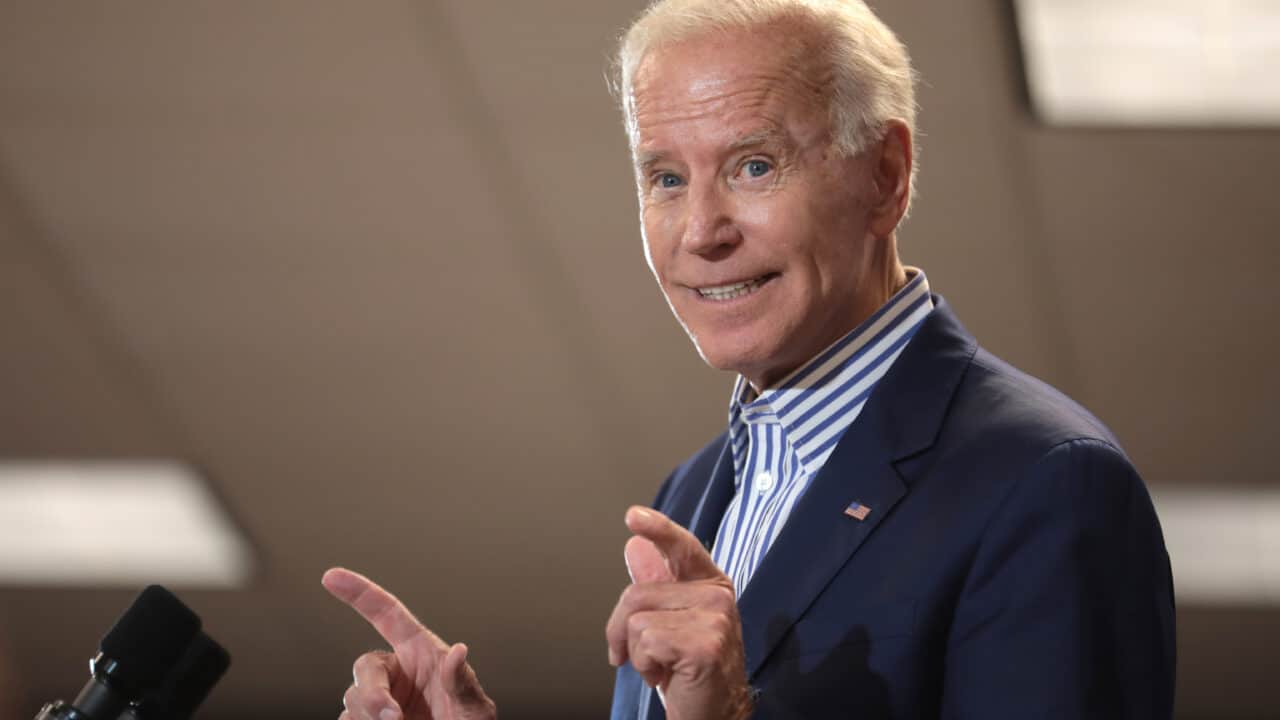

"Joe Biden" by Gage Skidmore is licensed under CC BY-SA 2.0. https://flic.kr/p/2gY4zT7

"Joe Biden" by Gage Skidmore is licensed under CC BY-SA 2.0. https://flic.kr/p/2gY4zT7

President Biden frequently praises himself as a man of his word. But the Biden Administration is once again considering a reckless extension of the moratorium on student loan repayments, according to the Washington Post.

On August 24, the Administration announced that their most recent extension, to the end of this year, was their “final” one:

Today, the U.S. Department of Education (Department) announced a final extension of the pause on student loan repayment, interest, and collections through December 31, 2022. Borrowers should plan to resume payments in January 2023.

The same day, Biden said:

“The student loan payment pause is gonna end. It is gonna end – I am extending it to Dec. 31, 2022. And it is gonna end at that time. It is time for the payments to resume.”

Talks of another extension come as a federal judge blocked Biden’s blatantly unconstitutional plan to unilaterally forgive $10,000/$20,000 is student loan debt for every borrower making below $125,000 (or $250,000 if someone files jointly).

The moratorium was originally implemented in March 2020 but has been extended several times far after the height of the crisis. Even back in December of 2021, President Biden announced he would be extending the moratorium, despite White House press secretary Jen Psaki’s promise two weeks before the announcement that the loan payments would restart in February. Unfortunately, the Administration continues to give in to pressures from leftist activists, exacerbating inflation and benefiting wealthy elites.

The moratorium has already cost taxpayers about $150 billion. According to an analysis by the Penn Wharton Budget Model, the latest extension from September 2022 to December 2022 will cost taxpayers another $16 billion.

This is just one example of high federal spending. In 2020, the U.S. government spent over $6 trillion. In 2021, the U.S. spent $6.82 trillion, or 30% of the economy. This massive amount of spending worsens inflation. The federal government is flooding the economy with so much money demand is growing too fast for production to keep up. The results of these policies are clear. In October, inflation remained high at 7.7 percent. Inflation has now been surging for over a year.

Further, on the most basic level, this policy is unfair.

It is unfair to the millions of Americans that did not rack up tens of thousands of dollars of debt. It is unfair to Americans that decided against attending college, opted for less expensive schooling, served in the military to receive free education, or have worked long hours to put themselves through school instead of going into debt. This policy is also unfair to those who were proactive in paying off their debt. All these sacrifices were made by people who could only work with the information they had: if they took out loans, they would be held to their contractual obligations.

Despite Democrat talking points, the moratorium isn’t helping low-income Americans hit hard by the pandemic. This policy primarily benefits the wealthy.

The Brookings Institution described those who would benefit most from student debt forgiveness as “higher income, better educated, and more likely to be white.” The top 20 percent of households currently hold $3 in student loan debt for every $1 of debt held by the bottom 20 percent of earners. About 75 percent of student loan repayments come from the top 40 percent of earners, as the Committee for a Responsible Federal Budget notes.

The median income of households making active payments on their student loans was $76,400, with just 4 percent of these households being below the federal poverty line.

One recent study provides further evidence of the privilege student loan borrowers hold. A new survey from Intelligent.com found that 73 percent of student loan forgiveness applicants would spend the extra money from relief on non-essentials like vacations, eating out at restaurants, buying a new phone, drugs/alcohol, gambling, and gaming systems.

The survey also provides a breakdown of which goods/services applicants would spend extra money on each month:

- Clothing and accessories (52%)

- Vacationing (46%)

- Eating out at restaurants (46%)

- Smartphone (44%)

- Investing in the stock market (43%)

- Gifts (42%)

- Gaming system (36%)

- Wedding (30%)

- Drugs/Alcohol (28%)

- Gambling (27%)

Presumably, this is not the group of people who require handouts from working class Americans.

The Biden administration must reject yet another extension of the moratorium on student loan repayments. The country cannot afford it, and borrowers do not need it.