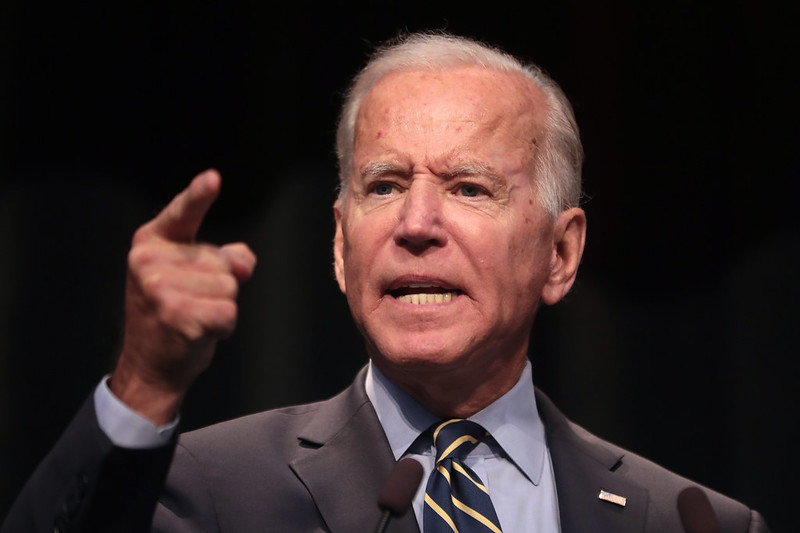

Democrat Presidential candidate Joe Biden’s tax hike plan will erode America’s competitive advantage in the global economy, which could result in American jobs being shipped overseas and a return of corporate inversions.

Biden’s plan includes several tax increases on American businesses, including a 21 percent minimum tax on “ALL foreign earnings” of U.S. companies. Biden also proposes raising the corporate tax rate from 21 percent to 28 percent, a 33 percent increase that would give the United States one of the highest rates in the developed world. In addition, Biden calls for imposing a 15 percent minimum tax on “book income” which will disallow companies from claiming widely-used credits and deductions and proposes an unspecified tax on “shipping jobs overseas.”

Biden’s tax on foreign earnings will impose a worldwide system of taxation that will lead to double taxation on American businesses and make it difficult for them to compete against foreign companies. Under Biden’s plan, an American business operating in the United Kingdom will face British taxes and then American taxes. By comparison, a British business operating in the U.S. will only pay U.S. taxes because the UK has a territorial system that taxes income only if it is earned in that country.

Before President Trump and Congressional Republicans passed the 2017 Tax Cuts and Jobs Act (TCJA), the U.S. was one of the few countries with a worldwide system of taxation. At the time, 26 nations in the Organisation for Economic Co-operation and Development (OECD) had territorial systems including Australia, Canada, France, Germany, Japan, Spain, and the UK. This system, in combination with the fact that the U.S. also had the highest corporate rate in the OECD at 35 percent, meant that American businesses could not compete on the world stage.

This uncompetitive system was causing businesses to invert, which occurred when a U.S. business merged with or acquired a foreign business with the intent of incorporating the new, combined entity overseas. Between 2004 and 2014, almost 50 American businesses left the country through inversions, according to the Congressional Research Service (CRS).

American businesses were also vulnerable to being acquired by foreign companies. According to a study released by EY, American companies also suffered a net loss of almost $510 billion in assets between 2004 and 2017. This was because the high U.S. rate and worldwide tax system meant non-U.S. companies could outbid U.S. companies.

If America’s corporate rate was at a globally competitive rate, the study estimates that U.S. companies would have acquired a net of $1.2 trillion worth of assets, meaning that more than $1.7 trillion in assets were lost in the 15-year period.

The TCJA addressed the root cause of these problems – the bill lowered the corporate rate to 21 percent and repealed the worldwide tax system and implemented a modern, more competitive territorial system of taxation which taxed businesses based on where income is earned. This law put a stop to inversions and encouraged companies to begin coming back to America.

However, Biden will undo this progress.

Not only will he impose double taxation on American businesses, he will raise the corporate tax rate back up to 28 percent, which will again make the U.S. rate one of the highest rates in the developed world and higher than China’s 25 percent rate.

Many countries also have lower rates for certain types of investment in order to encourage innovation. For instance, China has a 15% rate for industries including high tech enterprises, while the United Kingdom has a 10 percent “patent box” rate for businesses that depend on patented inventions and innovations.

The U.S. is already lagging behind when it comes to promoting research and development. According to a Manufacturing Leadership Council study, the U.S. ranks 26th in R&D tax incentives when ranking the 36 developed countries in the OECD.

Moving forward, we should be enacting policies that ensure American businesses can compete and thrive in the global economy. President Trump and Congressional Republicans have called for tax credits that will incentivize continued investment in the U.S.

Rather than calling for trillions in tax increases on American businesses, Biden should join with Republicans in acting to help American businesses.