USA-CHINA/ under CC BY-SA 2.0

USA-CHINA/ under CC BY-SA 2.0

As he meets with President Xi Jinping today, taxpayers are reminded that President Joe Biden wants to increase the U.S. corporate income tax rate to a level higher than communist China.

“When Xi meets with Biden he will thank Biden for fighting to impose a higher corporate tax rate on American businesses than China imposes on their companies,” said Grover Norquist, president of Americans for Tax Reform. “Biden’s higher tax rate would kneecap American workers and force America to compete on lower wages rather than lower taxes.”

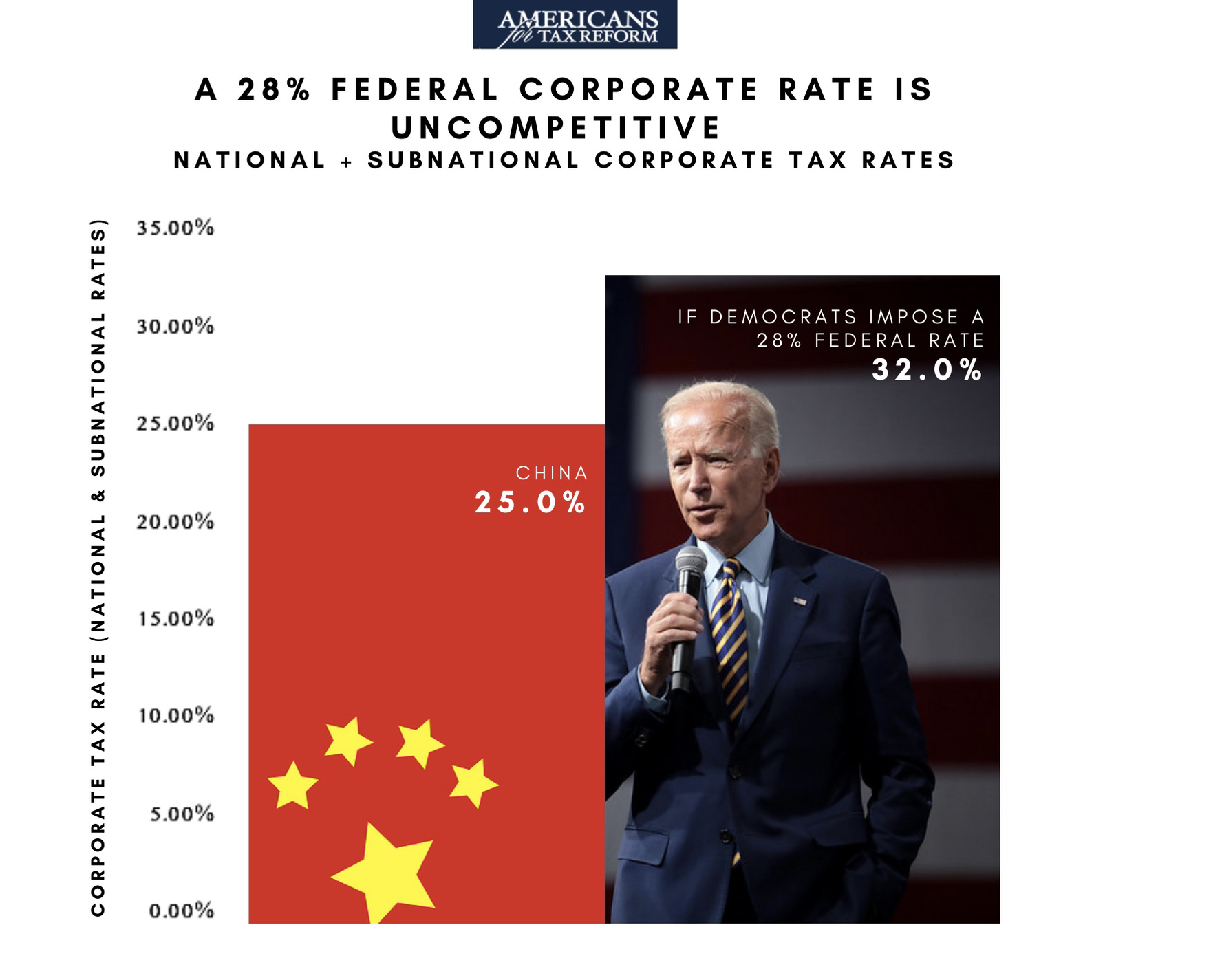

In his most recent budget, President Biden wants to take the current 21% federal corporate income tax rate and raise it to 28%, higher than communist China’s 25%.

After adding state corporate income taxes, the combined average U.S. federal-state tax rate under the Biden proposal amounts to more than 32%.

Industry sectors of strategic use to the Chinese government pay an even lower rate of 15% or even 10%.

As noted by PwC, “the tax rate could be reduced to 15% for qualified enterprises which are engaged in industries encouraged by the China government (e.g. New/high Tech Enterprises and certain integrated circuits production enterprises).”

Note the comparison below:

While Biden’s formal budget calls for a hike in the U.S. corporate tax rate to 28%, Biden and Vice President Kamala Harris have loudly and repeatedly vowed to “eliminate”, “get rid of”, “repeal” and “reverse” the Tax Cuts and Jobs Act. Such repeal would mean reverting to the pre-TCJA corporate income tax rate of 35%.

Biden should be working to reduce the corporate tax rate, not increase it.

Economists across the political spectrum agree that workers bear the brunt of corporate tax increases.

Workers bear an estimated 70 percent of the corporate income tax as Stephen Entin of the Tax Foundation wrote in 2017:

“Over the last few decades, economists have used empirical studies to estimate the degree to which the corporate tax falls on labor and capital, in part by noting an inverse correlation between corporate taxes and wages and employment. These studies appear to show that labor bears between 50 percent and 100 percent of the burden of the corporate income tax, with 70 percent or higher the most likely outcome.”

A 2012 Harvard Business Review piece by Mihir A. Desai notes that raising the corporate tax lands “straight on the back” of the American worker and will see a decline in real wages.

A 2012 paper at the University of Warwick and University of Oxford found that a $1 increase in the corporate tax reduces wages by 92 cents in the long term. This study was conducted by Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini and included data from over 55,000 businesses located in nine European countries in the period 1996-2003.

Even the left-of-center Tax Policy Center estimates that 20 percent of the burden of the corporate income tax is borne by labor.

While Biden likes to pretend his tax increases are for Scrooge McDuck and Rich Uncle Pennybags, everyone gets hit.