by $103 billion.

Even Obama-era IRS chief John Koskinen questioned the Biden $80 billion funding request. “I’m not sure you’d be able to efficiently use that much money,” he said.

Congress should refrain from passing a proposal that would give the federal government unprecedented access to your private information.