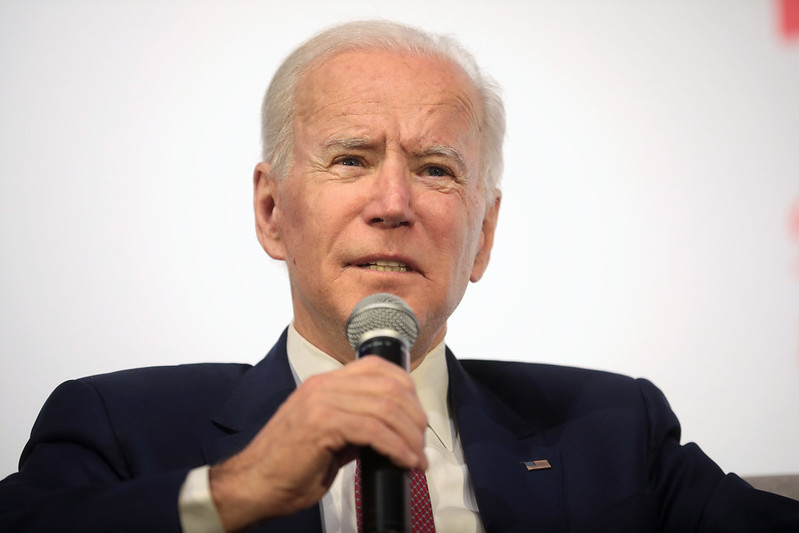

President Biden avoided paying $500,000 in payroll taxes including $121,000 in Obamacare taxes by utilizing a tax loophole, as noted in a letter by Republican Study Committee Chairman Jim Banks (R-Ind.).

As the letter notes, Biden used two S-corporations to avoid paying $500,000 in payroll taxes:

“Your 2017, 2018, and 2019 tax returns show that you and the First Lady sheltered over $13 million of income in two S-corporations: the CelticCapri Corporation and the Giacoppa Corporation. Press reports indicate that you both directed revenue from book royalties and speaking appearance fees into these two corporations.”

Sheltering this income was done for the sole purpose of avoiding tax. As the letter notes:

“Tax experts have questioned the propriety of diverting funds raised from one’s own intellectual property through an S-corporation. One accountant interviewed by the Wall Street Journal said ‘there’s no reason for these [earnings] to be in an S-corp – none, other than to save on self employment tax.”

Biden avoided the 3.8 percent Medicare Payroll Tax, and the 0.9 percent Obamacare “Additional Medicare Tax.” This is clear hypocrisy as Biden supports expanding Obamacare and routinely says “the rich” need to pay their fair share.

The Obama administration considered it a top priority to close this loophole. As such, not only did Joe Biden use a loophole that his administration actively fought to close, but he was able to avoid a tax that his own administration created.

This is particularly ironic given that Joe Biden has repeatedly railed against the “rich” using tax loopholes. For instance, during his speech at the 2020 Democrat National Committee he said loopholes should be repealed and the wealthy need to pay their fair share:

“We can pay for these investments by ending loopholes, unnecessary loopholes… Because we don’t need a tax code that rewards wealth more than it rewards work. I’m not looking to punish anyone. Far from it. But it’s long past time the wealthiest people and the biggest corporations in this country paid their fair share.”

Joe Biden has also said that paying taxes is a “patriotic” act. By this standard, Biden’s tax avoidance is clearly unpatriotic. This hypocrisy is made worse by the fact that Medicare faces significant funding shortfalls as the letter explains:

“Just this year, the Congressional Budget Office estimated its Hospital Insurance Trust Fund will face insolvency in the middle of Fiscal Year 2026—roughly five years from now.”

The Biden tax dodge was first reported in the Wall Street Journal:

Democratic presidential candidate Joe Biden used a tax loophole that the Obama administration tried and failed to close, substantially lowering his tax bill.

Mr. Biden and his wife, Dr. Jill Biden, routed their book and speech income through S corporations, according to tax returns the couple released this week. They paid income taxes on those profits, but the strategy let the couple avoid the 3.8% self-employment tax they would have paid had they been compensated directly instead of through the S corporations.

As noted by WSJ, even left-leaning tax experts called out Biden for his “pretty aggressive” tax maneuvers:

To the extent that the Bidens’ profits came directly from the couple’s consulting and public speaking, “to treat those as other than compensation is pretty aggressive,” said Steve Rosenthal, a senior fellow at the Tax Policy Center, a research group run by a former Obama administration official.

Biden should explain why he avoided paying taxes and, as the letter notes should be made to answer whether he intends to undo this hypocrisy and pay the funds back to the American people.